Tests on the Value at Risk

Let’s consider a Gaussian AR(2)-GARCH(1,2) model defined as:

1 Test on the number of violations

Let’s define a violation of the

and let’s define the number of violations of the conditional VaR as follows, i.e.

1.1 Asymptotic variance

Applying the central limit theorem (CLT) it is possible to prove that the statistic test converges in distribution to a standard normal, i.e.

where

1.2 Empirical variance

Instead of using the theoretical variance of

For small samples, the following relation between the two statistics should be used:

2 Example:

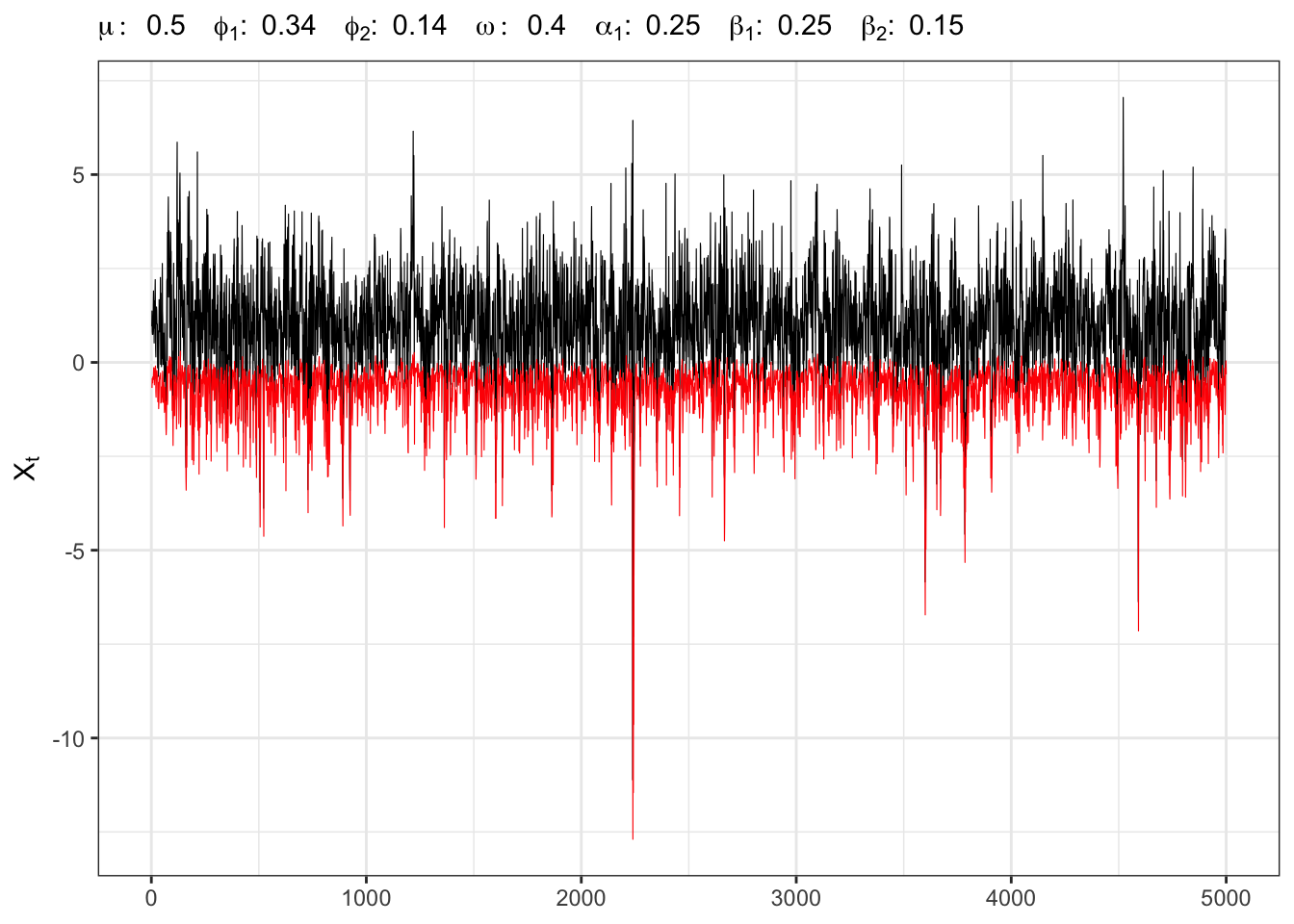

Instead of simulating exactly

AR(2)-GARCH(1,2) simulation and VaR

# ===================== Setups ======================

set.seed(1) # random seed

ci <- 0.05 # confidence level

t_bar <- 5000 # number of simulations

# parameters

parAR <- c(mu=0.5, phi1 = 0.34, phi1 = 0.14)

parGARCH <- c(omega=0.4, alpha1=0.25,

beta1=0.25, beta2=0.15)

# long-term std deviation of residuals

sigma_eps <- sqrt(parGARCH[1]/(1-sum(parGARCH[-1])))

# ================== Simulation =====================

# Initial points

Xt <- rep(parAR[1]/(1-sum(parAR[-1])), 3)

sigma <- rep(sigma_eps, 3)

# Simulated residuals

eps <- rt(t_bar, 25)

eps[1:3] = eps[1:3]*sigma_eps

# Value at Risk

q_alpha = qnorm(ci)

VaR = c(0)

for(t in 3:t_bar){

# AR component

Xt[t] <- parAR[1] + parAR[2]*Xt[t-1] + parAR[3]*Xt[t-2]

# ARCH component

sigma[t] <- parGARCH[1] + parGARCH[2]*eps[t-1]^2

# GARCH component

sigma[t] <- sigma[t] + parGARCH[3]*sigma[t-1]^2 + parGARCH[4]*sigma[t-2]^2

sigma[t] <- sqrt(sigma[t])

# Simulated residuals

eps[t] <- sigma[t]*eps[t]

# Simulated value at risk

VaR[t] <- Xt[t] + sigma[t]*q_alpha

# Simulated time series

Xt[t] <- Xt[t] + eps[t]

}

# ===================== Plot ======================

# GARCH(1,1) simulation

ggplot()+

geom_line(aes(1:t_bar, Xt), size = 0.2)+

geom_line(aes(1:t_bar, VaR), size = 0.2, color = "red")+

theme_bw()+

labs(x = NULL, y = TeX("$X_t$"),

subtitle = TeX(paste0("$\\mu:\\;", parAR[1],

"\\;\\; \\phi_{1}:\\;", parAR[2],

"\\;\\; \\phi_{2}:\\;", parAR[3],

"\\;\\; \\omega:\\;", parGARCH[1],

"\\;\\; \\alpha_{1}:\\;", parGARCH[2],

"\\;\\; \\beta_{1}:\\;", parGARCH[3],

"\\;\\; \\beta_{2}:\\;", parGARCH[4],

"$")))NV test Student-

# ======================================

# Violation of the VaR

vt <- ifelse(Xt < VaR, 1, 0)

vt[1:3] <- 0

# Theoric variance

v_theoric <- ci*(1-ci)

# Empiric variance

v_empiric <- (sum(vt)/t_bar)*(1 - sum(vt)/t_bar)

# Standardized number of violations

Nt <- sum((vt - ci)/sqrt(v_theoric))

# Statistic test (NV_1)

NV1 <- (1/sqrt(t_bar))*Nt

# Statistic test (NV_2)

NV2 <- (sqrt(v_theoric)/sqrt(v_empiric))*NV1

# Rejection level

t_alpha <- qnorm(ci/2)

# =============== Kable ===============

kab <- dplyr::tibble(

n = t_bar,

alpha = paste0(format(ci*100, digits = 3), "%"),

alpha_hat = paste0(format(sum(vt)/t_bar*100, digits = 3), "%"),

t_alpha_dw = t_alpha,

NV1 = NV1,

NV2 = NV2,

t_alpha_up = -t_alpha,

H01 = ifelse(NV1 > t_alpha_up | NV1 < t_alpha_dw, "Rejected", "Non-Rejected"),

H02 = ifelse(NV2 > t_alpha_up | NV2 < t_alpha_dw, "Rejected", "Non-Rejected")

) %>%

dplyr::mutate_if(is.numeric, format, digits = 4, scientific = FALSE)

colnames(kab) <- c("$$n$$", "$$\\alpha$$", "$$\\frac{N_n}{n}$$", "$$-t_{\\alpha/2}$$",

"$$NV_1$$", "$$NV_2$$", "$$t_{\\alpha/2}$$", "$$H_0(NV_1)$$", "$$H_0(NV_2)$$")

knitr::kable(kab, booktabs = TRUE ,escape = FALSE, align = 'c')%>%

kableExtra::row_spec(0, color = "white", background = "green") 3 Example:

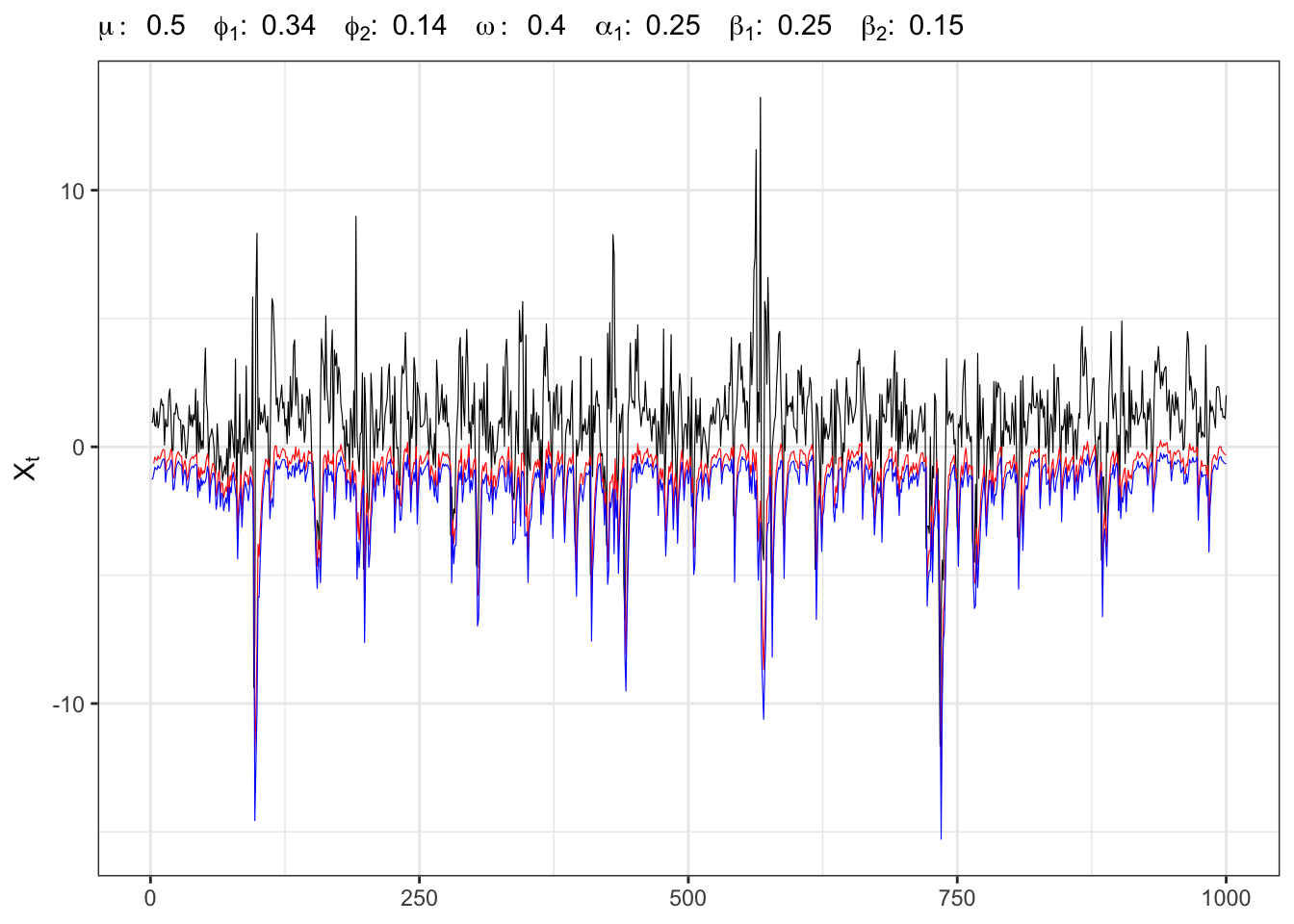

Instead of simulating exactly

AR(2)-GARCH(1,2) simulation and VaR

# ==================== Setups =====================

set.seed(1) # random seed

ci <- 0.05 # confidence level

t_bar <- 1000 # number of simulations

# parameters

parAR <- c(mu=0.5, phi1 = 0.34, phi1 = 0.14)

parGARCH <- c(omega=0.4, alpha1=0.25,

beta1=0.25, beta2=0.15)

# quasi long-term std deviation of residuals

sigma_eps <- sqrt(parGARCH[1]/(1-sum(parGARCH[-1])))

# ================== Simulation ===================

set.seed(1)

# Initial points

Xt <- rep(parAR[1]/(1-sum(parAR[-1])), 3)

mu <- rep(parAR[1]/(1-sum(parAR[-1])), 3)

sigma <- rep(sigma_eps, 3)

# Simulated residuals

eps <- rt(t_bar, 5)

eps[1:3] <- eps[1:3]*sigma_eps

# Value at Risk

q_alpha = qnorm(ci)

VaR = c(0)

for(t in 3:t_bar){

# AR component

mu[t] <- parAR[1] + parAR[2]*Xt[t-1] + parAR[3]*Xt[t-2]

# ARCH component

sigma[t] <- parGARCH[1] + parGARCH[2]*eps[t-1]^2

# GARCH component

sigma[t] <- sigma[t] + parGARCH[3]*sigma[t-1]^2 + parGARCH[4]*sigma[t-2]^2

sigma[t] <- sqrt(sigma[t])

# Simulated residuals

eps[t] <- sigma[t]*eps[t]

# Simulated value at risk

VaR[t] <- mu[t] + sigma[t]*q_alpha

# Simulated time series

Xt[t] <- mu[t] + eps[t]

}

# Empirical quantile

q_alpha_emp <- quantile(eps/sigma, probs = ci)

VaR_emp <- mu + sigma*q_alpha_emp

# ===================== Plot ======================

# GARCH(1,1) simulation

ggplot()+

geom_line(aes(1:t_bar, Xt), size = 0.2)+

geom_line(aes(1:t_bar, VaR), size = 0.2, color = "red")+

geom_line(aes(1:t_bar, VaR_emp), size = 0.2, color = "blue")+

theme_bw()+

labs(x = NULL, y = TeX("$X_t$"),

subtitle = TeX(paste0("$\\mu:\\;", parAR[1],

"\\;\\; \\phi_{1}:\\;", parAR[2],

"\\;\\; \\phi_{2}:\\;", parAR[3],

"\\;\\; \\omega:\\;", parGARCH[1],

"\\;\\; \\alpha_{1}:\\;", parGARCH[2],

"\\;\\; \\beta_{1}:\\;", parGARCH[3],

"\\;\\; \\beta_{2}:\\;", parGARCH[4],

"$")))Computing the test on the normal quantile gives a rejection of the null hypothesis

Theoric NV test Student-

# ======================================

# Violation of the VaR

vt <- ifelse(Xt < VaR, 1, 0)

vt[1:3] <- 0

# Theoric variance

v_theoric <- ci*(1-ci)

# Empiric variance

v_empiric <- (sum(vt)/t_bar)*(1 - sum(vt)/t_bar)

# Standardized number of violations

Nt <- sum((vt - ci)/sqrt(v_theoric))

# Statistic test (NV_1)

NV1 <- (1/sqrt(t_bar))*Nt

# Statistic test (NV_2)

NV2 <- (sqrt(v_theoric)/sqrt(v_empiric))*NV1

# Rejection level

t_alpha <- qnorm(ci/2)

# =============== Kable ===============

kab <- dplyr::tibble(

n = t_bar,

alpha = paste0(format(ci*100, digits = 3), "%"),

alpha_hat = paste0(format(sum(vt)/t_bar*100, digits = 3), "%"),

t_alpha_dw = t_alpha,

NV1 = NV1,

NV2 = NV2,

t_alpha_up = -t_alpha,

H01 = ifelse(NV1 > t_alpha_up | NV1 < t_alpha_dw, "Rejected", "Non-Rejected"),

H02 = ifelse(NV2 > t_alpha_up | NV2 < t_alpha_dw, "Rejected", "Non-Rejected")

) %>%

dplyr::mutate_if(is.numeric, format, digits = 4, scientific = FALSE)

colnames(kab) <- c("$$n$$", "$$\\alpha$$", "$$\\frac{N_n}{n}$$", "$$-t_{\\alpha/2}$$",

"$$NV_1$$", "$$NV_2$$", "$$t_{\\alpha/2}$$", "$$H_0(NV_1)$$", "$$H_0(NV_2)$$")

knitr::kable(kab, booktabs = TRUE ,escape = FALSE, align = 'c')%>%

kableExtra::row_spec(0, color = "white", background = "green") Setting

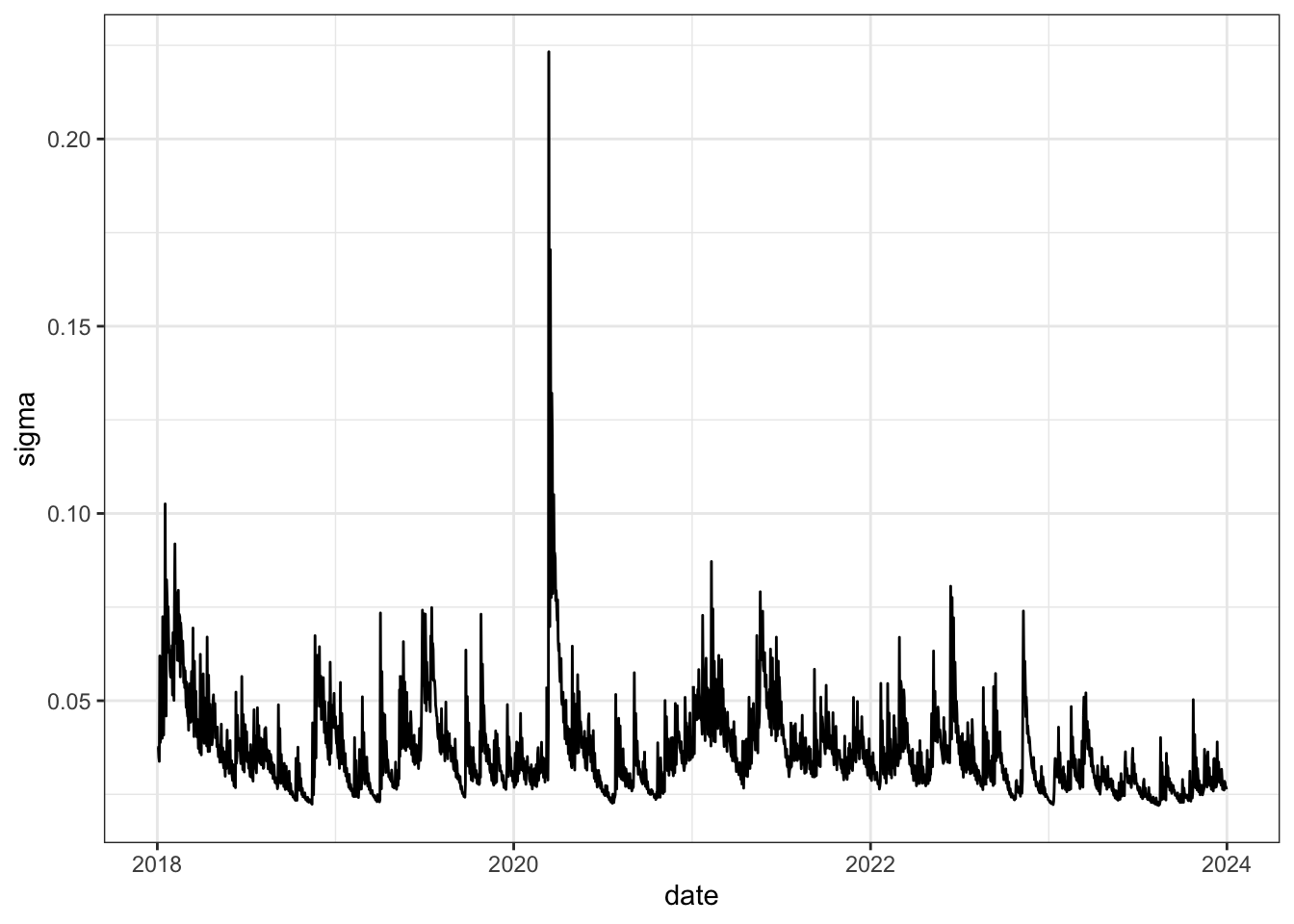

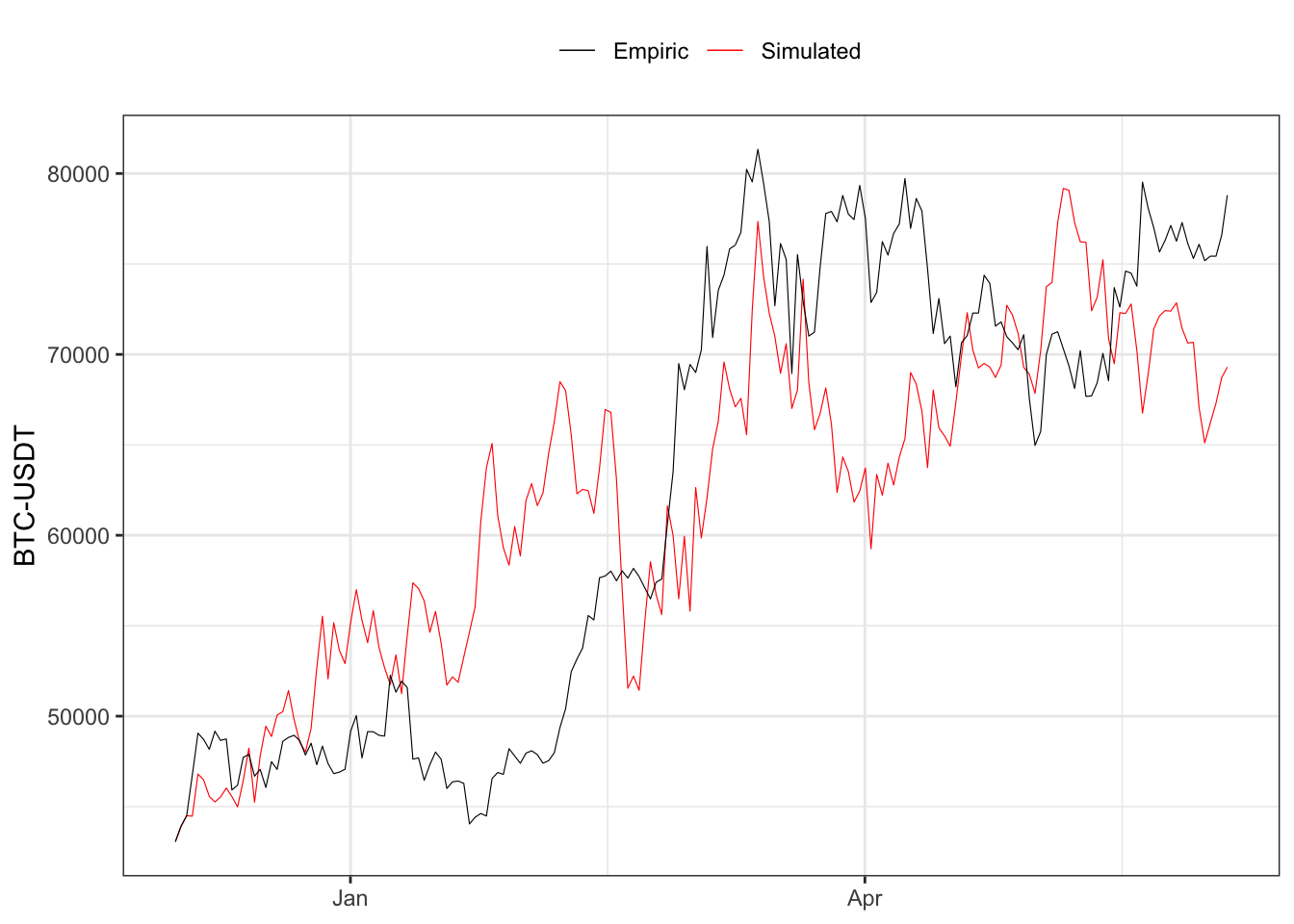

4 VaR for

From the series of close prices

library(rugarch)

ci <- 0.05 # confidence level

# library(binancer) download prices

load("../../../databases/data/temporary/crypto_prices.RData")

#btcusdt <- binancer::binance_klines("BTCUSDT", api = "spot", interval = "1d",

# from = "2018-01-01", to = Sys.Date())

# log close prices

btcusdt$log_Pt <- log(btcusdt$close)

# log returns

btcusdt$Rt <- c(0, diff(btcusdt$log_Pt))

# In sample estimate

data <- dplyr::filter(btcusdt, date <= as.POSIXct("2024-01-01"))

# Test

data_test <- dplyr::filter(btcusdt, date >= as.POSIXct("2023-12-01"))fit GARCH(2,3)

# GARCH Model

# Variance specification

GARCH_spec <- rugarch::ugarchspec(

variance.model = list(model = "sGARCH", garchOrder = c(2,3), external.regressors = NULL),

mean.model = list(armaOrder = c(0,0), include.mean = FALSE), distribution.model = "norm")

# Fitted model

GARCH_model <- rugarch::ugarchfit(data = data$Rt, spec = GARCH_spec, out.sample = 0)

# Fitted variance

data$sigma2 <- GARCH_model@fit$var

# Fitted standard deviation

data$sigma <- sqrt(data$sigma2)

# Standardized residuals

data$ut <- data$Rt/data$sigma

kab <- as_tibble(t(as_tibble(GARCH_model@fit$coef)))%>%

dplyr::mutate_if(is.numeric, format, digits = 4, scientific = FALSE)

colnames(kab) <- c("$$\\omega$$", "$$\\alpha_1$$", "$$\\alpha_2$$",

"$$\\beta_1$$", "$$\\beta_2$$", "$$\\beta_3$$")

knitr::kable(kab, booktabs = TRUE ,escape = FALSE, align = 'c')%>%

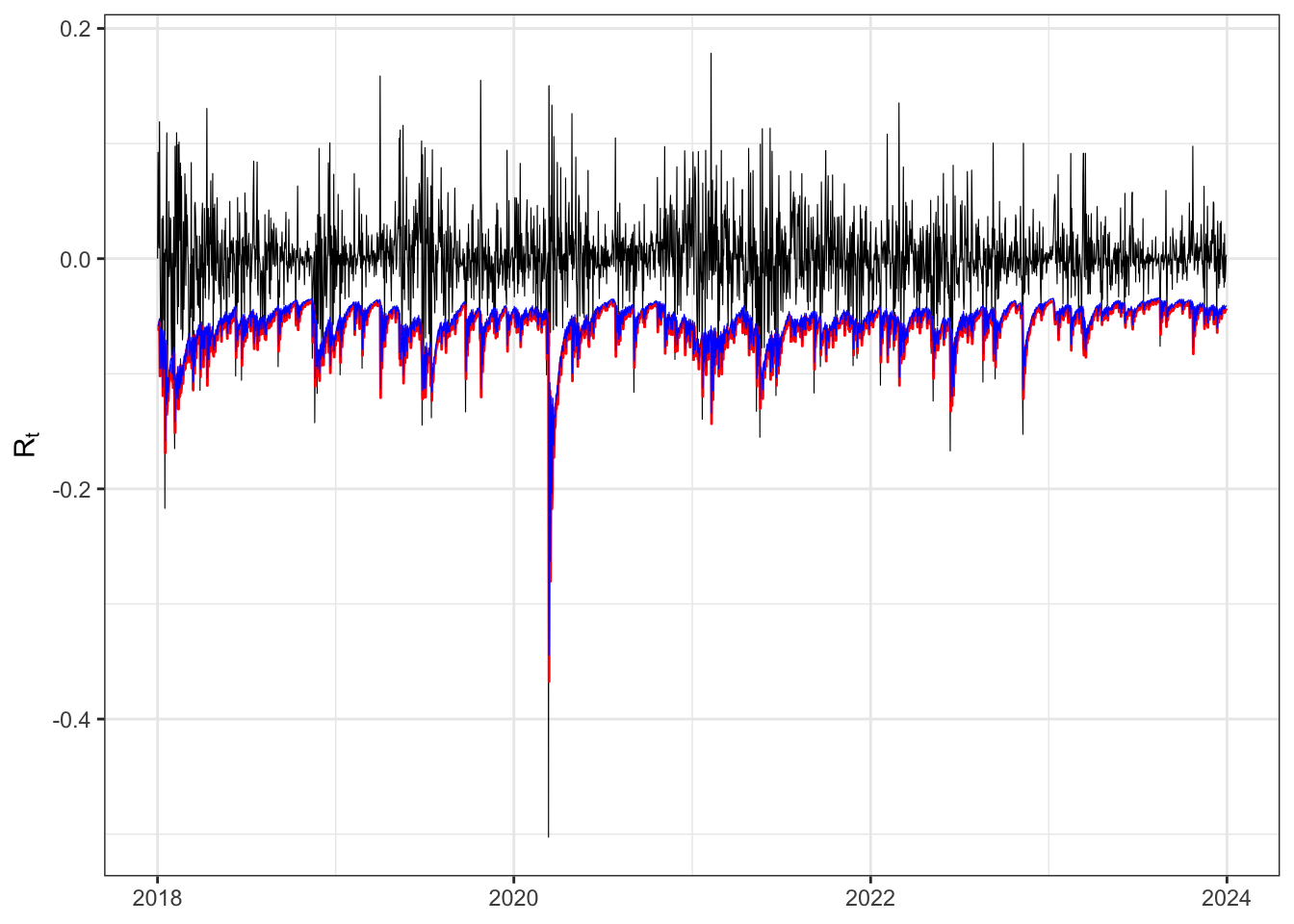

kableExtra::row_spec(0, color = "white", background = "green") Empiric vs theoric VaR on (

Empiric NV test (

# ======================================

Xt <- data$Rt

t_bar <- nrow(data)

# Violation of the VaR

vt <- ifelse(Xt < VaR, 1, 0)

vt[1:3] <- 0

# Theoric variance

v_theoric <- ci*(1-ci)

# Empiric variance

v_empiric <- (sum(vt)/t_bar)*(1 - sum(vt)/t_bar)

# Standardized number of violations

Nt <- sum((vt - ci)/sqrt(v_theoric))

# Statistic test (NV_1)

NV1 <- (1/sqrt(t_bar))*Nt

# Statistic test (NV_2)

NV2 <- (sqrt(v_theoric)/sqrt(v_empiric))*NV1

# Rejection level

t_alpha <- qnorm(ci/2)

# =============== Kable ===============

kab <- dplyr::tibble(

n = t_bar,

alpha_hat = paste0(format(sum(vt)/t_bar*100, digits = 3), "%"),

t_alpha_dw = t_alpha,

NV1 = NV1,

NV2 = NV2,

t_alpha_up = -t_alpha,

H01 = ifelse(NV1 > t_alpha_up | NV1 < t_alpha_dw, "Rejected", "Non-Rejected"),

H02 = ifelse(NV2 > t_alpha_up | NV2 < t_alpha_dw, "Rejected", "Non-Rejected")

) %>%

dplyr::mutate_if(is.numeric, round, digits = 4)

colnames(kab) <- c("$$n$$", "$$\\frac{N_n}{n}$$", "$$-t_{\\alpha/2}$$",

"$$NV_1$$", "$$NV_2$$", "$$t_{\\alpha/2}$$", "$$H_0(NV_1)$$", "$$H_0(NV_2)$$")

knitr::kable(kab, booktabs = TRUE ,escape = FALSE, align = 'c')%>%

kableExtra::row_spec(0, color = "white", background = "green") GARCH(2,3) simulation (

# ==================== Setups =====================

set.seed(3959) # random seed

parAR <- c(mu=0, phi1=0, phi2=0) # AR parameters

parGARCH <- GARCH_model@fit$coef # GARCH parameters

# long-term std deviation of residuals

sigma_eps <- sqrt(parGARCH[1]/(1-sum(parGARCH[-1])))

# ================== Simulation ===================

# Initial points

Xt <- data_test$Rt

# number of simulations

t_bar <- length(Xt)

mu <- rep(parAR[1]/(1-sum(parAR[-1])), 4)

sigma <- rep(sigma_eps, 4)

# Simulated residuals

eps <- rnorm(t_bar)

eps[1:4] = eps[1:4]*sigma[1]

# Value at Risk

q_alpha = qnorm(ci)

VaR = c(0)

for(t in 4:t_bar){

# AR component

mu[t] <- parAR[1] + parAR[2]*Xt[t-1] + parAR[3]*Xt[t-2]

# ARCH component

sigma[t] <- parGARCH[1] + parGARCH[2]*eps[t-1]^2 + parGARCH[3]*eps[t-2]^2

# GARCH component

sigma[t] <- sigma[t] + parGARCH[4]*sigma[t-1]^2 + parGARCH[5]*sigma[t-2]^2 + parGARCH[6]*sigma[t-3]^2

sigma[t] <- sqrt(sigma[t])

# Simulated residuals

eps[t] <- sigma[t]*eps[t]

# Simulated value at risk

VaR[t] <- mu[t] + sigma[t]*q_alpha

# Simulated time series

Xt[t] <- mu[t] + eps[t]

}

# Empirical quantile

q_alpha_emp <- quantile(eps/sigma, probs = ci)

VaR_emp <- mu + sigma*q_alpha_emp

# ===================== Plot ======================

# GARCH(2,3) simulation

ggplot()+

geom_line(aes(data_test$date, data_test$close[4]*cumprod(exp(Xt)), color = "sim"), size = 0.2)+

geom_line(aes(data_test$date, data_test$close[4]*cumprod(exp(data_test$Rt)), color = "emp"), size = 0.2)+

scale_color_manual(values = c(sim = "red", emp = "black"),

labels = c(sim = "Simulated", emp = "Empiric"))+

theme_bw()+

theme(legend.position = "top")+

labs(x = NULL, y = "BTC-USDT", color = NULL)Citation

@online{sartini2024,

author = {Sartini, Beniamino},

title = {Tests on the {Value} at {Risk}},

date = {2024-05-01},

url = {https://greenfin.it/statistics/tests/var-tests.html},

langid = {en}

}