ARCH-GARCH process

1 ARCH(p) process

The autoregressive conditional heteroskedasticity (ARCH) models were introduced in 1982 by Robert Engle to model varying (conditional) variance of time series. It is often found in economics that the larger values of time series also lead to larger instability. Let’s define a time series such as \(X_t \sim ARCH(p)\), then it is defined as: \[ \begin{aligned} & {} x_t = \mu + e_t \\ & e_t = \sigma_t u_t \\ & \sigma_t^{2} = \omega + \sum_{i=1}^{p} \alpha_i e_{t-i}^2 \end{aligned} \] where \(u_t \sim \text{MDS}(0,1)\).

The unconditional and conditional mean of a process \(X_t \sim ARCH(p)\) are equal to: \[ \mathbb{E}\{X_t\} = \mathbb{E}\{X_t|I_{t-1}\} = \mu \text{,} \] where \(I_{t-1}\) denotes the information available up to time \(t-1\). Instead, the long term variance of the process, i.e. the unconditional variance, is defined as: \[ \begin{aligned} \mathbb{V}\{X_t\} {} & = \mathbb{V}\{\mu + \sigma_t u_t\} = {} & \\ & = \mathbb{V}\{\sigma_t u_t\} = & (\mathbb{E}\{u_t\} = 0) \\ & = \mathbb{E}\{\sigma_t^2 u_t^2\} = & (u_t \text{ iid}) \\ & = \mathbb{E}\{\sigma_t^2\} \mathbb{E}\{u_t^2\} = & (\mathbb{E}\{u_t^2\} = 1) \\ & = \mathbb{E}\{\sigma_t^2\} \cdot 1 \end{aligned} \] where the unconditional expectation of the stochastic variance is given by \[ \mathbb{E}\{\sigma_t^2\} = \frac{\omega}{1 - \sum_{i=1}^{p} \alpha_i} \text{.} \] It is clear that, in general \(\omega \neq 0\) and, to ensure that the process is stationary, the following condition on the parameters must be satisfied: \[ \sum_{i=1}^{p} \alpha_i < 1 \quad \alpha_i > 0 \;\; \forall i \]

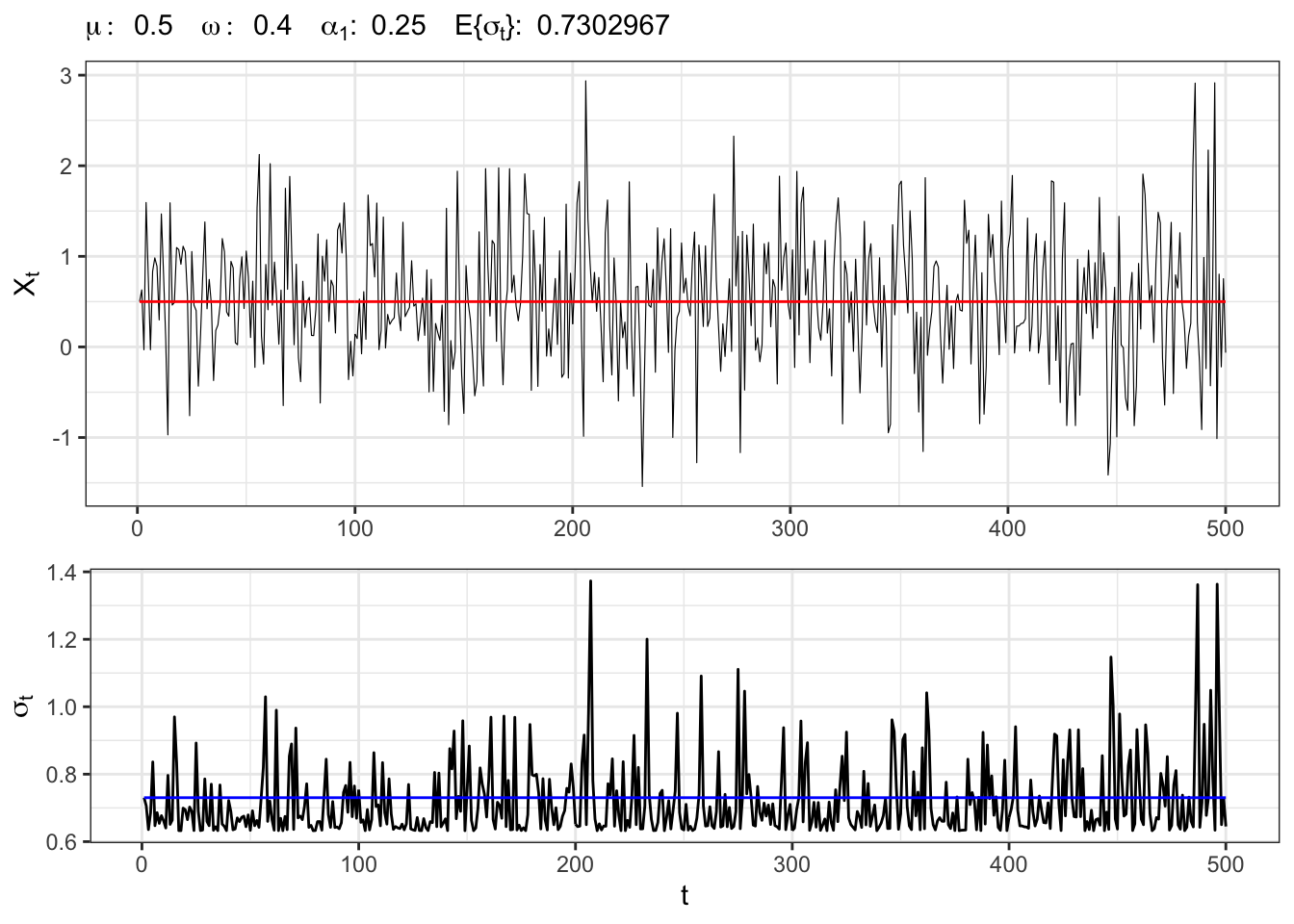

1.1 Example: ARCH(1) process

Let’s simulate an ARCH(1) process with normal residuals, namely \(X_t \sim ARCH(1)\), i.e. \[ \begin{aligned} & {} x_t = \mu + e_t \\ & e_t = \sigma_t u_t \\ & \sigma_t^{2} = \omega + \alpha_1 e_{t-1}^2 \end{aligned} \] where \(u_t \sim \mathcal{N}(0,1)\).

ARCH(1) simulation

# Random seed

set.seed(1)

# ==================== Setups =====================

# Nsumber of simulations

t_bar <- 500

# Parameters

par <- c(mu=0.5, omega=0.4, alpha1=0.25)

# Long-term std deviation of residuals

sigma_eps <- sqrt(par[2]/(1-par[3]))

# ================== Simulation ===================

# Initial point

Xt <- rep(par[1], 1)

# Store stochastic variance

sigma <- rep(sigma_eps, 1)

# Simulated residuals

eps <- rnorm(t_bar, 0, 1)

for(t in 2:t_bar){

# ARCH(1) variance

sigma[t] <- par[3]*eps[t-1]^2

# ARCH(1) std. deviation

sigma[t] <- sqrt(par[2] + sigma[t])

# Simulated residuals

eps[t] <- sigma[t]*eps[t]

# Simulated time series

Xt[t] <- par[1] + eps[t]

}

# ===================== Plot ======================

# ARCH(1) simulation

plot_arch <- ggplot()+

geom_line(aes(1:t_bar, Xt), size = 0.2)+

geom_line(aes(1:t_bar, par[1]), color = "red")+

theme_bw()+

labs(x = NULL, y = TeX("$X_t$"),

subtitle = TeX(paste0("$\\mu:\\;", par[1],

"\\;\\; \\omega:\\;", par[2],

"\\;\\; \\alpha_{1}:\\;", par[3],

"\\;\\; E\\{\\sigma_t\\}:\\;", sigma_eps,

"$")))

# ARCH(1) std. deviation

plot_sigma <- ggplot()+

geom_line(aes(1:t_bar, sigma), alpha = 1)+

geom_line(aes(1:t_bar, sigma_eps), alpha = 1, color = "blue")+

labs(x = "t", y = TeX("$\\sigma_{t}$"))+

theme_bw()

gridExtra::grid.arrange(plot_arch, plot_sigma, heights = c(0.6, 0.4))

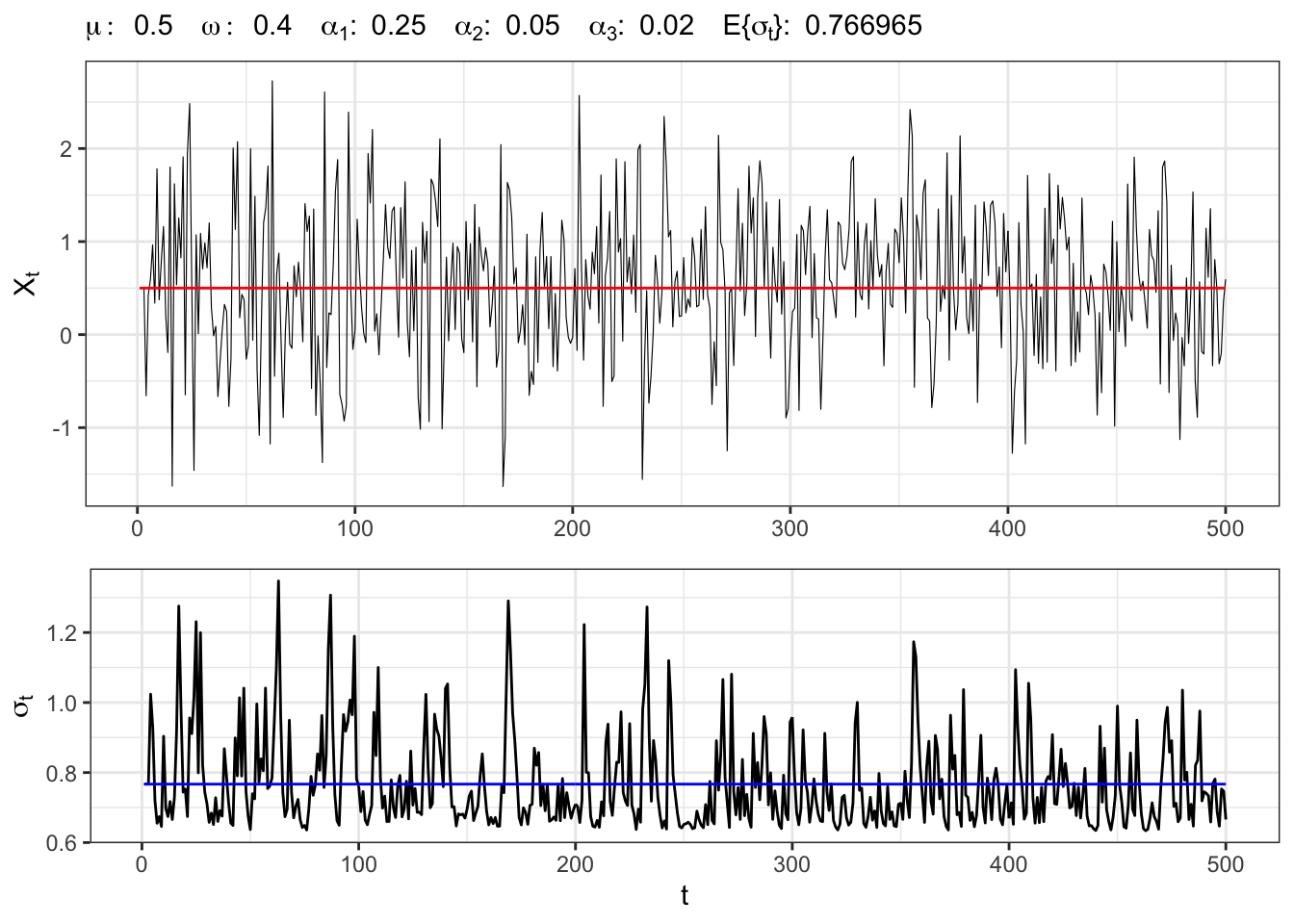

1.2 Example: ARCH(3) process

Let’s simulate an ARCH(3) process with normal residuals, namely \(X_t \sim ARCH(3)\), i.e. \[ \begin{aligned} & {} x_t = \mu + e_t \\ & e_t = \sigma_t u_t \\ & \sigma_t^{2} = \omega + \alpha_1 e_{t-1}^2 + \alpha_2 e_{t-2}^2 + \alpha_3 e_{t-3}^2 \end{aligned} \] where \(u_t \sim \mathcal{N}(0,1)\).

ARCH(3) simulation

# Random seed

set.seed(2)

# ==================== Setups =====================

# Number of simulations

t_bar <- 500

# Parameters

par <- c(mu=0.5, omega=0.4,

alpha1=0.25, alpha2=0.05,alpha3=0.02)

# Long-term std deviation of residuals

sigma_eps <- sqrt(par[2]/(1-sum(par[3:5])))

# ================== Simulation ===================

# Initial point

Xt <- rep(par[1], 3)

# Store stochastic variance

sigma <- rep(sigma_eps, 3)

# Simulated residuals

eps <- rnorm(t_bar, 0, 1)

for(t in 4:t_bar){

# ARCH(3) variance

sigma[t] <- par[3]*eps[t-1]^2 + par[4]*eps[t-2]^2 + par[5]*eps[t-3]^2

# ARCH(3) std. deviation

sigma[t] <- sqrt(par[2] + sigma[t])

# Simulated residuals

eps[t] <- sigma[t]*eps[t]

# Simulated time series

Xt[t] <- par[1] + eps[t]

}

# ===================== Plot ======================

# ARCH(3) simulation

plot_arch <- ggplot()+

geom_line(aes(1:t_bar, Xt), size = 0.2)+

geom_line(aes(1:t_bar, par[1]), color = "red")+

theme_bw()+

labs(x = NULL, y = TeX("$X_t$"),

subtitle = TeX(paste0("$\\mu:\\;", par[1],

"\\;\\; \\omega:\\;", par[2],

"\\;\\; \\alpha_{1}:\\;", par[3],

"\\;\\; \\alpha_{2}:\\;", par[4],

"\\;\\; \\alpha_{3}:\\;", par[5],

"\\;\\; E\\{\\sigma_t\\}:\\;", sigma_eps,

"$")))

# ARCH(3) std. deviation

plot_sigma <- ggplot()+

geom_line(aes(1:t_bar, sigma), alpha = 1)+

geom_line(aes(1:t_bar, sigma_eps), alpha = 1, color = "blue")+

labs(x = "t", y = TeX("$\\sigma_{t}$"))+

theme_bw()

gridExtra::grid.arrange(plot_arch, plot_sigma, heights = c(0.6, 0.4))

2 GARCH(p,q) process

As done with the ARCH(p), with generalized autoregressive conditional heteroskedasticity (GARCH) we model the dependency of the conditional second moment. It represents a more parsimonious way to express the conditional variance. Let’s consider a process \(X_t \sim \text{GARCH}(p,q)\), then it is defined as: \[ \begin{aligned} & {} x_t = \mu + e_t \\ & e_t = \sigma_t u_t \\ & \sigma_t^{2} = \omega + \sum_{i=1}^{p} \alpha_i e_{t-i}^2 + \sum_{j=1}^{q} \beta_j \sigma_{t-j}^2 \end{aligned} \] where \(u_t \sim \text{MDS}(0,1)\).

The unconditional and conditional mean of a process \(X_t \sim GARCH(p,q)\) are equal to: \[

\mathbb{E}\{X_t\} = \mathbb{E}\{X_t|I_{t-1}\} = \mu \text{,}

\] where \(I_{t-1}\) denotes the information available up to time \(t-1\). Instead, the long term variance of the process, i.e. the unconditional variance, is defined as for the ARCH(p) model:

\[

\mathbb{V}\{X_t\} = \mathbb{E}\{\sigma_t^2\}

\] where what changes is the unconditional expectation of the stochastic variance i.e. \[

\mathbb{E}\{\sigma_t^2\} = \frac{\omega}{1 - \sum_{i=1}^{p} \alpha_i - \sum_{j=1}^{q} \beta_j} \text{.}

\] It is clear that, in general \(\omega \neq 0\) and, to ensure that the process is stationary, the following condition on the parameters must be satisfied: \[

\sum_{i=1}^{p} \alpha_i + \sum_{j=1}^{q} \beta_j < 1 \quad \alpha_i, \beta_j > 0 \;\; \forall i, \forall j \text{.}

\]

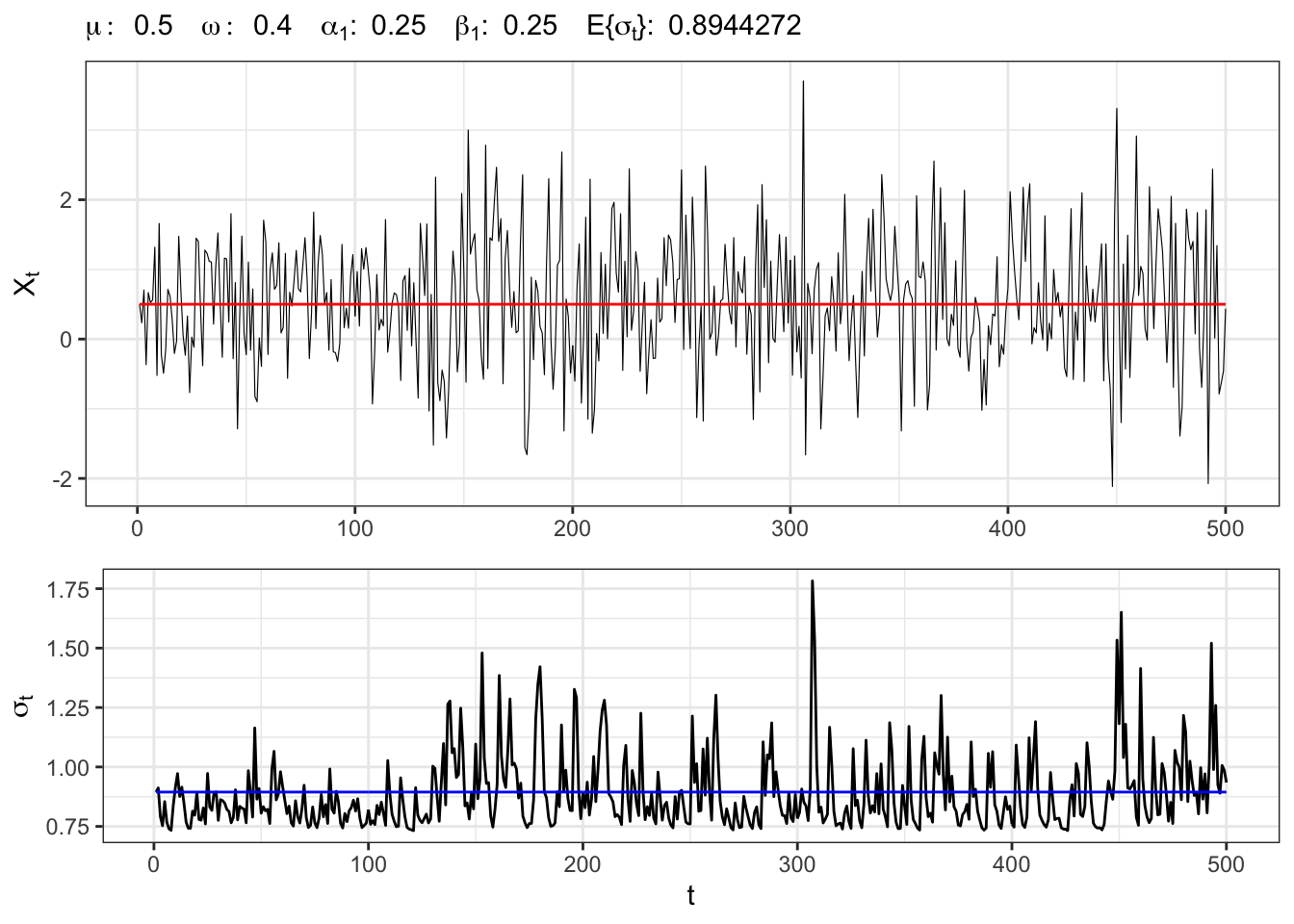

2.1 Example: GARCH(1,1) process

Let’s simulate an GARCH(1,1) process with normal residuals, namely \(X_t \sim GARCH(1,1)\), i.e. \[ \begin{aligned} & {} x_t = \mu + e_t \\ & e_t = \sigma_t u_t \\ & \sigma_t^{2} = \omega + \alpha_1 e_{t-1}^2 + \beta_1 \sigma_{t-1}^2 \end{aligned} \] where \(u_t \sim \mathcal{N}(0,1)\).

GARCH(1,1) simulation

# Random seed

set.seed(3)

# ==================== Setups =====================

# number of simulations

t_bar <- 500

# parameters

par <- c(mu=0.5, omega=0.4, alpha1=0.25, beta1=0.25)

# long-term std deviation of residuals

sigma_eps <- sqrt(par[2]/(1 - par[3] - par[4]))

# ================== Simulation ===================

# Initial points

Xt <- rep(par[1], 1)

sigma <- rep(sigma_eps, 1)

# Simulated residuals

eps <- rnorm(t_bar, 0, 1)

for(t in 2:t_bar){

# GARCH(1,1) variance

sigma[t] <- par[3]*eps[t-1]^2 + par[4]*sigma[t-1]^2

# GARCH std. deviation

sigma[t] <- sqrt(par[2] + sigma[t])

# Simulated residuals

eps[t] <- sigma[t]*eps[t]

# Simulated time series

Xt[t] <- par[1] + eps[t]

}

# ===================== Plot ======================

# GARCH(1,1) simulation

plot_garch <- ggplot()+

geom_line(aes(1:t_bar, Xt), size = 0.2)+

geom_line(aes(1:t_bar, par[1]), color = "red")+

theme_bw()+

labs(x = NULL, y = TeX("$X_t$"),

subtitle = TeX(paste0("$\\mu:\\;", par[1],

"\\;\\; \\omega:\\;", par[2],

"\\;\\; \\alpha_{1}:\\;", par[3],

"\\;\\; \\beta_{1}:\\;", par[4],

"\\;\\; E\\{\\sigma_t\\}:\\;", sigma_eps,

"$")))

# GARCH(1,1) std. deviation

plot_sigma <- ggplot()+

geom_line(aes(1:t_bar, sigma), alpha = 1)+

geom_line(aes(1:t_bar, sigma_eps), alpha = 1, color = "blue")+

labs(x = "t", y = TeX("$\\sigma_{t}$"))+

theme_bw()

gridExtra::grid.arrange(plot_garch, plot_sigma, heights = c(0.6, 0.4))

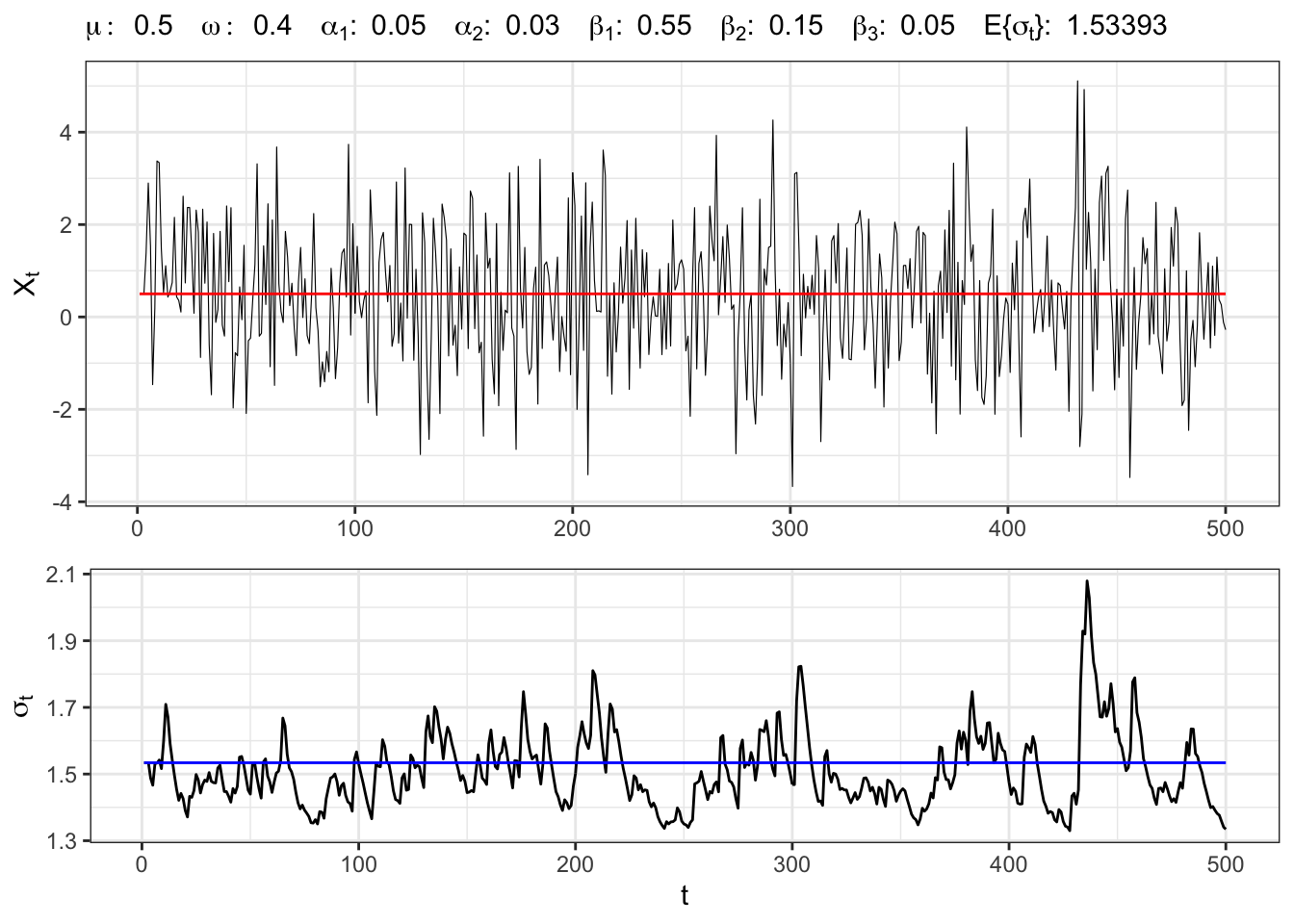

2.2 Example: GARCH(2,3) process

Let’s simulate an GARCH(2,3) process with normal residuals, namely \(X_t \sim GARCH(2,3)\), i.e. \[ \begin{aligned} & {} x_t = \mu + e_t \\ & e_t = \sigma_t u_t \\ & \sigma_t^{2} = \omega + \sum_{i=1}^{2} \alpha_i e_{t-i}^2 + \sum_{j=1}^{3} \beta_j \sigma_{t-j}^2 \end{aligned} \] where \(u_t \sim \mathcal{N}(0,1)\).

GARCH(2,3) simulation

# Random seed

set.seed(4)

# ==================== Setups =====================

# Number of simulations

t_bar <- 500

# Parameters

par <- c(mu=0.5, omega=0.4,

alpha1=0.05, alpha1=0.03,

beta1=0.55, beta2=0.15, beta3=0.05)

# Long-term std deviation of residuals

sigma_eps <- sqrt(par[2]/(1 - sum(par[3:7])))

# ================== Simulation ===================

# Initial points

Xt <- rep(par[1], 4)

sigma <- rep(sigma_eps, 4)

# Simulated residuals

eps <- rnorm(t_bar, 0, 1)

for(t in 4:t_bar){

# ARCH(2) variance

sigma2_arch <- par[3]*eps[t-1]^2 + par[4]*eps[t-2]^2

# GARCH(3) variance

sigma2_garch <- par[5]*sigma[t-1]^2 + par[6]*sigma[t-2]^2 + par[7]*sigma[t-3]^2

# GARCH(2,3) std. deviation

sigma[t] <- sqrt(par[2] + sigma2_arch + sigma2_garch)

# Simulated residuals

eps[t] <- sigma[t]*eps[t]

# Simulated time series

Xt[t] <- par[1] + eps[t]

}

# ===================== Plot ======================

# GARCH(2,3) simulation

plot_garch <- ggplot()+

geom_line(aes(1:t_bar, Xt), size = 0.2)+

geom_line(aes(1:t_bar, par[1]), color = "red")+

theme_bw()+

labs(x = NULL, y = TeX("$X_t$"),

subtitle = TeX(paste0("$\\mu:\\;", par[1],

"\\;\\; \\omega:\\;", par[2],

"\\;\\; \\alpha_{1}:\\;", par[3],

"\\;\\; \\alpha_{2}:\\;", par[4],

"\\;\\; \\beta_{1}:\\;", par[5],

"\\;\\; \\beta_{2}:\\;", par[6],

"\\;\\; \\beta_{3}:\\;", par[7],

"\\;\\; E\\{\\sigma_t\\}:\\;", sigma_eps,

"$")))

# GARCH(2,3) std. deviation

plot_sigma <- ggplot()+

geom_line(aes(1:t_bar, sigma), alpha = 1)+

geom_line(aes(1:t_bar, sigma_eps), color = "blue")+

labs(x = "t", y = TeX("$\\sigma_{t}$"))+

theme_bw()

gridExtra::grid.arrange(plot_garch, plot_sigma, heights = c(0.6, 0.4))

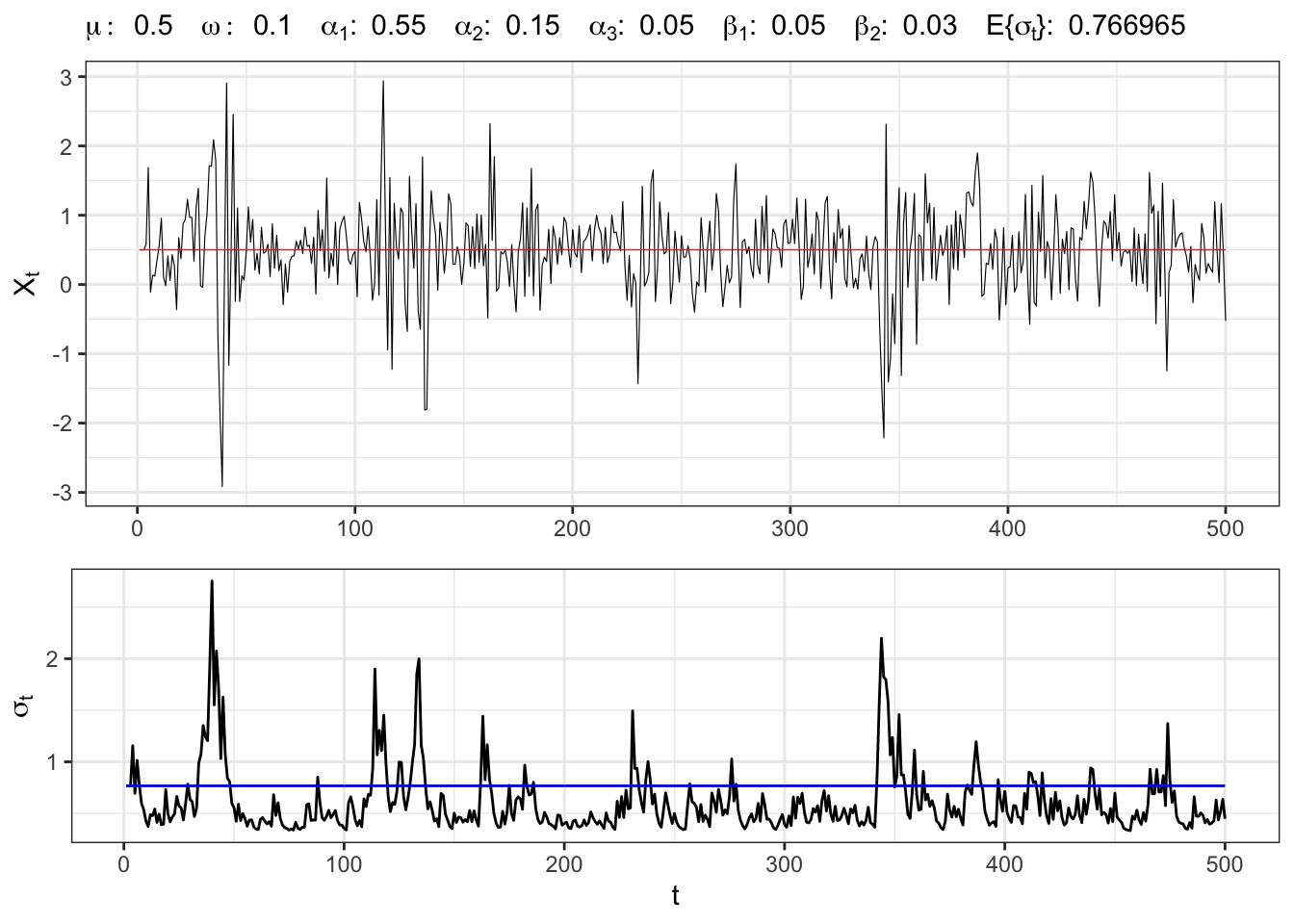

2.3 Example: GARCH(3,2) process

Let’s simulate an GARCH(3,2) process with normal residuals, namely \(X_t \sim GARCH(3,2)\), i.e. \[ \begin{aligned} & {} x_t = \mu + e_t \\ & e_t = \sigma_t u_t \\ & \sigma_t^{2} = \omega + \sum_{i=1}^{3} \alpha_i e_{t-i}^2 + \sum_{j=1}^{2} \beta_j \sigma_{t-j}^2 \end{aligned} \] where \(u_t \sim \mathcal{N}(0,1)\).

GARCH(3,2) simulation

# Random seed

set.seed(5)

# ==================== Setups =====================

# Number of simulations

t_bar <- 500

# Parameters

par <- c(mu = 0.5, omega = 0.1, alpha1 = 0.55,

alpha2 = 0.15, alpha3 = 0.05,

beta1 = 0.05, beta2 = 0.03)

# Long-term std deviation of residuals

sigma_eps <- sqrt(par[2]/(1 - sum(par[3:7])))

# ================== Simulation ===================

# Initial points

Xt <- rep(par[1], 4)

sigma <- rep(sigma_eps, 4)

# Simulated residuals

eps <- rnorm(t_bar, 0, 1)

for(t in 4:t_bar){

# ARCH(3) variance

sigma2_arch <- par[3]*eps[t-1]^2 + par[4]*eps[t-2]^2 + par[5]*eps[t-3]^2

# GARCH(2) variance

sigma2_garch <- par[6]*sigma[t-3]^2 + par[7]*sigma[t-2]^2

# GARCH(3,2) std. deviation

sigma[t] <- sqrt(par[2] + sigma2_arch + sigma2_garch)

# Simulated residuals

eps[t] <- sigma[t]*eps[t]

# Simulated time series

Xt[t] <- par[1] + eps[t]

}

# ===================== Plot ======================

# GARCH(3,2) simulation

plot_garch <- ggplot()+

geom_line(aes(1:t_bar, Xt), size = 0.2)+

geom_line(aes(1:t_bar, par[1]), color = "red", size = 0.2)+

theme_bw()+

labs(x = NULL, y = TeX("$X_t$"),

subtitle = TeX(paste0("$\\mu:\\;", par[1],

"\\;\\; \\omega:\\;", par[2],

"\\;\\; \\alpha_{1}:\\;", par[3],

"\\;\\; \\alpha_{2}:\\;", par[4],

"\\;\\; \\alpha_{3}:\\;", par[5],

"\\;\\; \\beta_{1}:\\;", par[6],

"\\;\\; \\beta_{2}:\\;", par[7],

"\\;\\; E\\{\\sigma_t\\}:\\;", sigma_eps,

"$")))

# GARCH(3,2) std. deviation

plot_sigma <- ggplot()+

geom_line(aes(1:t_bar, sigma), alpha = 1)+

geom_line(aes(1:t_bar, sigma_eps), color = "blue")+

labs(x = "t", y = TeX("$\\sigma_{t}$"))+

theme_bw()

gridExtra::grid.arrange(plot_garch, plot_sigma, heights = c(0.6, 0.4))

3 IGARCH

Integrated Generalized Autoregressive Conditional heteroskedasticity (IGARCH(p,q)) is a restricted version of the GARCH model, where the persistent parameters sum up to one, and imports a unit root in the GARCH process. The condition for this is

\[ \sum_{i=1}^{p} \alpha_i + \sum_{j=1}^{q} \beta_j = 1 \]

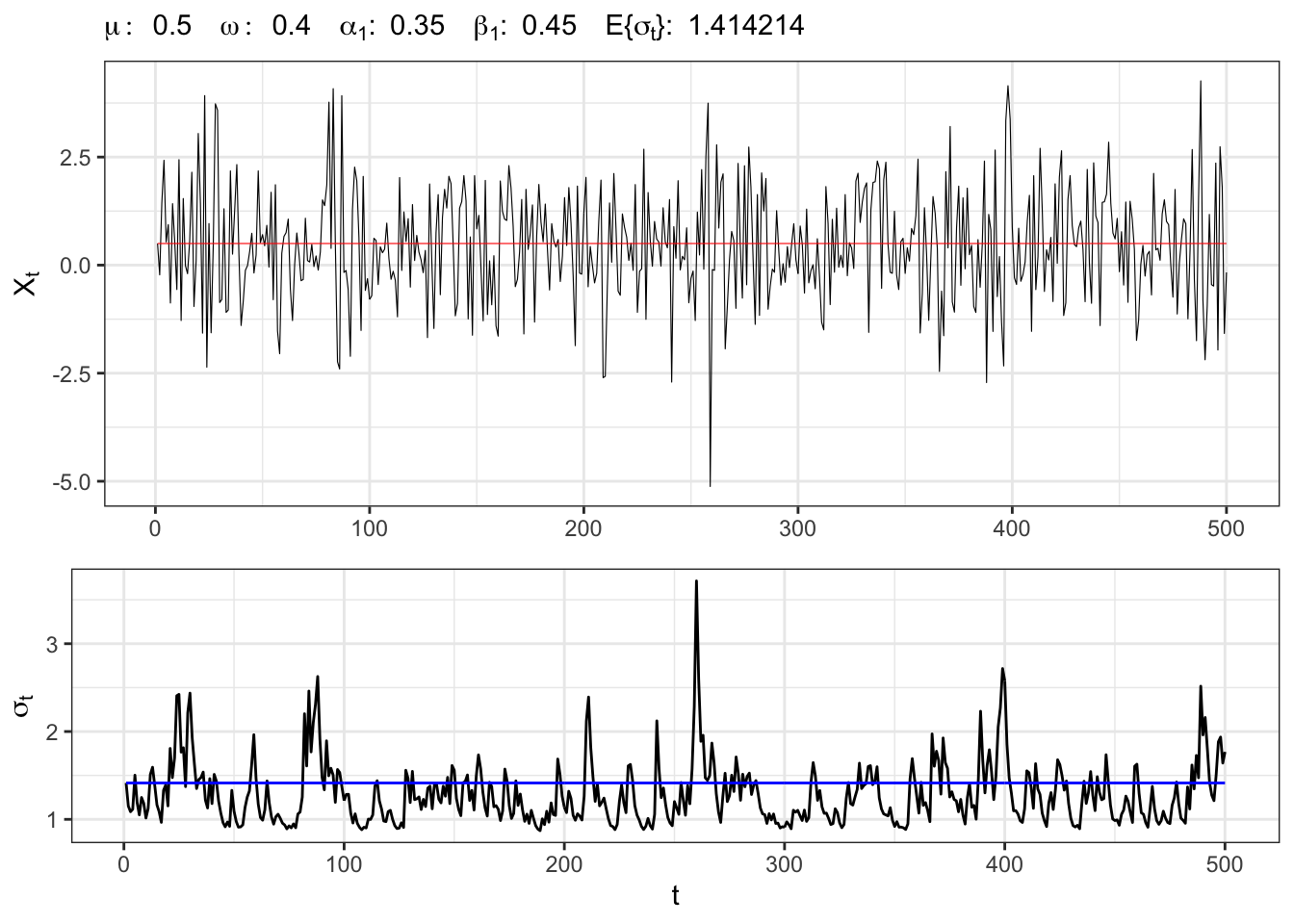

3.1 Example: IGARCH(1,1)

IGARCH(1,1) simulation

# Random seed

set.seed(6)

# ==================== Setups =====================

# number of simulations

t_bar <- 500

# parameters

par <- c(mu=0.5, omega=0.4, alpha1=0.35, beta1=0.45)

# long-term std deviation of residuals

sigma_eps <- sqrt(par[2]/(1 - par[3] - par[4]))

# ================== Simulation ===================

# Initial points

Xt <- rep(par[1], 1)

sigma <- rep(sigma_eps, 1)

# Simulated residuals

eps <- rnorm(t_bar, 0, 1)

for(t in 2:t_bar){

# iGARCH(1,1) variance

sigma[t] <- par[3]*eps[t-1]^2 + par[4]*sigma[t-1]^2

# iGARCH std. deviation

sigma[t] <- sqrt(par[2] + sigma[t])

# Simulated residuals

eps[t] <- sigma[t]*eps[t]

# Simulated time series

Xt[t] <- par[1] + eps[t]

}

# ===================== Plot ======================

# iGARCH(1,1) simulation

plot_garch <- ggplot()+

geom_line(aes(1:t_bar, Xt), size = 0.2)+

geom_line(aes(1:t_bar, par[1]), color = "red", size = 0.2)+

theme_bw()+

labs(x = NULL, y = TeX("$X_t$"),

subtitle = TeX(paste0("$\\mu:\\;", par[1],

"\\;\\; \\omega:\\;", par[2],

"\\;\\; \\alpha_{1}:\\;", par[3],

"\\;\\; \\beta_{1}:\\;", par[4],

"\\;\\; E\\{\\sigma_t\\}:\\;", sigma_eps,

"$")))

# iGARCH(1,1) std. deviation

plot_sigma <- ggplot()+

geom_line(aes(1:t_bar, sigma), alpha = 1)+

geom_line(aes(1:t_bar, sigma_eps), alpha = 1, color = "blue")+

labs(x = "t", y = TeX("$\\sigma_{t}$"))+

theme_bw()

gridExtra::grid.arrange(plot_garch, plot_sigma, heights = c(0.6, 0.4))

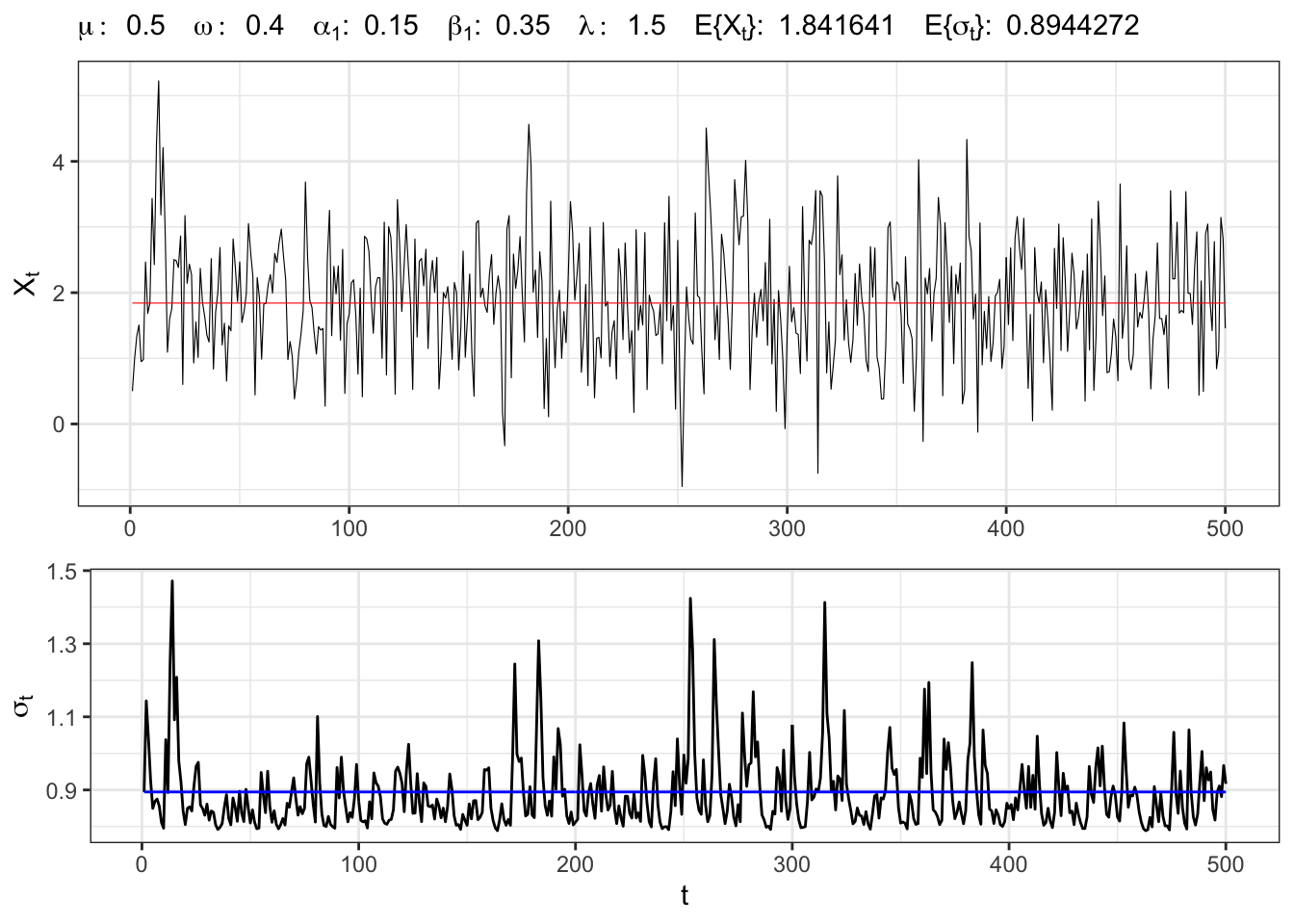

4 GARCH-M

The GARCH in-mean (GARCH-M) model adds a stochastic term into the mean equation, i.e.

\[ \begin{aligned} & {} x_t = \mu + \sigma_t \lambda + e_t \\ & e_t = \sigma_t u_t \\ & \sigma_t^{2} = \omega + \sum_{i=1}^{p} \alpha_i e_{t-i}^2 + \sum_{j=1}^{q} \beta_j \sigma_{t-j}^2 \end{aligned} \] The effect of the parameter \(\lambda\) is a shift of the mean of the process. The unconditional mean became \[ \mathbb{E}\{X_t\} = \mu + \mathbb{E}\{\sigma_t\} \lambda \]

4.1 Example: GARCH-M(1,1)

GARCH-M(1,1) simulation

set.seed(7)

# ==================== Setups =====================

# number of simulations

t_bar <- 500

# parameters

par <- c(mu=0.5, omega=0.4,

alpha1=0.15, beta1=0.35, lambda = 1.5)

# long-term std deviation of residuals

sigma_eps <- sqrt(par[2]/(1 - par[3] - par[4]))

# ================== Simulation ===================

# Initial points

Xt <- rep(par[1], 1)

sigma <- rep(sigma_eps, 1)

# Simulated residuals

eps <- rnorm(t_bar, 0, 1)

eps[1:2] <- eps[1:2]*sigma_eps

for(t in 2:t_bar){

# GARCH(1,1) variance

sigma[t] <- par[3]*eps[t-1]^2 + par[4]*sigma[t-1]^2

# GARCH std. deviation

sigma[t] <- sqrt(par[2] + sigma[t])

# Simulated residuals

eps[t] <- sigma[t]*eps[t]

# Simulated time series

Xt[t] <- par[1] + sigma[t]*par[5] + eps[t]

}

# ===================== Plot ======================

# GARCH-M(1,1) simulation

plot_garch <- ggplot()+

geom_line(aes(1:t_bar, Xt), size = 0.2)+

geom_line(aes(1:t_bar, par[1] + sigma_eps*par[5]), color = "red", size = 0.2)+

theme_bw()+

labs(x = NULL, y = TeX("$X_t$"),

subtitle = TeX(paste0("$\\mu:\\;", par[1],

"\\;\\; \\omega:\\;", par[2],

"\\;\\; \\alpha_{1}:\\;", par[3],

"\\;\\; \\beta_{1}:\\;", par[4],

"\\;\\; \\lambda:\\;", par[5],

"\\;\\; E\\{\\X_t\\}:\\;", par[1] + sigma_eps*par[5],

"\\;\\; E\\{\\sigma_t\\}:\\;", sigma_eps,

"$")))

# GARCH-M(1,1) std. deviation

plot_sigma <- ggplot()+

geom_line(aes(1:t_bar, sigma), alpha = 1)+

geom_line(aes(1:t_bar, sigma_eps), alpha = 1, color = "blue")+

labs(x = "t", y = TeX("$\\sigma_{t}$"))+

theme_bw()

gridExtra::grid.arrange(plot_garch, plot_sigma, heights = c(0.6, 0.4))

Citation

@online{sartini2024,

author = {Sartini, Beniamino},

title = {ARCH-GARCH Process},

date = {2024-05-01},

url = {https://greenfin.it/statistics/arch-garch-process.html},

langid = {en}

}