1 Hourly energy demand generation and weather

2 Project description

The dataset contains 4 years of electrical consumption, generation, pricing, and weather data for Spain. Consumption and generation data was retrieved from ENTSOE a public portal for Transmission Service Operator (TSO) data. Settlement prices were obtained from the Spanish TSO Red Electric España. Weather data was purchased as part of a personal project from the Open Weather API for the 5 largest cities in Spain. The original datasets can be downloaded from Kaggle. However, the dataset to be used for the project has been already pre-processed. The code used for preprocessing is in this github repository, while the dataset to be used can be downloaded here.

- date: datetime index localized to CET.

- date_day: date without hour.

- city: reference city. (

Valencia.Madrid,Bilbao,Barcelona,Seville) - Year: number for the year.

- Month: number for the month.

- Day: number for the day in a month.

- Hour: reference hour of the day.

Energy variables

- fossil: energy produced with fossil sources: i.e. coal/lignite, natural gas, oil (MW).

- nuclear: energy produced with nuclear sources (MW).

- energy_other: other generation (MW).

- solar: solar generation (MW).

- biomass: biomass generation (MW).

- river: hydroeletric generation (MW).

- wind: wind generation (MW).

- energy_other_renewable: other renewable generation (MW).

- energy_waste: wasted generation (MW).

- pred_solar: forecasted solar generation (MW).

- pred_demand: forecasted electrical demand by TSO (MW).

- pred_price: forecasted day ahead electrical price by TSO (Eur/MWh).

- price: actual electrical price (Eur/MWh).

- demand: actual electrical demand (Eur/MWh).

- prod_tot: total electrical production (MW).

- prod_renewable: total renewable electrical production (MW).

Weather variables

- temp: mean temperature.

- temp_min: minimum temperature (degrees).

- temp_max: maximum temperature (degrees).

- pressure: pressure in (hPas).

- humidity: humidity in percentage.

- wind_speed: wind speed (m/s).

- wind_deg: wind direction.

- rain_1h: rain in last hour (mm).

- rain_3h: rain in last 3 hours (mm).

- snow_3h: show last 3 hours (mm).

- clouds_all: cloud cover in percentage.

Import data

dir_data <- "../grenfin-summer-school/data"

filepath <- file.path(dir_data, "data.csv")

data <- readr::read_csv(filepath, show_col_types = FALSE, progress = FALSE)

head(data) %>%

knitr::kable(booktabs = TRUE ,escape = FALSE, align = 'c')%>%

kableExtra::row_spec(0, color = "white", background = "green")| date | date_day | Year | Month | Day | Hour | Season | fossil | nuclear | energy_other | solar | biomass | river | energy_other_renewable | energy_waste | wind | pred_solar | pred_demand | pred_price | demand | price | prod | prod_renewable | temp | temp_min | temp_max | pressure | humidity | wind_speed | wind_deg | rain_1h | rain_3h | snow_3h | clouds_all |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2014-12-31 23:00:00 | 2014-12-31 | 2014 | 12 | 31 | 23 | Winter | 10156 | 7096 | 43 | 49 | 447 | 3813 | 73 | 196 | 6378 | 17 | 26118 | 50.10 | 25385 | 65.41 | 27939 | 10687 | -0.6585375 | -5.825 | 8.475 | 1016.4 | 82.4 | 2.0 | 135.2 | 0 | 0 | 0 | 0 |

| 2015-01-01 00:00:00 | 2015-01-01 | 2015 | 1 | 1 | 0 | Winter | 10437 | 7096 | 43 | 50 | 449 | 3587 | 71 | 195 | 5890 | 16 | 24934 | 48.10 | 24382 | 64.92 | 27509 | 9976 | -0.6373000 | -5.825 | 8.475 | 1016.2 | 82.4 | 2.0 | 135.8 | 0 | 0 | 0 | 0 |

| 2015-01-01 01:00:00 | 2015-01-01 | 2015 | 1 | 1 | 1 | Winter | 9918 | 7099 | 43 | 50 | 448 | 3508 | 73 | 196 | 5461 | 8 | 23515 | 47.33 | 22734 | 64.48 | 26484 | 9467 | -1.0508625 | -6.964 | 8.136 | 1016.8 | 82.0 | 2.4 | 119.0 | 0 | 0 | 0 | 0 |

| 2015-01-01 02:00:00 | 2015-01-01 | 2015 | 1 | 1 | 2 | Winter | 8859 | 7098 | 43 | 50 | 438 | 3231 | 75 | 191 | 5238 | 2 | 22642 | 42.27 | 21286 | 59.32 | 24914 | 8957 | -1.0605312 | -6.964 | 8.136 | 1016.6 | 82.0 | 2.4 | 119.2 | 0 | 0 | 0 | 0 |

| 2015-01-01 03:00:00 | 2015-01-01 | 2015 | 1 | 1 | 3 | Winter | 8313 | 7097 | 43 | 42 | 428 | 3499 | 74 | 189 | 4935 | 9 | 21785 | 38.41 | 20264 | 56.04 | 24314 | 8904 | -1.0041000 | -6.964 | 8.136 | 1016.6 | 82.0 | 2.4 | 118.4 | 0 | 0 | 0 | 0 |

| 2015-01-01 04:00:00 | 2015-01-01 | 2015 | 1 | 1 | 4 | Winter | 7962 | 7098 | 43 | 34 | 410 | 3804 | 74 | 188 | 4618 | 4 | 21441 | 35.72 | 19905 | 53.63 | 23926 | 8866 | -1.1260000 | -7.708 | 7.317 | 1017.4 | 82.6 | 2.4 | 174.8 | 0 | 0 | 0 | 0 |

3 Part A: Descriptive analysis

Consider the data of the energy market in Spain and let’s examine the composition of the energy mix. At your disposal you have 6 sources that generate energy, i.e. 4 renewable (columns biomass, solar, river, wind) and 2 non-renewable (columns nuclear, fossil). The column demand represents the amount of demanded electricity in MW for a given day, denoted as \(D_t\). Let’s denote the energy of the \(\ast\)-th source as \[

E^{\boldsymbol{\ast}}_{t} =

\begin{cases}

E^{b}_{t} \quad \boldsymbol{\ast} \to b = \text{biomass} \\

E^{s}_{t} \quad \boldsymbol{\ast} \to s = \text{solar} \\

E^{h}_{t} \quad \boldsymbol{\ast} \to h = \text{hydroelettric} \\

E^{w}_{t} \quad \boldsymbol{\ast} \to w = \text{wind} \\

E^{n}_{t} \quad \boldsymbol{\ast} \to n = \text{nuclear} \\

E^{f}_{t} \quad \boldsymbol{\ast} \to f = \text{fossil} \\

E^{o}_{t} \quad \boldsymbol{\ast} \to o = \text{others} \\

\end{cases}

\tag{1}\] where others is the sum of the column energy_other and energy_other_renewable.

3.1 Task A.1

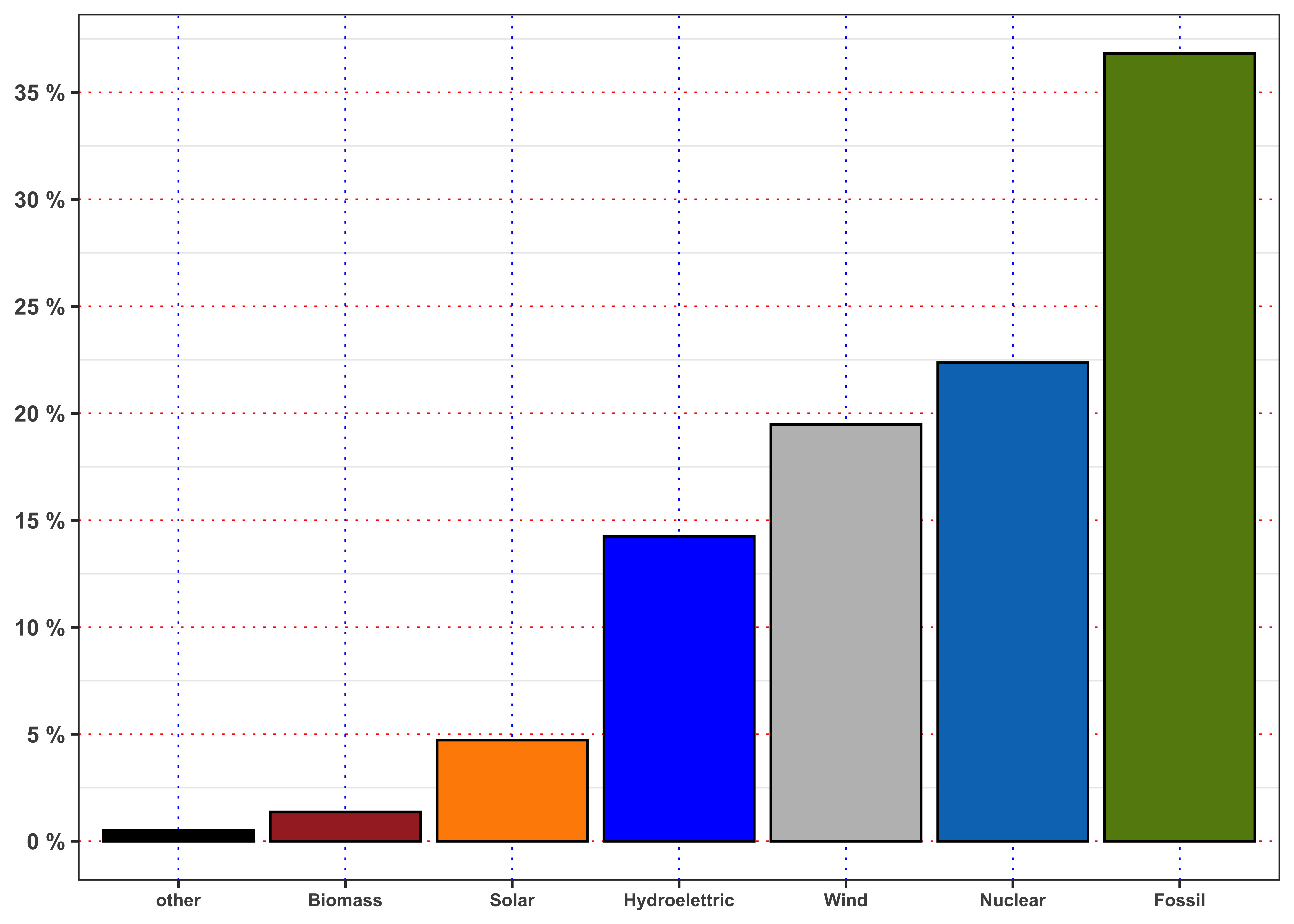

Let’s decompose the total demand across all the sources by defining share of demand met by source \(\ast\), i.e. \[ s^{\ast}_{t} = \frac{E^{\ast}_{t}}{D_t} \tag{2}\] where \(E^{\ast}_{t}\) is defined as in Equation 1. Then, let’s compute the average share of demand \(\bar{s}^{\ast}\) between the electricity produced from each source and the total electricity demanded from the market, i.e. \[ \bar{s}^{\ast} = \frac{1}{n} \sum_{t = 1}^{n} s_{t}^{\ast} \tag{3}\] Then, rank the first 5 sources by the percentage of demand satisfied with respect to the total demand in decreasing order. Plot the results with an histogram. Which is the source of energy that, on average, satisfy most of the electricity demand?

Figure average ratio between production and demand.

var_levels <- c("other", "biomass", "solar", "hydroelettric", "wind", "nuclear", "fossil")

var_labels <- c("other", "Biomass", "Solar", "Hydroelettric", "Wind", "Nuclear", "Fossil")

# Compute the ratio of the demand satisfied with respect to total demand

df_A1 <- data %>%

dplyr::summarise(other = mean((energy_other+energy_other_renewable)/demand),

biomass = mean(biomass/demand),

solar = mean(solar/demand),

hydroelettric = mean(river/demand),

wind = mean(wind/demand),

nuclear = mean(nuclear/demand),

fossil = mean(fossil/demand))%>%

tidyr::gather(key = "source", value = "perc")

# Categorical variable (plots purposes)

df_A1$id <- factor(df_A1$source, levels = var_levels, labels = var_labels)

# Figure

df_A1 %>%

arrange(desc(perc)) %>%

head(n = 7) %>%

ggplot()+

geom_bar(aes(id, perc, fill = source), color = "black", stat = "identity")+

theme_bw()+

custom_theme+

theme(legend.position = "none")+

scale_fill_manual(values = c(fossil = "#65880f", nuclear = "#0477BF", biomass = "brown",

solar = "darkorange", hydroelettric = "blue", wind = "gray", other = "black"))+

scale_y_continuous(breaks = seq(0, 1, 0.05),

labels = paste0(seq(0, 1, 0.05)*100, " %"))+

labs(fill = NULL, x = NULL, y = NULL)

# Rank the sources in decreasing order

vec_max <- df_A1$perc

names(vec_max) <- var_labels

vec_max_sort <- vec_max[order(vec_max, decreasing = TRUE)]

Solution: ranked sources

# Rank the sources in decreasing order

vec_max <- df_A1$perc

names(vec_max) <- var_labels

vec_max_sort <- vec_max[order(vec_max, decreasing = TRUE)]

# Generate the response based on previous computations

response <- ""

for(i in 1:length(vec_max_sort)){

response <- paste0(response, " The ", i, "°", " source with respect to production/demand is ", names(vec_max_sort[i]), " (", round(vec_max_sort[i]*100, 2), "%).")

}The 1° source with respect to production/demand is Fossil (36.82%). The 2° source with respect to production/demand is Nuclear (22.37%). The 3° source with respect to production/demand is Wind (19.48%). The 4° source with respect to production/demand is Hydroelettric (14.24%). The 5° source with respect to production/demand is Solar (4.73%). The 6° source with respect to production/demand is Biomass (1.37%). The 7° source with respect to production/demand is other (0.52%).

3.2 Task A.2

Aggregate the sources of energy in two groups:

- Renewable: computed as the sum of

solar,river,windandbiomass. - Non-renewable: computed as the sum of

nuclearandfossil.

Then, compute the percentage of energy demand satisfied by each group. What is the percentage of energy satisfied by renewable sources? And by the fossil ones?

Repeat the computations, but filtering the data firstly only for year 2015 and then only for 2018. Are the percentage obtained different? Describe the result and explain if the transition to renewable energy is supported by data (to be supported the percentage of renewable energy should increase while percentage of fossil fuels should decrease.)

The percentage of demand satisfied by renewable sources is 39.82 %. Instead, the percentage of demand satisfied by fossil and nuclear sources is 59.19 %. The ratio of the fossil plus nuclear is 46.73 % bigger with respect to renewable sources.

Solution: transition 2015-2019

# Percentage of demand by source in 2015

df_A2_2015 <- data %>%

filter(Year == 2015) %>%

summarise(other = mean((energy_other+energy_other_renewable)/demand),

biomass = mean(biomass/demand, na.rm = TRUE),

solar = mean(solar/demand, na.rm = TRUE),

hydroelettric = mean(river/demand, na.rm = TRUE),

wind = mean(wind/demand, na.rm = TRUE),

nuclear = mean(nuclear/demand, na.rm = TRUE),

fossil = mean(fossil/demand, na.rm = TRUE))%>%

gather(key = "source", value = "perc")

df_A2_2015 <- filter(df_A2_2015, source != "other")

# Normalize

df_A2_2015$perc <- df_A2_2015$perc/sum(df_A2_2015$perc)

# Categorical variable (plots purposes)

df_A2_2015$id <- factor(df_A2_2015$source, levels = var_levels[-1], labels = var_labels[-1])

# Percentage of demand by source in 2018

df_A2_2018 <- data %>%

filter(Year == 2018) %>%

summarise(other = mean((energy_other+energy_other_renewable)/demand),

biomass = mean(biomass/demand, na.rm = TRUE),

solar = mean(solar/demand, na.rm = TRUE),

hydroelettric = mean(river/demand, na.rm = TRUE),

wind = mean(wind/demand, na.rm = TRUE),

nuclear = mean(nuclear/demand, na.rm = TRUE),

fossil = mean(fossil/demand, na.rm = TRUE))%>%

gather(key = "source", value = "perc")

df_A2_2018 <- filter(df_A2_2018, source != "other")

# Normalize

df_A2_2018$perc <- df_A2_2018$perc/sum(df_A2_2018$perc)

# Categorical variable (plots purposes)

df_A2_2018$id <- factor(df_A2_2018$source, levels = var_levels[-1], labels = var_labels[-1])

# Response

response <- paste0(

"In 2015 the percentage of demand satisfied by renewable sources was ",

round(sum(df_A2_2015$perc[1:4])*100, 3), " %, while in 2018 was ",

round(sum(df_A2_2018$perc[1:4])*100, 3), " %. ",

"Hence, the dominance of renewable sources in this period increased by ",

round((sum(df_A2_2018$perc[1:4])/sum(df_A2_2015$perc[1:4])-1)*100, 3), " %.",

" Instead, in 2015 the percentage of demand satisfied by fossil and nuclear sources was ",

round(sum(df_A2_2015$perc[5:6])*100, 3), " %, while in 2018 was ",

round(sum(df_A2_2018$perc[5:6])*100, 3), " %. ",

"Hence, the dominance of fossil sources in this period decreased by ",

round((sum(df_A2_2018$perc[5:6])/sum(df_A2_2015$perc[5:6])-1)*100, 3),

" %. and the transition seems to be supported by data."

)In 2015 the percentage of demand satisfied by renewable sources was 39.335 %, while in 2018 was 42.132 %. Hence, the dominance of renewable sources in this period increased by 7.111 %. Instead, in 2015 the percentage of demand satisfied by fossil and nuclear sources was 60.665 %, while in 2018 was 57.868 %. Hence, the dominance of fossil sources in this period decreased by -4.611 %. and the transition seems to be supported by data.

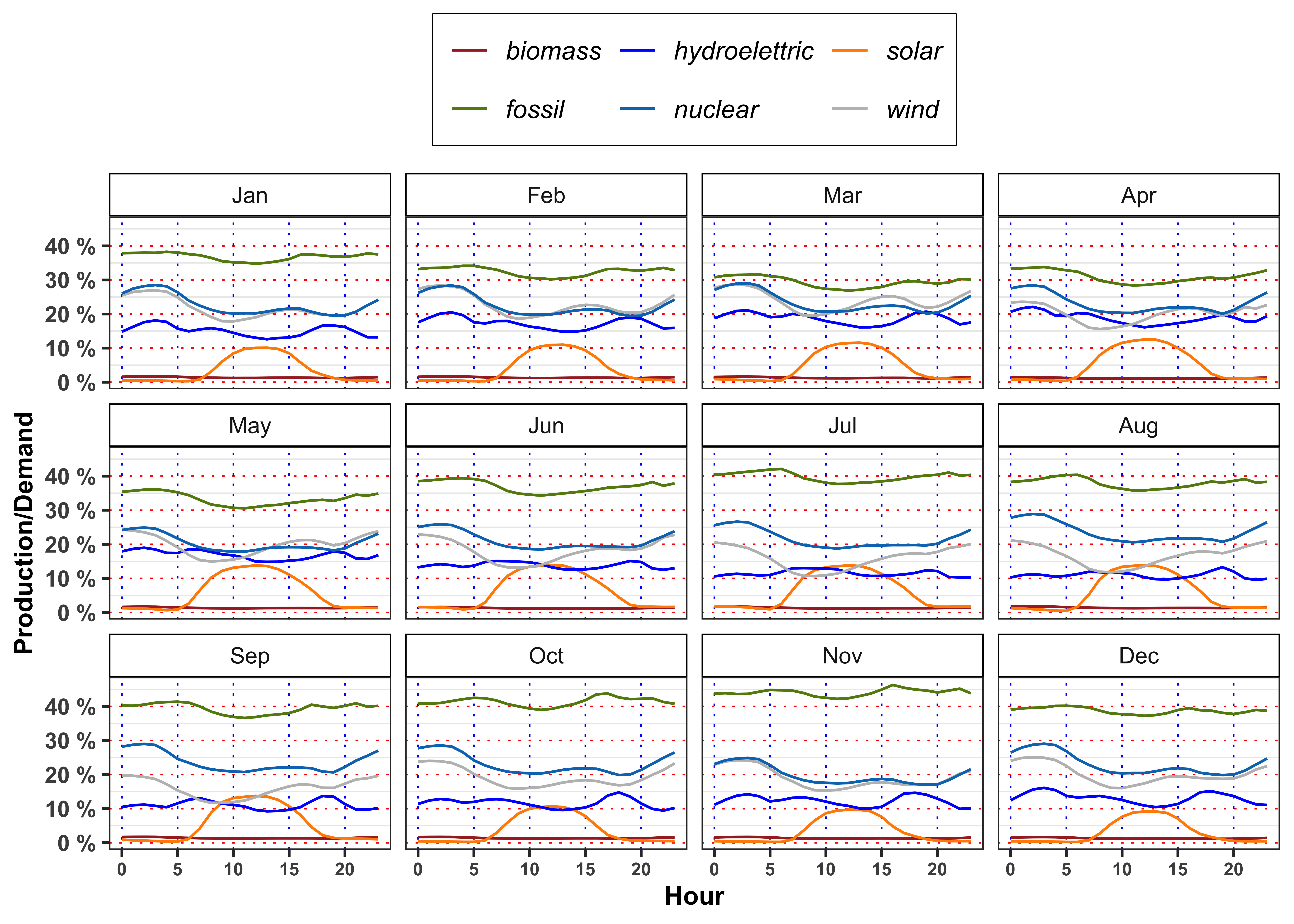

3.3 Task A.3

For each month, compute the mean percentage of demand of energy satisfied by the fossil sources. In order to compute \(D^{{\boldsymbol{\ast}}}_m\) for the \(m\)-month, let’s denote with \(n_m\) the number of day in that month, then: \[ D^{{\boldsymbol{\ast}}}_m = \frac{1}{n_m} \sum_{t = 1}^{n_m} \frac{E^{\boldsymbol{\ast}}_{t}}{D_{t}} = \frac{1}{n_m} \sum_{t = 1}^{n_m} D^{{\boldsymbol{\ast}}}_t \tag{4}\]

Compute also the maximum, minimum, median and standard deviation of \(D^{{\boldsymbol{\ast}}}_t\) for each month. Repeat the computation for the others 4 sources of energy, i.e. nuclear, solar, river and wind. Which are the source with the lowest and the highest standard deviation in December? And in June? Comment the results obtained (max 200 words).

create_monthly_kable()

create_monthly_kable <- function(data, target = "fossil"){

data[["target"]] <- data[[target]]

data <- data %>%

mutate(Month = lubridate::month(date_day, label = TRUE)) %>%

group_by(Month) %>%

mutate(target = target/demand) %>%

summarise(min = min(target, na.rm = TRUE),

mean = mean(target, na.rm = TRUE),

meadian = median(target, na.rm = TRUE),

max = max(target, na.rm = TRUE),

sd = sd(target))

kab <- data %>%

mutate_if(is.numeric, ~.x*100) %>%

mutate(sd = paste0(format(sd, digits = 4), " %"))%>%

mutate_if(is.numeric, ~paste0(format(.x, digits = 4), " %")) %>%

knitr::kable(booktabs = TRUE, escape = FALSE, align = 'c') %>%

kableExtra::row_spec(0, color = "white", background = "green")

structure(

list(

data = data,

kab = kab

)

)

}| Month | min | mean | meadian | max | sd |

|---|---|---|---|---|---|

| Jan | 10.607 % | 36.87 % | 38.61 % | 66.58 % | 10.082 % |

| Feb | 9.125 % | 32.48 % | 32.21 % | 67.95 % | 11.214 % |

| Mar | 13.351 % | 29.39 % | 26.56 % | 69.18 % | 10.438 % |

| Apr | 12.396 % | 31.03 % | 28.80 % | 70.62 % | 11.246 % |

| May | 9.976 % | 33.35 % | 33.01 % | 76.60 % | 10.764 % |

| Jun | 12.730 % | 36.97 % | 37.35 % | 75.26 % | 11.359 % |

| Jul | 14.677 % | 39.85 % | 40.64 % | 63.78 % | 9.407 % |

| Aug | 13.075 % | 38.00 % | 38.82 % | 60.91 % | 8.791 % |

| Sep | 12.927 % | 39.40 % | 40.53 % | 68.04 % | 9.156 % |

| Oct | 12.531 % | 41.37 % | 41.69 % | 72.10 % | 10.998 % |

| Nov | 12.924 % | 44.10 % | 45.71 % | 78.15 % | 12.626 % |

| Dec | 13.891 % | 38.77 % | 39.69 % | 67.38 % | 11.030 % |

| Month | min | mean | meadian | max | sd |

|---|---|---|---|---|---|

| Jan | 12.271 % | 22.74 % | 21.86 % | 39.22 % | 4.498 % |

| Feb | 11.660 % | 22.56 % | 21.77 % | 38.42 % | 4.655 % |

| Mar | 13.040 % | 23.46 % | 22.74 % | 36.57 % | 4.504 % |

| Apr | 12.624 % | 23.13 % | 22.65 % | 37.64 % | 4.906 % |

| May | 4.999 % | 20.40 % | 19.98 % | 37.59 % | 3.990 % |

| Jun | 12.569 % | 21.17 % | 20.67 % | 37.76 % | 4.381 % |

| Jul | 12.390 % | 21.65 % | 21.09 % | 34.93 % | 3.956 % |

| Aug | 12.780 % | 23.61 % | 23.08 % | 34.00 % | 4.113 % |

| Sep | 13.929 % | 23.65 % | 22.98 % | 35.29 % | 4.348 % |

| Oct | 14.127 % | 23.09 % | 22.54 % | 35.85 % | 4.503 % |

| Nov | 0.000 % | 19.82 % | 19.25 % | 33.38 % | 4.343 % |

| Dec | 13.425 % | 23.08 % | 22.31 % | 39.37 % | 5.219 % |

| Month | min | mean | meadian | max | sd |

|---|---|---|---|---|---|

| Jan | 1.1883 % | 21.80 % | 20.39 % | 62.26 % | 11.609 % |

| Feb | 1.5627 % | 22.85 % | 21.24 % | 61.05 % | 13.511 % |

| Mar | 1.5243 % | 24.03 % | 23.67 % | 64.02 % | 12.726 % |

| Apr | 1.8202 % | 20.14 % | 18.09 % | 64.49 % | 11.326 % |

| May | 1.1022 % | 19.88 % | 17.45 % | 57.96 % | 11.555 % |

| Jun | 1.0185 % | 18.12 % | 15.68 % | 65.36 % | 10.978 % |

| Jul | 0.6918 % | 15.96 % | 14.27 % | 59.08 % | 9.259 % |

| Aug | 0.7066 % | 16.75 % | 15.52 % | 57.37 % | 9.134 % |

| Sep | 0.9261 % | 16.05 % | 13.60 % | 56.38 % | 10.383 % |

| Oct | 0.7795 % | 19.22 % | 16.83 % | 62.57 % | 12.014 % |

| Nov | 0.0000 % | 18.93 % | 16.16 % | 69.16 % | 12.136 % |

| Dec | 1.6081 % | 20.17 % | 18.12 % | 67.28 % | 12.108 % |

| Month | min | mean | meadian | max | sd |

|---|---|---|---|---|---|

| Jan | 2.983 % | 15.06 % | 13.798 % | 41.58 % | 6.731 % |

| Feb | 3.003 % | 17.33 % | 16.062 % | 42.13 % | 7.674 % |

| Mar | 2.540 % | 18.69 % | 18.987 % | 45.22 % | 7.715 % |

| Apr | 2.928 % | 18.84 % | 16.437 % | 49.09 % | 9.524 % |

| May | 2.858 % | 16.92 % | 15.327 % | 50.66 % | 8.092 % |

| Jun | 2.796 % | 13.81 % | 13.050 % | 38.07 % | 5.839 % |

| Jul | 2.261 % | 11.50 % | 10.293 % | 40.04 % | 5.887 % |

| Aug | 3.040 % | 10.94 % | 9.488 % | 43.30 % | 6.013 % |

| Sep | 2.635 % | 11.05 % | 9.611 % | 36.30 % | 5.534 % |

| Oct | 2.271 % | 11.61 % | 10.175 % | 44.41 % | 6.266 % |

| Nov | 0.000 % | 12.28 % | 11.021 % | 43.45 % | 6.441 % |

| Dec | 3.519 % | 13.11 % | 11.911 % | 46.06 % | 6.121 % |

| Month | min | mean | meadian | max | sd |

|---|---|---|---|---|---|

| Jan | 0.024068 % | 3.523 % | 0.7840 % | 25.38 % | 4.830 % |

| Feb | 0.006935 % | 3.966 % | 1.3321 % | 22.70 % | 5.080 % |

| Mar | 0.018776 % | 4.517 % | 2.0257 % | 21.22 % | 5.345 % |

| Apr | 0.009580 % | 4.986 % | 2.3468 % | 21.88 % | 5.572 % |

| May | 0.008510 % | 5.942 % | 3.0158 % | 22.48 % | 5.939 % |

| Jun | 0.011501 % | 6.248 % | 3.2706 % | 22.03 % | 5.761 % |

| Jul | 0.008478 % | 6.221 % | 2.9958 % | 23.40 % | 5.726 % |

| Aug | 0.009806 % | 5.774 % | 2.6587 % | 21.32 % | 5.825 % |

| Sep | 0.017305 % | 5.333 % | 2.2467 % | 23.02 % | 5.875 % |

| Oct | 0.007038 % | 3.767 % | 1.0721 % | 21.75 % | 4.974 % |

| Nov | 0.000000 % | 3.355 % | 0.6537 % | 18.63 % | 4.619 % |

| Dec | 0.008983 % | 3.063 % | 0.4059 % | 19.26 % | 4.386 % |

| Month | min | mean | meadian | max | sd |

|---|---|---|---|---|---|

| Jan | 0.7321 % | 1.404 % | 1.383 % | 2.630 % | 0.3501 % |

| Feb | 0.6226 % | 1.394 % | 1.380 % | 2.741 % | 0.3070 % |

| Mar | 0.4760 % | 1.334 % | 1.306 % | 2.680 % | 0.4059 % |

| Apr | 0.6078 % | 1.191 % | 1.147 % | 2.819 % | 0.3495 % |

| May | 0.0000 % | 1.394 % | 1.308 % | 2.718 % | 0.3703 % |

| Jun | 0.6752 % | 1.344 % | 1.277 % | 2.614 % | 0.3477 % |

| Jul | 0.6938 % | 1.365 % | 1.305 % | 2.719 % | 0.3265 % |

| Aug | 0.5274 % | 1.447 % | 1.373 % | 2.859 % | 0.3776 % |

| Sep | 0.5987 % | 1.424 % | 1.348 % | 2.809 % | 0.3834 % |

| Oct | 0.5433 % | 1.404 % | 1.314 % | 2.890 % | 0.4034 % |

| Nov | 0.0000 % | 1.372 % | 1.298 % | 2.830 % | 0.3720 % |

| Dec | 0.5796 % | 1.339 % | 1.284 % | 2.801 % | 0.3663 % |

Solution: June vs December

sd_june <- c(fossil = filter(df_fossil$data, Month == "Jun")$sd,

nuclear = filter(df_nuclear$data, Month == "Jun")$sd,

wind = filter(df_wind$data, Month == "Jun")$sd,

hydro = filter(df_hydro$data, Month == "Jun")$sd,

solar = filter(df_solar$data, Month == "Jun")$sd)

sd_dec <- c(fossil = filter(df_fossil$data, Month == "Dec")$sd,

nuclear = filter(df_nuclear$data, Month == "Dec")$sd,

wind = filter(df_wind$data, Month == "Dec")$sd,

hydro = filter(df_hydro$data, Month == "Dec")$sd,

solar = filter(df_solar$data, Month == "Dec")$sd)

min_sd_jun <- sd_june[order(sd_june, decreasing = FALSE)][1]

min_sd_dec <- sd_dec[order(sd_dec, decreasing = FALSE)][1]

max_sd_jun <- sd_june[order(sd_june, decreasing = FALSE)][length(sd_june)]

max_sd_dec <- sd_dec[order(sd_dec, decreasing = FALSE)][length(sd_dec)]The nuclear energy has the lowest standard deviation of percentage demand satisfied in June with a standard deviation of 4.4 %. The maximum standard deviation is from fossil with 11 %.

Instead the solar energy has the lowest standard deviation of percentage demand satisfied in December with a standard deviation of 4.4 %. The maximum standard deviation is from wind with 12 %.

Figure percentage demand of energy by source

df_A3 <- data %>%

mutate(Month = lubridate::month(date_day, label = TRUE)) %>%

group_by(Month, Hour) %>%

summarise(biomass = mean(biomass/demand, na.rm = TRUE),

solar = mean(solar/demand, na.rm = TRUE),

hydroelettric = mean(river/demand, na.rm = TRUE),

wind = mean(wind/demand, na.rm = TRUE),

nuclear = mean(nuclear/demand, na.rm = TRUE),

fossil = mean(fossil/demand, na.rm = TRUE),

demand = mean(demand, na.rm = TRUE))

ggplot(df_A3)+

geom_line(aes(Hour, biomass, color = "biomass"))+

geom_line(aes(Hour, solar, color = "solar"))+

geom_line(aes(Hour, hydroelettric, color = "hydroelettric"))+

geom_line(aes(Hour, wind, color = "wind"))+

geom_line(aes(Hour, nuclear, color = "nuclear"))+

geom_line(aes(Hour, fossil, color = "fossil"))+

facet_wrap(~Month)+

theme_bw()+

custom_theme+

scale_color_manual(values = c(fossil = "#65880f", nuclear = "#0477BF", biomass = "brown",

solar = "darkorange", hydroelettric = "blue", wind = "gray"))+

scale_y_continuous(breaks = seq(0, 1, 0.1),

labels = paste0(seq(0, 1, 0.1)*100, " %"))+

labs(color = NULL, y = "Production/Demand")

3.4 Task A.4

In mean, the demand satisfied by solar energy with respect to total demand is greater or lower with respect to the one satisfied by hydroelectric on 12:00 in March? In July, August and September at the same hour the situation changes? Answer, providing a possible explanation of the results obtained (max 200 words).

Code

df_A4 <- bind_rows(

filter(df_A3, Month == "Mar" & Hour == 12),

filter(df_A3, Month == "Jul" & Hour == 12),

filter(df_A3, Month == "Aug" & Hour == 12),

filter(df_A3, Month == "Sep" & Hour == 12)

)

df_A4 %>%

mutate_if(is.numeric, ~.x*100) %>%

mutate_if(is.numeric, ~paste0(format(.x, digits = 3), " %")) %>%

mutate(demand = paste0(str_remove_all(demand, "\\%"), " MW"),

Hour = paste0(as.numeric(str_remove_all(Hour, "\\%"))/100, ":00")) %>%

knitr::kable(booktabs = TRUE, escape = FALSE, align = 'c') %>%

kableExtra::row_spec(0, color = "white", background = "green") | Month | Hour | biomass | solar | hydroelettric | wind | nuclear | fossil | demand |

|---|---|---|---|---|---|---|---|---|

| Mar | 12:00 | 1.19 % | 11.5 % | 16.7 % | 21.7 % | 20.9 % | 26.9 % | 3179217 MW |

| Jul | 12:00 | 1.19 % | 13.8 % | 11.8 % | 12.4 % | 19.1 % | 37.8 % | 3354479 MW |

| Aug | 12:00 | 1.28 % | 13.8 % | 10.3 % | 13.6 % | 20.9 % | 35.8 % | 3191764 MW |

| Sep | 12:00 | 1.28 % | 13.7 % | 9.6 % | 13.4 % | 21.3 % | 36.9 % | 3107519 MW |

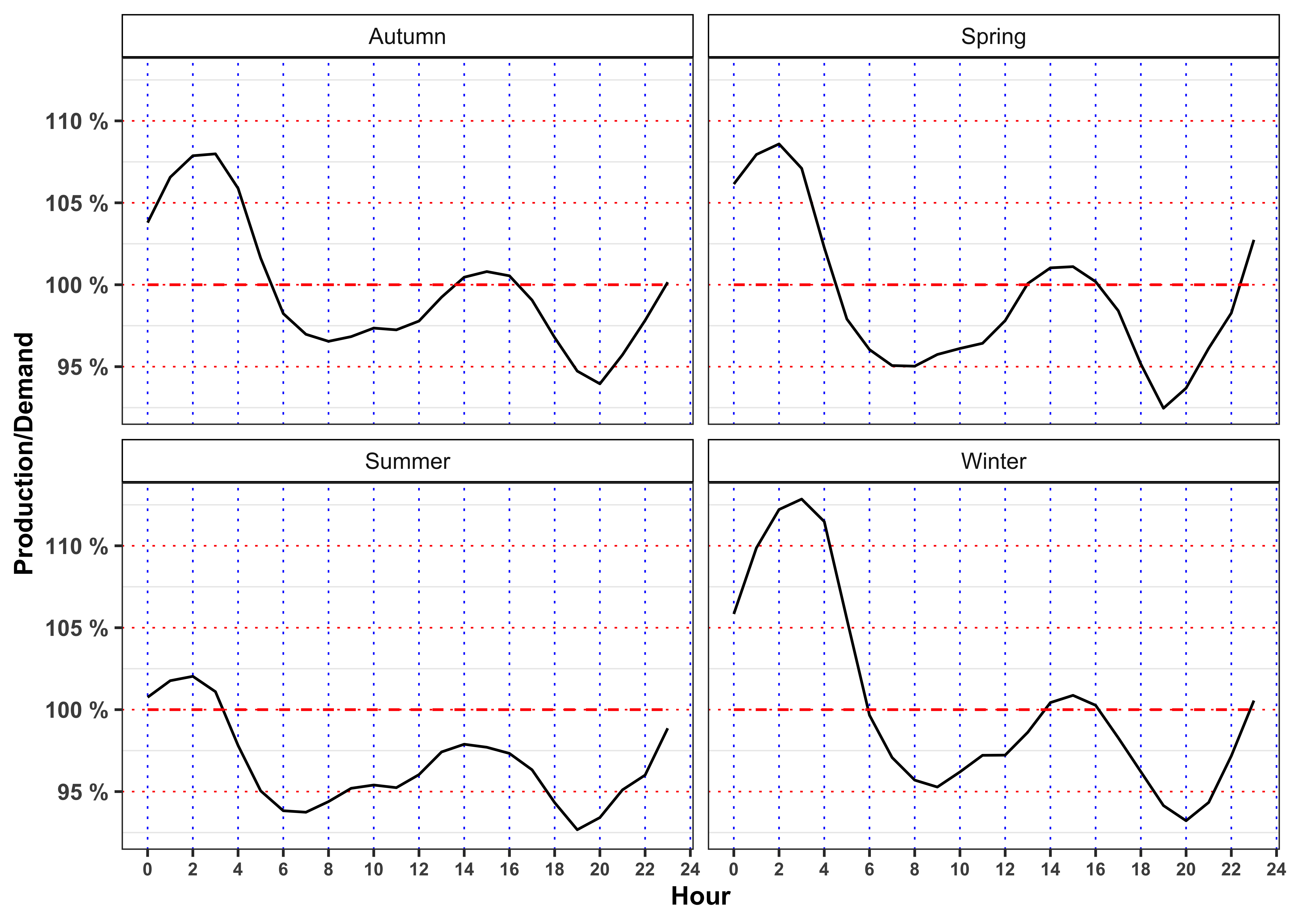

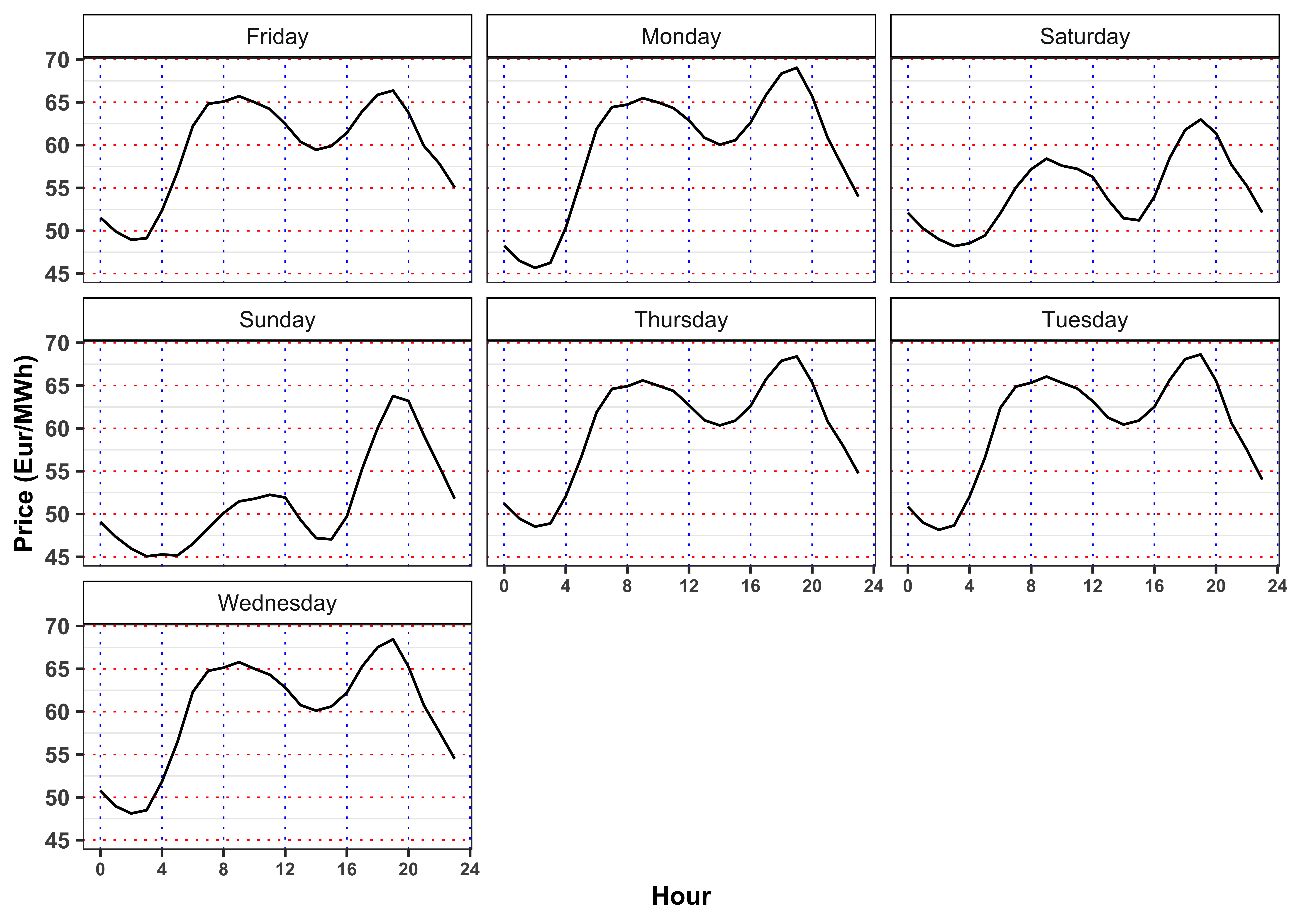

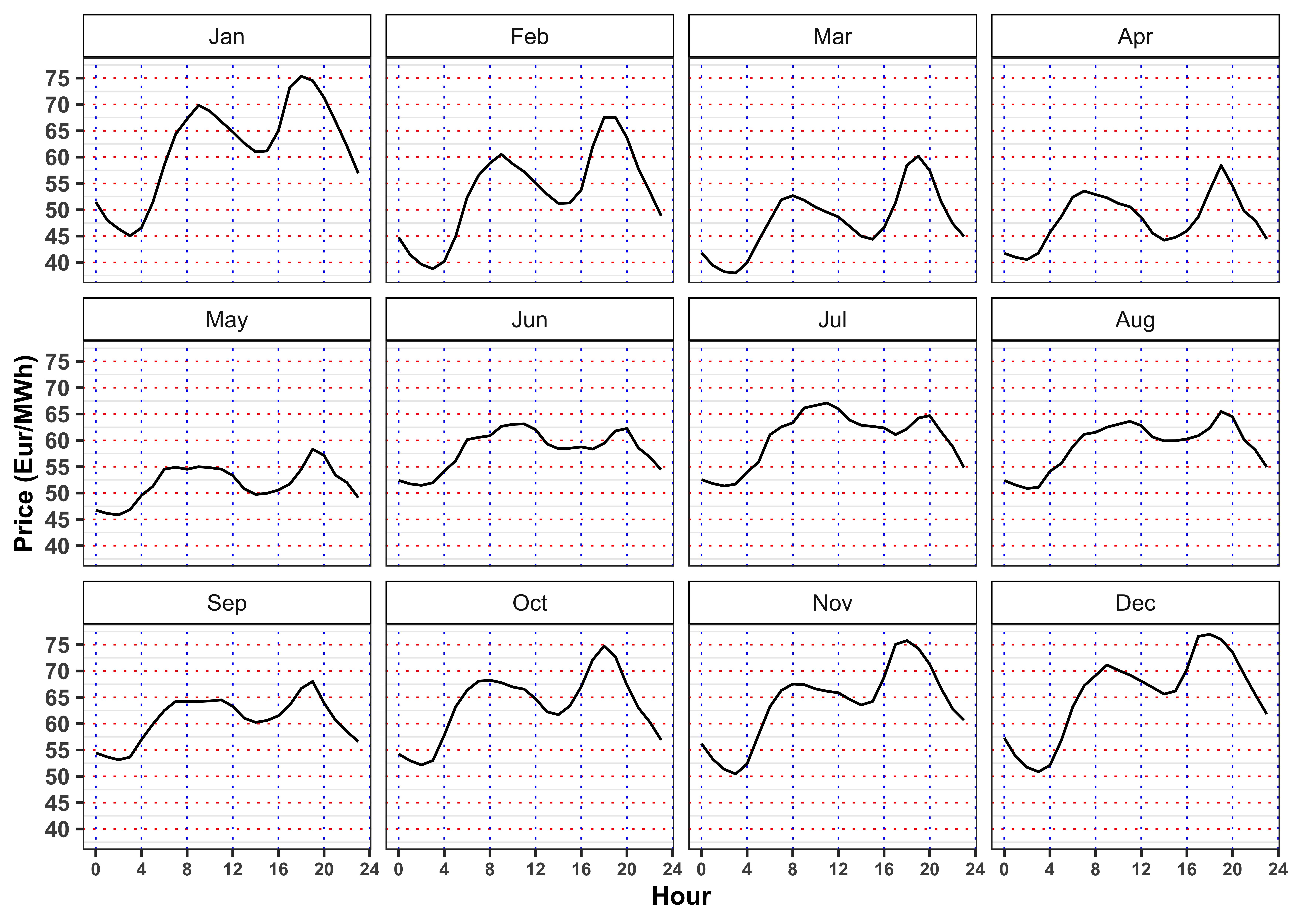

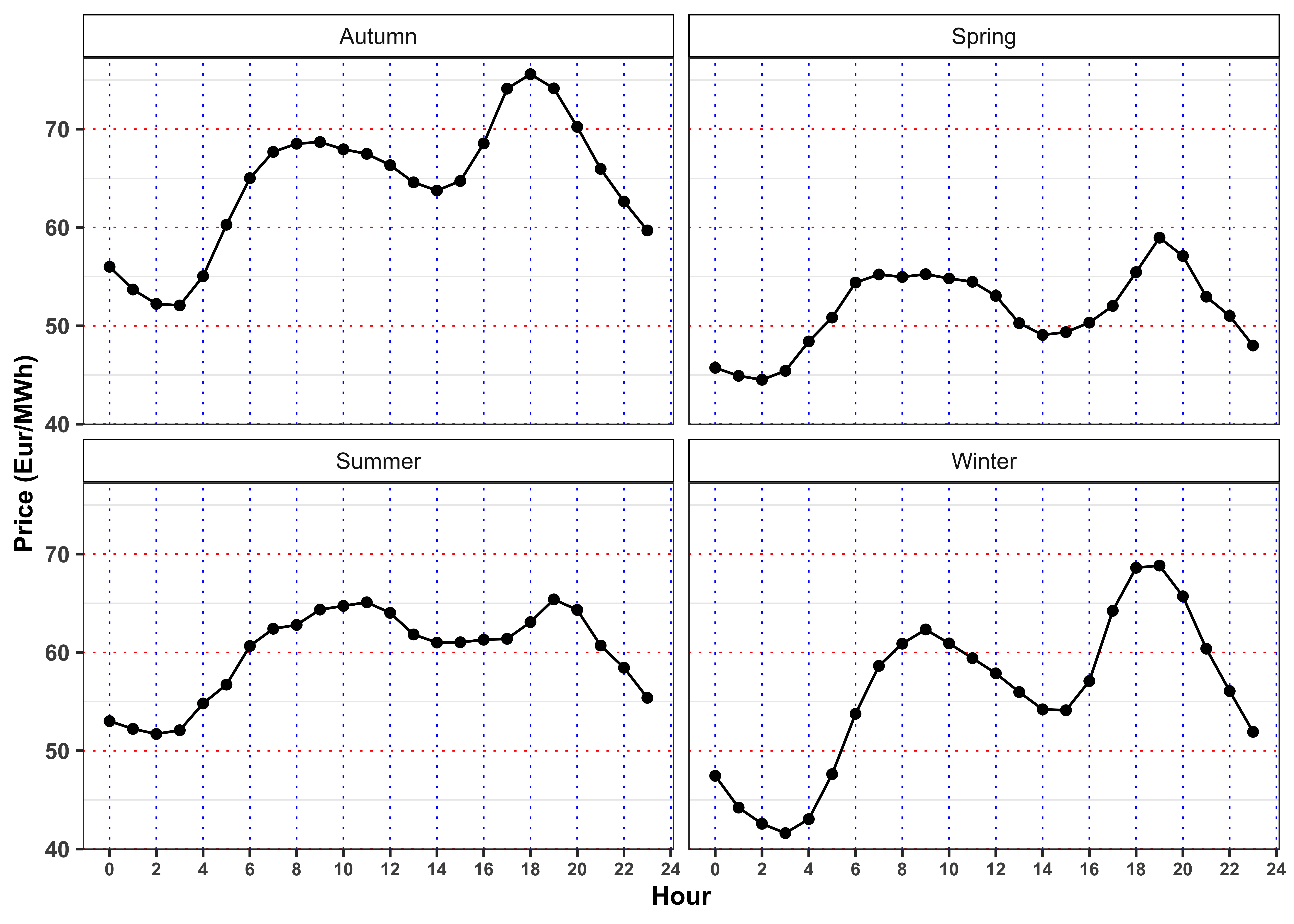

3.5 Task A.5

Grouping the data by season and hour (\(4 \times 24\) groups) and by month and hour (\(12 \times 24\) groups) and compute:

- Average electricity price.

- Average ratio between total production and total demand, i.e.

prod/demand.

For both groups, answer to the following questions.

What is the meaning of a ratio between total production and total demand greater than 1? And greater than 1? Following the demand and supply law, what is the expected behavior of the price in such situations? Comment the results (max 200 words).

When the price reaches it’s minimum value? In such situation, does the ratio reach its maximum value? What happen when the prices reaches it’s maximum? Comment the results (max 200 words).

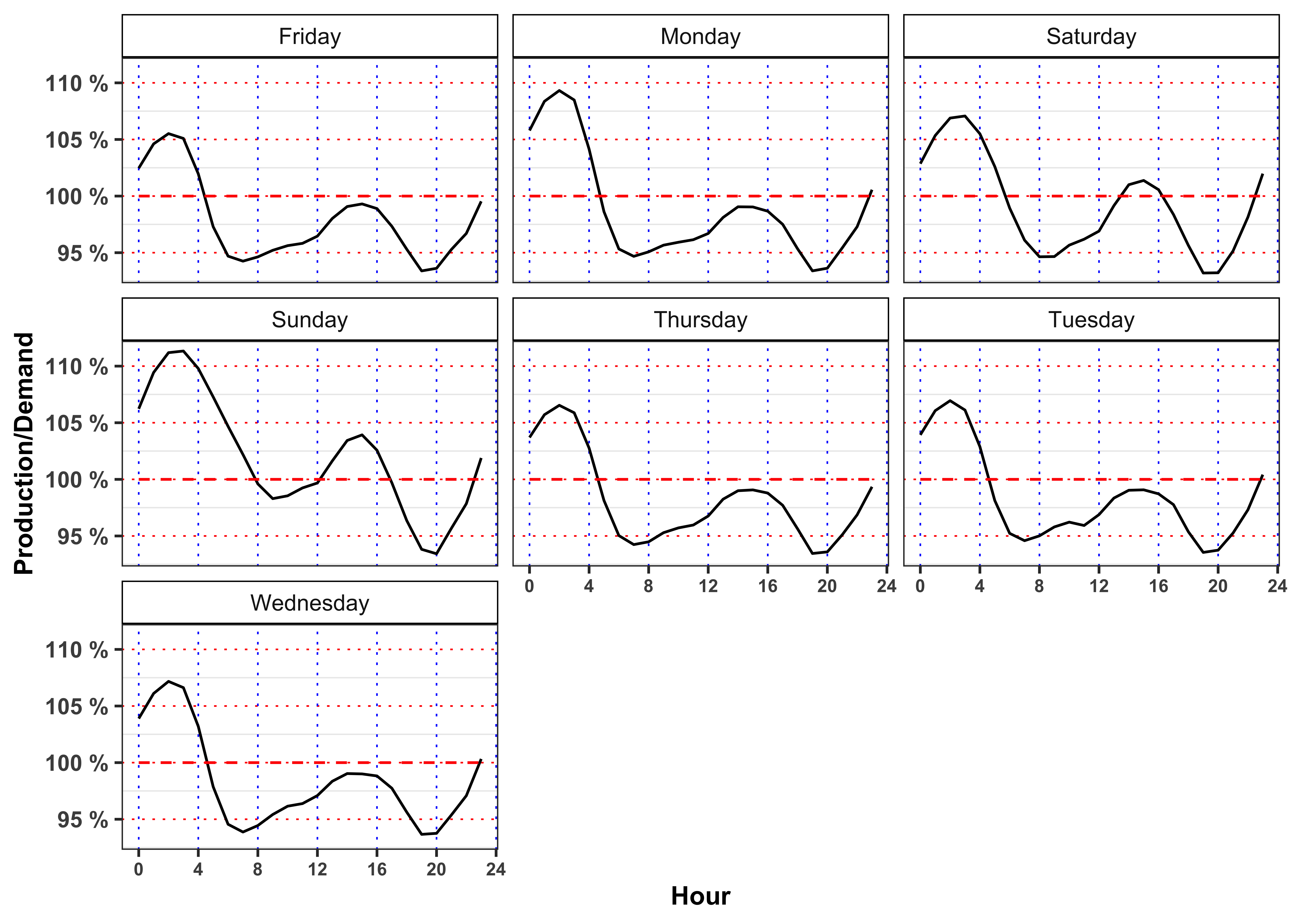

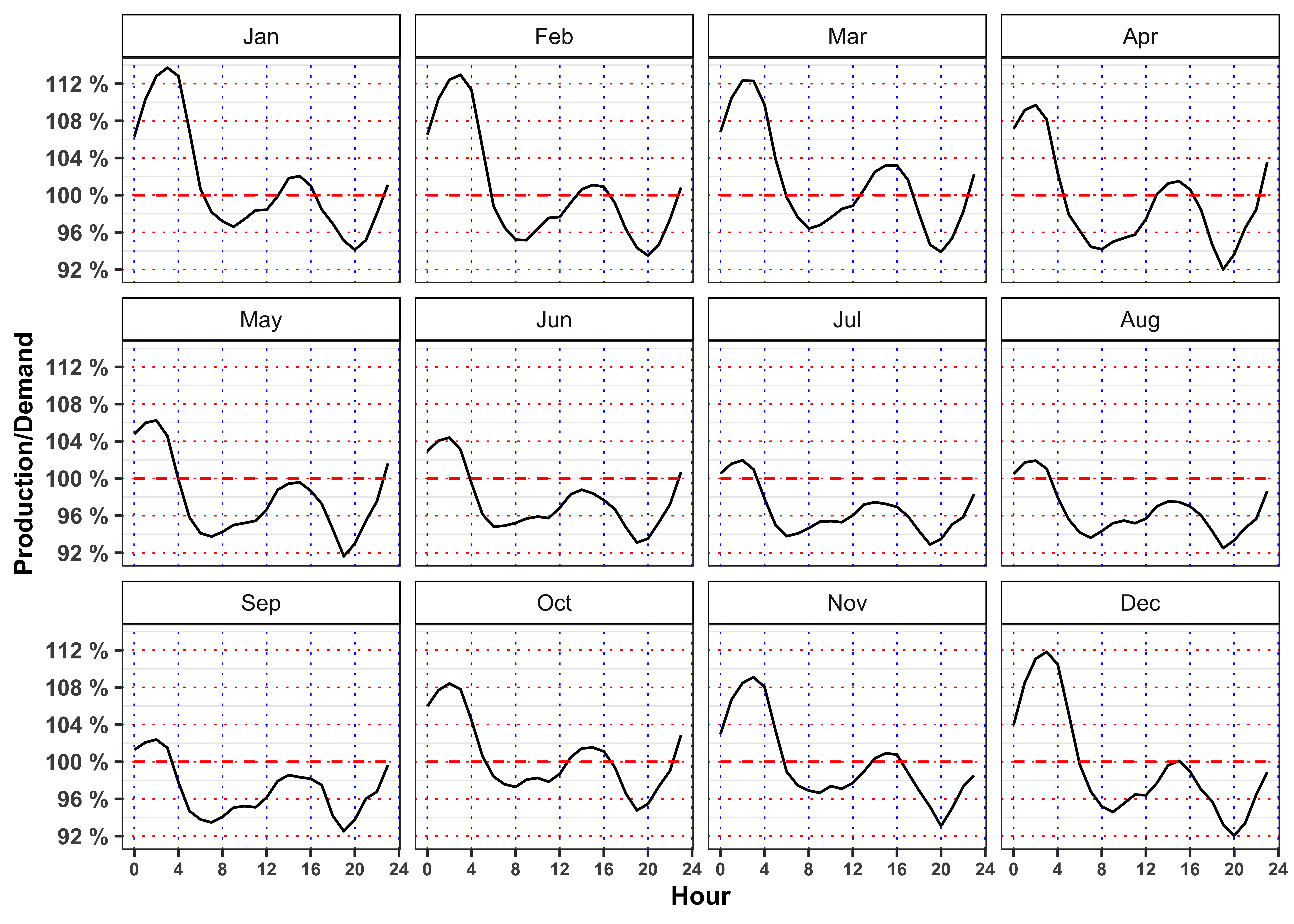

The minimum price for electricity by season and hour is reached, in mean, at 3:00 in all the seasons. Moreover, for all the seasons the ratio between production and demand is above 100% between 00:00 and 3:00 denoting a general excess of production with respect to the demand. Interestingly, when this ratio goes again above 100% again between 14:00 to 16:00 (except is summer) the price, in mean, reaches a relative minimum for the day.

On contrary the maximum price for the electricity, by season and hour is reached, in mean, at 19:00 except for Autumn (18:00). As expected, in the same period the production ratio reaches a minimum that for all the seasons is also a global minimum for the day.

In the monthly plots is highlighted the fact that is the drop in electricity price in 14:00 to 16:00 and the subsequent increase during the afternoon is smoothed going from May up to September.

Let’s compute the average by Season, Month, Weekday and Hour of the total production divided by the total demand.

Code

data %>%

mutate(Weekday = weekdays(date)) %>%

mutate(prod = prod/demand) %>%

group_by(Weekday, Hour) %>%

summarise(prod = mean(prod, na.rm = TRUE)) %>%

ggplot()+

geom_line(aes(Hour, prod), color = "black")+

geom_line(aes(Hour, 1), color = "red", linetype = "dashed")+

facet_wrap(~Weekday)+

theme_bw()+

custom_theme+

scale_x_continuous(breaks = seq(0, 24, 4))+

scale_y_continuous(breaks = seq(0, 2, 0.05),

labels = paste0(seq(0, 2, 0.05)*100, " %"))+

labs(color = NULL, y = "Production/Demand")

Code

data %>%

mutate(Month = lubridate::month(date_day, label = TRUE)) %>%

group_by(Month, Hour) %>%

summarise(ratio = mean(prod/demand, na.rm = TRUE)) %>%

ggplot()+

geom_line(aes(Hour, ratio), color = "black")+

geom_line(aes(Hour, 1), color = "red", linetype = "dashed")+

facet_wrap(~Month)+

scale_x_continuous(breaks = seq(0, 24, 4))+

scale_y_continuous(breaks = seq(0, 2, 0.04),

labels = paste0(seq(0, 2, 0.04)*100, " %"))+

theme_bw()+

custom_theme+

labs(color = NULL, y = "Production/Demand")

Code

data %>%

mutate(prod = prod/demand) %>%

group_by(Season, Hour) %>%

summarise(prod = mean(prod, na.rm = TRUE)) %>%

ggplot()+

geom_line(aes(Hour, prod), color = "black")+

geom_line(aes(Hour, 1), color = "red", linetype = "dashed")+

facet_wrap(~Season)+

theme_bw()+

custom_theme+

scale_x_continuous(breaks = seq(0, 24, 2))+

scale_y_continuous(breaks = seq(0, 2, 0.05),

labels = paste0(seq(0, 2, 0.05)*100, " %"))+

labs(color = NULL, y = "Production/Demand")

Let’s now compute the average by Season, Month, Weekday and Hour of the electricity price.

Code

data %>%

mutate(Month = lubridate::month(date_day, label = TRUE)) %>%

mutate(Weekday = weekdays(date)) %>%

group_by(Weekday, Hour) %>%

summarise(price = mean(price, na.rm = TRUE)) %>%

ggplot()+

geom_line(aes(Hour, price), color = "black")+

facet_wrap(~Weekday)+

theme_bw()+

custom_theme+

scale_x_continuous(breaks = seq(0, 24, 4))+

scale_y_continuous(breaks = seq(0, 100, 5),

labels = seq(0, 100, 5))+

labs(color = NULL, y = "Price (Eur/MWh)")

Code

data %>%

mutate(Month = lubridate::month(date_day, label = TRUE)) %>%

group_by(Month, Hour) %>%

summarise(price = mean(price, na.rm = TRUE)) %>%

ggplot()+

geom_line(aes(Hour, price), color = "black")+

facet_wrap(~Month)+

theme_bw()+

custom_theme+

scale_x_continuous(breaks = seq(0, 24, 4))+

scale_y_continuous(breaks = seq(0, 100, 5),

labels = seq(0, 100, 5))+

labs(color = NULL, y = "Price (Eur/MWh)")

Code

data %>%

group_by(Season, Hour) %>%

summarise(price = mean(price, na.rm = TRUE)) %>%

ggplot()+

geom_line(aes(Hour, price))+

geom_point(aes(Hour, price))+

facet_wrap(~Season)+

theme_bw()+

custom_theme+

scale_x_continuous(breaks = seq(0, 24, 2))+

scale_y_continuous(breaks = seq(0, 100, 10))+

labs(color = NULL, y = "Price (Eur/MWh)")

4 Part B: Model daily electricity price

4.1 Task B.1

Let’s aggregate the data on a daily basis by computing the daily average electricity prices.

Daily Aggregation

# Daily prices

data_prices <- data %>%

mutate(date = date_day) %>%

group_by(date, Year, Month, Day) %>%

summarise(price = mean(price), Season = unique(Season)) %>%

ungroup() %>%

mutate(log_price = log(price),

Weekday = weekdays(date))

# Prepare the seasonal variables

# Day of the week

levels_weekday <- c("Monday", "Tuesday", "Wednesday", "Thursday", "Friday", "Saturday", "Sunday")

data_prices$Weekday_ <- factor(data_prices$Weekday, levels = levels_weekday, labels = levels_weekday)

# Months

levels_month <- c("January", "February", "March", "April",

"May", "June", "July", "August",

"September", "October", "November", "December")

data_prices$Month_ <- factor(data_prices$Month, levels = 1:12, labels = levels_month)

# Seasons

levels_season <- c("Winter", "Spring", "Summer", "Autumn")

data_prices$Season_ <- factor(data_prices$Season, levels = levels_season, labels = levels_season)4.1.1 Task B.1 (a)

Let’s consider only positive prices \(P_t\) for electricity, hence we transform them into the corresponding log-prices \(S_t\), i.e. \[ S_t = \log(P_t) \iff P_t = \exp(S_t) \text{.} \tag{5}\] Then, we can proceed by removing the seasonality from the time series. Let’s define a seasonal function to remove deterministic components from the month, day of the week, i.e. \[ \bar{S}_t = s_0 + D(t) + M(t) + S(t) \text{,} \] where \(D(t)\), \(M(t)\) and \(S(t)\) stands for the indicator functions \[ \begin{aligned} D(t) = \begin{cases} D_2 \quad \ \text{Tuesday} \\ \vdots \\ D_{7} \quad \text{Sunday} \\ \end{cases} \quad M(t) = \begin{cases} M_2 \quad \ \text{February} \\ \vdots \\ M_{12} \quad \text{December} \\ \end{cases} \quad S(t) = \begin{cases} S_{2} \quad \ \text{Spring} \\ S_{3} \quad \ \text{Summer} \\ S_{4} \quad \text{Autumn} \\ \end{cases} \end{aligned} \tag{6}\] It follows that, by construction, the intercept \(s_0\) is interpreted as the average log price when the day is Monday, the month is January and the season is Spring. Estimate the parameters of the model with Ordinary Least Square, then compute the seasonal price \(\bar{S}_t\) and the deseasonalized time series, i.e. \[ \tilde{S}_t = S_t - \bar{S}_t \text{.} \]

Fit the seasonal model

# Seasonal model

seasonal_model <- lm(log_price ~ Month_ + Weekday_ + Season_, data = data_prices)

# Predicted seasonal mean

data_prices$log_price_bar <- predict(seasonal_model, newdata = data_prices)

# Fitted residuals

data_prices$log_price_tilde <- data_prices$log_price - data_prices$log_price_barTable statistics.

| r.squared | adj.r.squared | sigma | statistic | p.value | df | logLik | AIC | BIC | deviance | df.residual | nobs |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 0.2953 | 0.2855 | 0.2061 | 30.1916 | 0 | 20 | 245.3127 | -446.6255 | -330.2991 | 61.197 | 1441 | 1462 |

Table estimates.

| term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| (Intercept) | 4.1173 | 0.0227 | 181.2863 | 0.0000 |

| Month_February | -0.1517 | 0.0268 | -5.6618 | 0.0000 |

| Month_March | -0.2391 | 0.0281 | -8.4973 | 0.0000 |

| Month_April | -0.1988 | 0.0443 | -4.4906 | 0.0000 |

| Month_May | -0.1290 | 0.0441 | -2.9238 | 0.0035 |

| Month_June | -0.0103 | 0.0427 | -0.2404 | 0.8101 |

| Month_July | -0.0203 | 0.0491 | -0.4139 | 0.6790 |

| Month_August | -0.0463 | 0.0491 | -0.9415 | 0.3466 |

| Month_September | -0.0303 | 0.0451 | -0.6710 | 0.5023 |

| Month_October | -0.0204 | 0.0439 | -0.4646 | 0.6423 |

| Month_November | -0.0165 | 0.0441 | -0.3733 | 0.7089 |

| Month_December | 0.0303 | 0.0361 | 0.8390 | 0.4016 |

| Weekday_Tuesday | 0.0141 | 0.0202 | 0.6997 | 0.4842 |

| Weekday_Wednesday | 0.0098 | 0.0202 | 0.4836 | 0.6288 |

| Weekday_Thursday | 0.0135 | 0.0202 | 0.6678 | 0.5044 |

| Weekday_Friday | 0.0038 | 0.0202 | 0.1882 | 0.8507 |

| Weekday_Saturday | -0.0936 | 0.0202 | -4.6430 | 0.0000 |

| Weekday_Sunday | -0.1654 | 0.0202 | -8.2057 | 0.0000 |

| Season_Spring | -0.0435 | 0.0355 | -1.2226 | 0.2217 |

| Season_Summer | 0.0230 | 0.0416 | 0.5523 | 0.5808 |

| Season_Autumn | 0.0805 | 0.0353 | 2.2808 | 0.0227 |

4.1.2 Task B.1 (b)

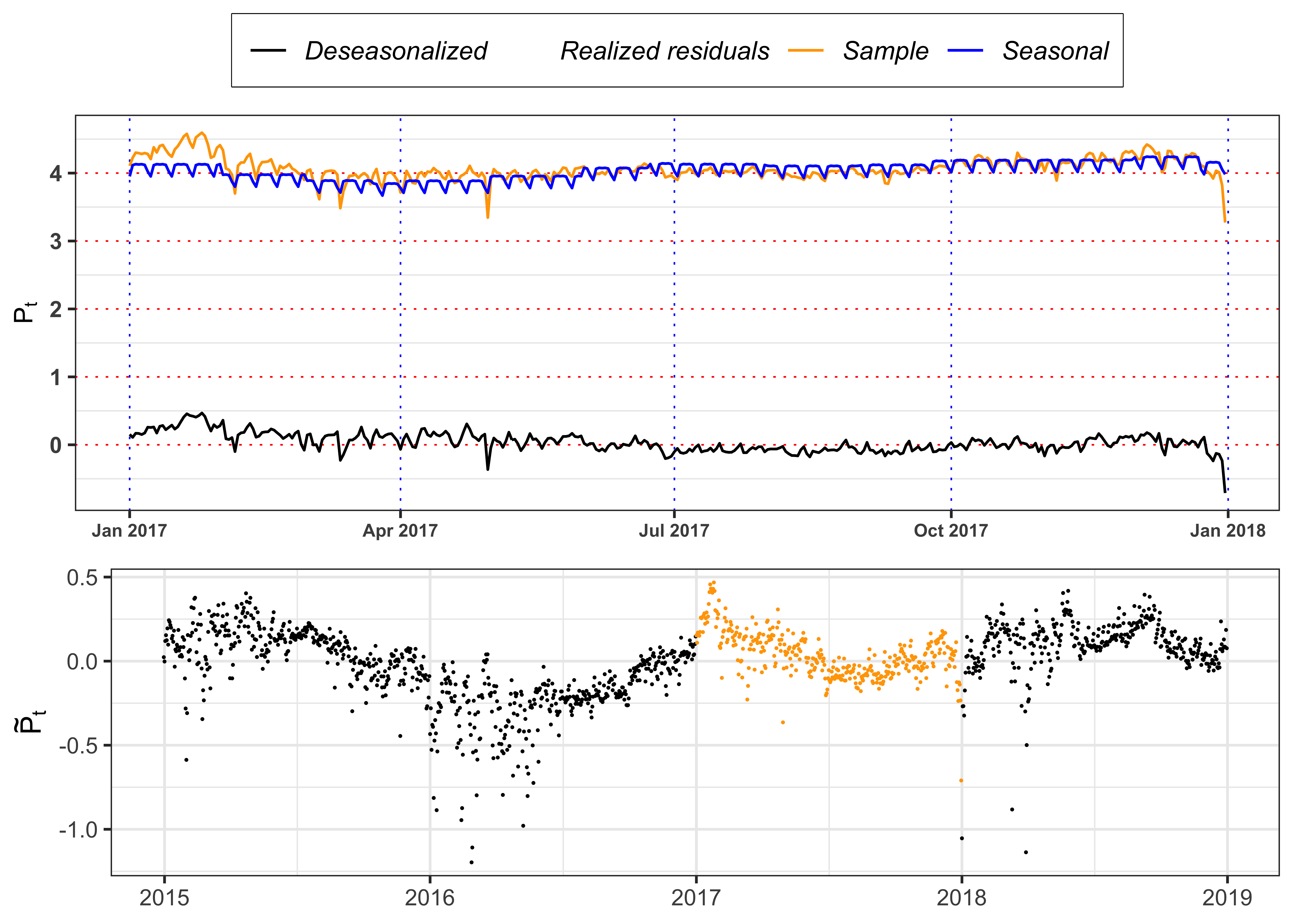

Plot the log-prices \(S_t\), the deseasonalized log-prices \(\tilde{S}_t\) and the estimated seasonal function \(\bar{S}_t\) for 2017.

Figure deseasonalized series.

# Plot year

plot_year <- 2017

# Plot realized, seasonal function and deseasonalized prices for `plot_year`

plot_seasonal <- data_prices %>%

filter(Year == plot_year)%>%

ggplot()+

geom_point(aes(date, log_price_tilde, color = "realized"), alpha = 0)+

geom_line(aes(date, log_price, color = "sample"))+

geom_line(aes(date, log_price_tilde, color = "deseasonal"))+

geom_line(aes(date, log_price_bar, color = "seasonal"))+

geom_line(aes(date, 0, color = "realized"), alpha = 0)+

labs(x = NULL, y = latex2exp::TeX("$P_t$"), color = NULL)+

scale_color_manual(values = c(sample = "orange", realized = "black",

seasonal = "blue", deseasonal = "black"),

labels = c(sample = "Sample", realized = "Realized residuals",

seasonal = "Seasonal", deseasonal = "Deseasonalized"))+

theme_bw()+

custom_theme+

theme(legend.position = "top")

# Plot realized deseasonalized prices for all the data

plot_eps <- data_prices %>%

mutate(type = ifelse(Year == plot_year, "col", "nocol")) %>%

ggplot()+

geom_point(aes(date, log_price_tilde, color = type), size = 0.05)+

labs(x = NULL, y = latex2exp::TeX("$\\tilde{P}_t$"), color = NULL)+

scale_color_manual(values = c(col = "orange", nocol = "black"))+

custom_theme+

theme_bw()+

theme(legend.position = "none")

gridExtra::grid.arrange(plot_seasonal, plot_eps, ncol = 1, heights = c(0.6, 0.4))

4.1.3 Task B.1 (c)

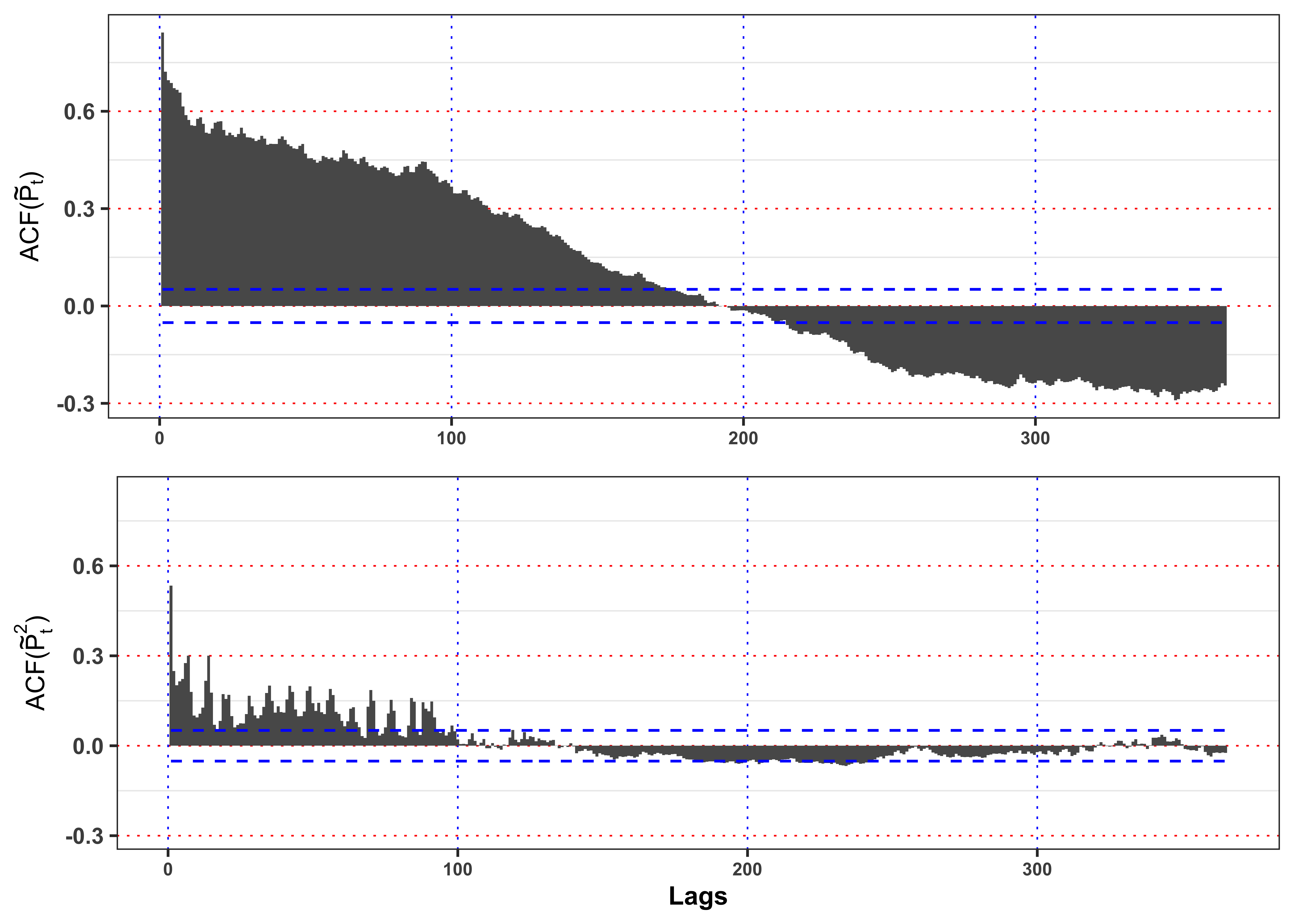

Plot the autocorrelation function for the deseasonalized log-prices \(\tilde{S}_t\) and for the squared deseasonalized log-prices \(\tilde{S}_t^2\) and their confidence intervals with \(\alpha = 0.05\). Is the time series of \(\tilde{S}_t\) uncorrelated?

Figure autocorrelation.

# Maximum number of lags

lag.max <- 365

# Confidence level

ci <- 0.05

# ACF log price tilde

acf_x <- acf(data_prices$log_price_tilde, type = "correlation", plot = FALSE, lag.max = lag.max)$acf[,,1][-1]

# ACF log price tilde squared

acf_x2 <- acf(data_prices$log_price_tilde^2, type = "correlation", plot = FALSE, lag.max = lag.max)$acf[,,1][-1]

# Limits for y-axis

limits_y <- range(c(acf_x, acf_x2))

# Confidence levels

acf_ci_bound <- qnorm(1 - ci / 2) / sqrt(nrow(data_prices))

plot_acf_x <- ggplot()+

geom_bar(aes(1:lag.max, acf_x), stat = "identity", width = 1)+

geom_line(aes(1:lag.max, acf_ci_bound), color = "blue", linetype = "dashed")+

geom_line(aes(1:lag.max, -acf_ci_bound), color = "blue", linetype = "dashed")+

scale_y_continuous(limits = limits_y)+

labs(x = NULL, y = latex2exp::TeX("ACF($\\tilde{P}_t$)"), color = NULL)+

theme_bw()+

custom_theme+

theme(legend.position = "none")

plot_acf_x2 <-ggplot()+

geom_bar(aes(1:lag.max, acf_x2), stat = "identity", width = 1)+

geom_line(aes(1:lag.max, acf_ci_bound), color = "blue", linetype = "dashed")+

geom_line(aes(1:lag.max, -acf_ci_bound), color = "blue", linetype = "dashed")+

scale_y_continuous(limits = limits_y)+

labs(x = "Lags", y = latex2exp::TeX("ACF($\\tilde{P}_t^2$)"), color = NULL)+

theme_bw()+

custom_theme+

theme(legend.position = "none")

gridExtra::grid.arrange(plot_acf_x, plot_acf_x2, ncol = 1)

4.2 Task B.2

The deseasonalized log-prices presents a strong autocorrelation in mean and variance. Let’s proceed by removing the first and then we will deal with the second. A popular model for electricity prices is the Autoregressive model of order 1 (AR(1)), the correspondent discrete version of an OU-process.

4.2.1 Task B.2 (a)

Test the hypothesis that the deseasonalized log-prices follows a random walk with an appropriate test. For example, you can consider an Augmented Dickey-Fuller Test. Fit with OLS an AR(1) model of the form \[ \tilde{S}_t = \phi \tilde{S}_{t-1} + \varepsilon_t \text{.} \] where we refer to this section for more details. Then, compute the fitted residuals \[ \varepsilon_t = \tilde{S}_t - \phi \tilde{S}_{t-1} \text{,} \tag{7}\] their standard deviation \[ \sigma_{\varepsilon} = \sqrt{\frac{1}{n-1}\sum_{t = 1}^n \varepsilon_t^2} \text{,} \tag{8}\] and the standardized residuals \[ \tilde{\varepsilon}_t = \frac{\varepsilon_t}{\sigma_{\varepsilon}} \text{.} \tag{9}\] Is the estimated model stationary?

Table ADF Test.

tseries::adf.test(data_prices$log_price_tilde, k = 7, alternative = "stationary") %>%

broom::tidy() %>%

dplyr::select(-alternative) %>%

dplyr::mutate(lags = 20,

H0 = ifelse(p.value <= 0.01, "Rejected (stationary)", "Non-rejected (explosive)")) %>%

dplyr::mutate_if(is.numeric, format, digits = 4, scientific = FALSE) %>%

knitr::kable(booktabs = TRUE, escape = FALSE, align = 'c') %>%

kableExtra::row_spec(0, color = "white", background = "green") | statistic | p.value | parameter | method | lags | H0 |

|---|---|---|---|---|---|

| -5.151 | 0.01 | 7 | Augmented Dickey-Fuller Test | 20 | Rejected (stationary) |

AR model on the deseasonalized log-prices.

# AR model

AR_model <- lm(log_price_tilde ~ I(dplyr::lag(log_price_tilde, 1)) - 1, data = data_prices)

# Fitted values

data_prices$log_price_tilde_hat <- predict(AR_model, newdata = data_prices)

# Fitted residuals

data_prices$eps <- data_prices$log_price_tilde - data_prices$log_price_tilde_hat

# Estimated constant standard deviation

data_prices$sigma_bar <- sd(data_prices$eps, na.rm = TRUE)*sqrt(nrow(data_prices)/(nrow(data_prices)-1))

# Standardized residuals

data_prices$std_eps <- data_prices$eps/data_prices$sigma_bar

data_prices <- data_prices[-c(1),]Table statistics.

glance_AR_model <- broom::glance(AR_model)

glance_AR_model %>%

dplyr::select(-df, -logLik, -AIC, -BIC) %>%

dplyr::mutate_if(is.numeric, format, digits = 4, scientific = FALSE) %>%

knitr::kable(booktabs = TRUE, escape = FALSE, align = 'c') %>%

kableExtra::row_spec(0, color = "white", background = "green") | r.squared | adj.r.squared | sigma | statistic | p.value | deviance | df.residual | nobs |

|---|---|---|---|---|---|---|---|

| 0.7105 | 0.7103 | 0.1102 | 3583 | 0 | 17.72 | 1460 | 1461 |

Table estimates.

| term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| $$\phi$$ | 0.8429 | 0.01408 | 59.86 | 0 |

Note that, since \(\phi =\) 0.843 is less than 1 in absolute value, then the AR(1) model is stationary.

4.2.2 Task B.2 (b)

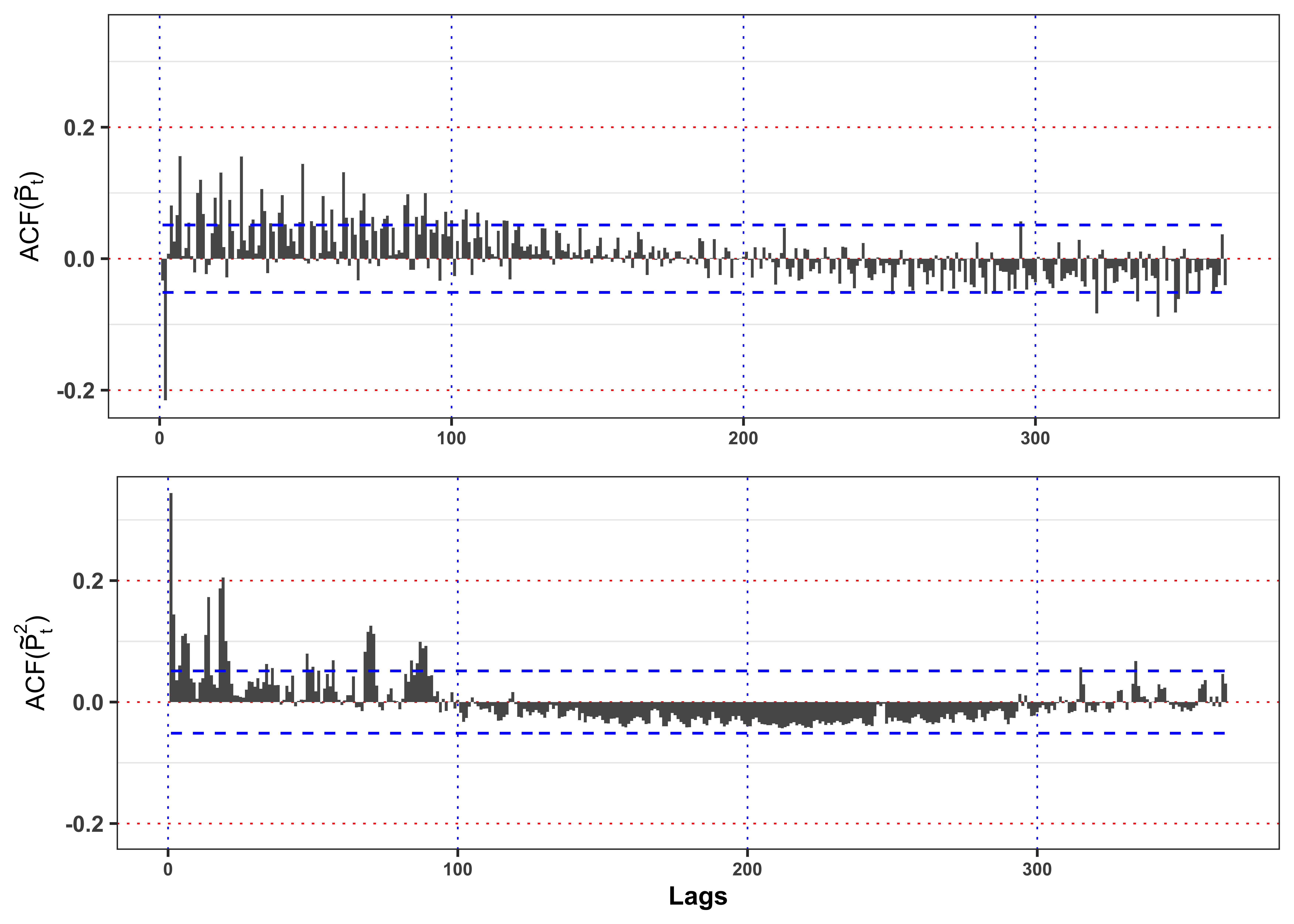

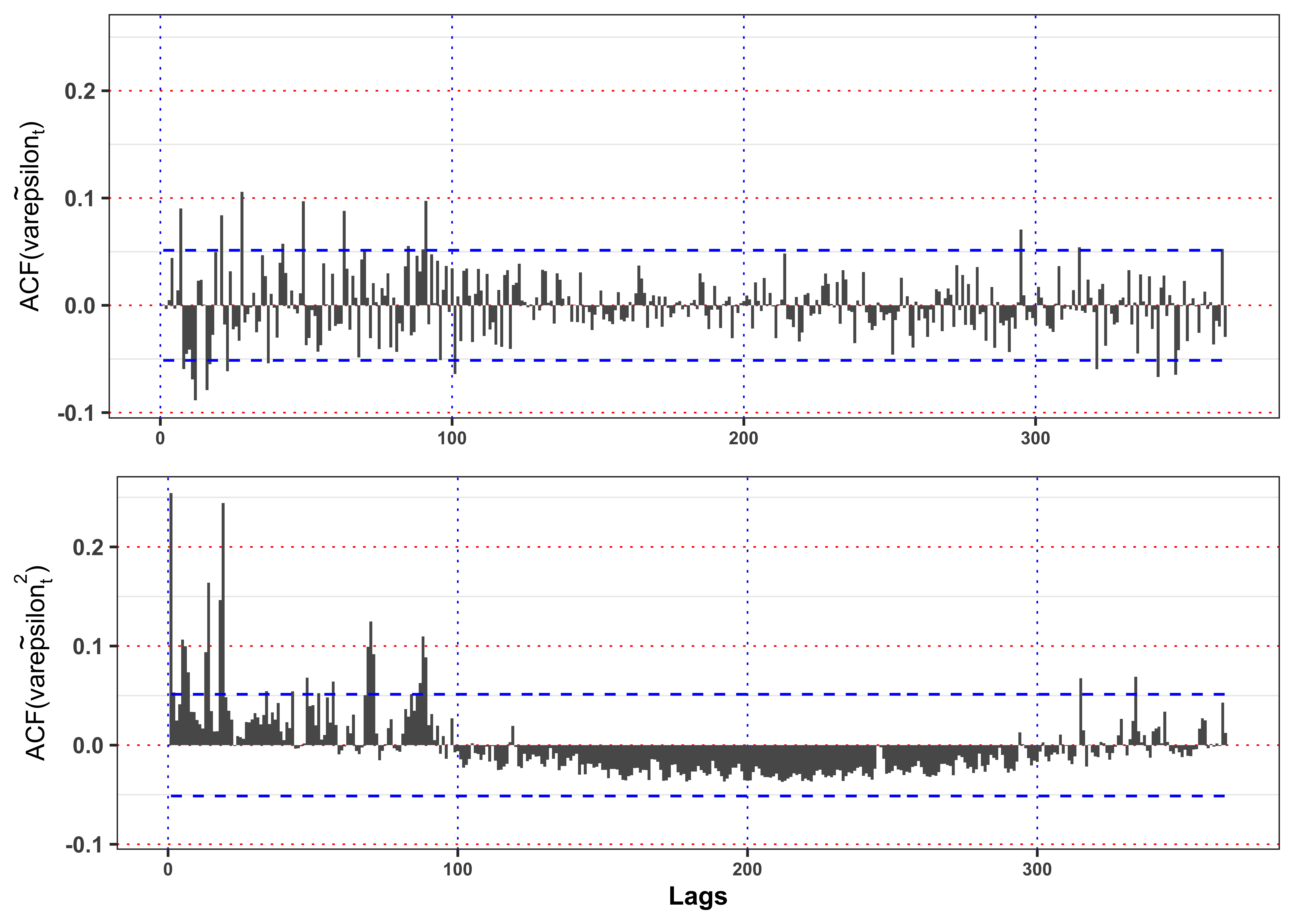

Plot the autocorrelation function of standardized residuals \(\tilde{\varepsilon}_t\), the squared standardized residuals \(\tilde{\varepsilon}_t^2\) and their confidence intervals with \(\alpha = 0.05\). Then, let’s verify if the basic assumptions of the model hold.

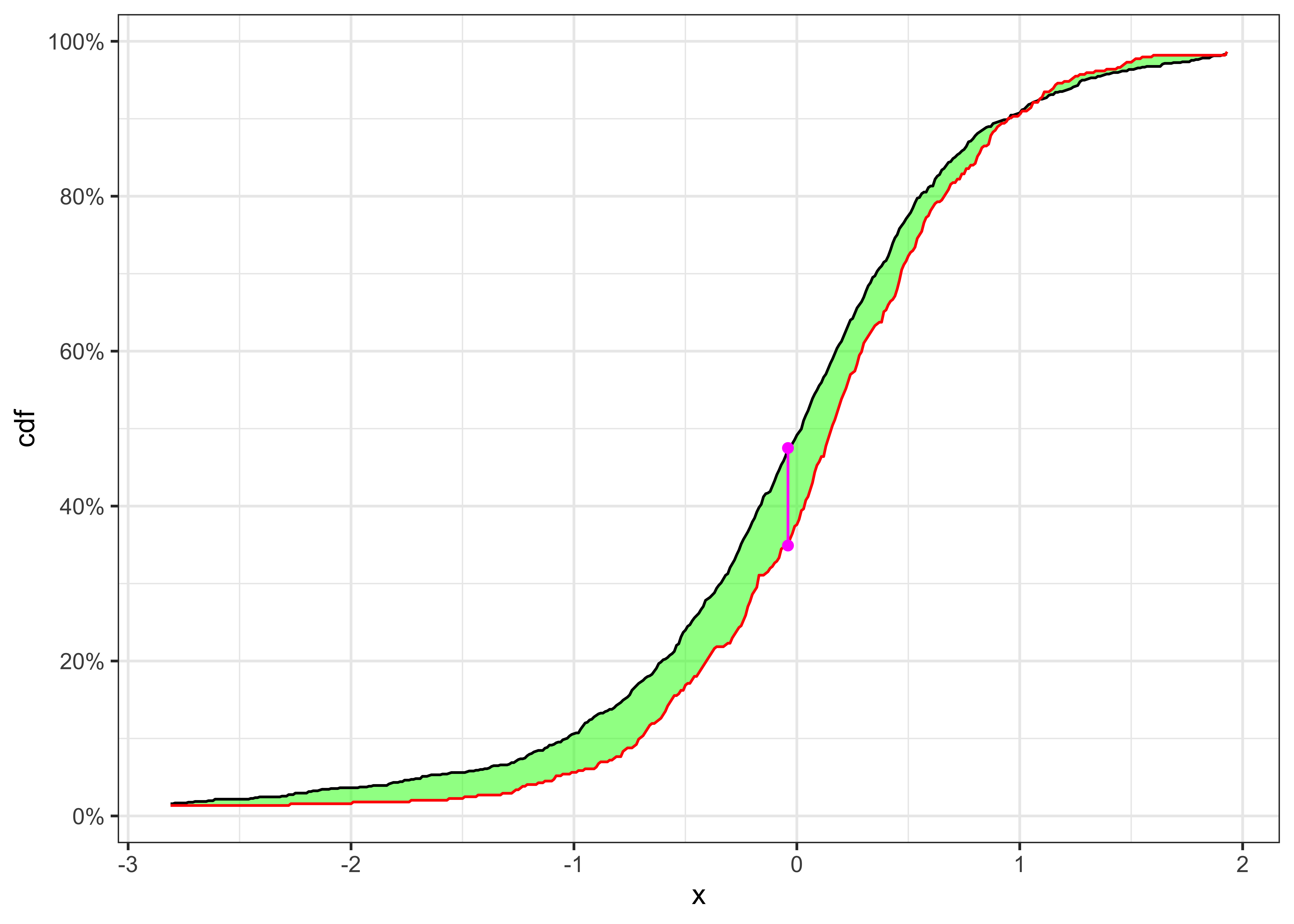

- Assumption 1.: Identically distributed residuals. We can verify this hypothesis with a two-sample Kolmogorov test. (see here)

Hint: For the two-sample Kolmogorov test you can consider the following R function.

Two-sample Kolmogorov Smirnov Test

#' Kolmogorov Smirnov test for a distribution

#'

#' Test against a specific distribution

#'

#' @param x a vector.

#' @param ci p.value for rejection.

#' @param idx_split Index used for splitting the time series. If `missing` will be random sampled.

#' @param min_quantile minimum quantile for the grid of values.

#' @param max_quantile maximum quantile for the grid of values.

#' @param seed random seed for two sample test.

#' @param plot when `TRUE` a plot is returned, otherwise a `tibble`.

#' @return when `plot = TRUE` a plot is returned, otherwise a `tibble`.

ks_test_ts <- function(x, ci = 0.05, idx_split, min_quantile = 0.015, max_quantile = 0.985, seed = 1, plot = FALSE){

# Random seed

set.seed(seed)

# number of observations

n <- length(x)

# Random split of the time series

idx_split <- ifelse(missing(idx_split), sample(n, 1), idx_split)

x1 <- x[1:idx_split]

x2 <- x[(idx_split+1):n]

# Number of elements for each sub sample

n1 <- length(x1)

n2 <- length(x2)

# Grid of values for KS-statistic

grid <- seq(quantile(x, min_quantile), quantile(x, max_quantile), 0.01)

# Empiric cdfs

cdf_n1 <- ecdf(x1)

cdf_n2 <- ecdf(x2)

# KS-statistic

ks_stat <- max(abs(cdf_n1(grid) - cdf_n2(grid)))

# Rejection level

# Equivalent: sqrt(-log(ci / 2) * (1 + n2/n1) / (2*n2))

rejection_lev <- sqrt(-0.5 * log(ci / 2)) * sqrt((n1+n2)/(n1*n2))

# P-value

p.value <- 2 * exp(- 2 * n2 / (1 + n1/n2) * ks_stat^2)

# ========================== Plot ==========================

if (plot) {

y_breaks <- seq(0, 1, 0.2)

y_labels <- paste0(format(y_breaks*100, digits = 2), "%")

grid_max <- grid[which.max(abs(cdf_n1(grid) - cdf_n2(grid)))]

plt <- ggplot()+

geom_ribbon(aes(grid, ymax = cdf_n1(grid), ymin = cdf_n2(grid)),

alpha = 0.5, fill = "green") +

geom_line(aes(grid, cdf_n1(grid)))+

geom_line(aes(grid, cdf_n2(grid)), color = "red")+

geom_segment(aes(x = grid_max, xend = grid_max,

y = cdf_n1(grid_max), yend = cdf_n2(grid_max)),

linetype = "solid", color = "magenta")+

geom_point(aes(grid_max, cdf_n1(grid_max)), color = "magenta")+

geom_point(aes(grid_max, cdf_n2(grid_max)), color = "magenta")+

scale_y_continuous(breaks = y_breaks, labels = y_labels)+

labs(x = "x", y = "cdf")+

theme_bw()

return(plt)

} else {

kab <- dplyr::tibble(

idx_split = idx_split,

ci = paste0(ci*100, "%"),

n1 = n1,

n2 = n2,

KS = ks_stat,

p.value = p.value,

rejection_lev = rejection_lev,

H0 = ifelse(KS > rejection_lev, "Rejected", "Non-Rejected")

)

class(kab) <- c("ks_test_ts", class(kab))

return(kab)

}

}- Assumption 2.: Uncorrelated residuals. If we do not reject Assumption 1. we can use Box-cox test, however if we reject Assumption 1. the Box-Cox tests are not valid and it is better to rely on a more general approach. In general, we can fit an AR(p) mode on the standardized residuals, i.e.

\[ \tilde{\varepsilon}_t \sim a_0 + a_1 \tilde{\varepsilon}_{t-1} + \dots + a_p \tilde{\varepsilon}_{t-p} + z_t \text{,} \] and test for the significance of the entire regression with the F-test. More precisely, the F-statistic and its p-value are evaluated under the null hypothesis \[ H_0 = a_1 = \dots = a_p = 0 \implies \tilde{\varepsilon}_t = a_0 + z_t \text{.} \] In other words, under \(H_0\) the standardized residuals are uncorrelated and with expectation equal to \(a_0\). Is the AR model able to remove the autocorrelation in mean? Are the standardized residuals stationary in variance?

Figure autocorrelation.

# Maximum number of lags

lag.max <- 365

# Confidence level

ci <- 0.05

# ACF log price tilde

acf_x <- acf(data_prices$std_eps, type = "correlation", plot = FALSE, lag.max = lag.max)$acf[,,1][-1]

# ACF log price tilde squared

acf_x2 <- acf(data_prices$std_eps^2, type = "correlation", plot = FALSE, lag.max = lag.max)$acf[,,1][-1]

# Limits for y-axis

limits_y <- range(c(acf_x, acf_x2))

# Confidence levels

acf_ci_bound <- qnorm(1 - ci / 2) / sqrt(nrow(data_prices))

plot_acf_x <- ggplot()+

geom_bar(aes(1:lag.max, acf_x), stat = "identity", width = 1)+

geom_line(aes(1:lag.max, acf_ci_bound), color = "blue", linetype = "dashed")+

geom_line(aes(1:lag.max, -acf_ci_bound), color = "blue", linetype = "dashed")+

scale_y_continuous(limits = limits_y)+

labs(x = NULL, y = latex2exp::TeX("ACF($\\tilde{P}_t$)"), color = NULL)+

theme_bw()+

custom_theme+

theme(legend.position = "none")

plot_acf_x2 <-ggplot()+

geom_bar(aes(1:lag.max, acf_x2), stat = "identity", width = 1)+

geom_line(aes(1:lag.max, acf_ci_bound), color = "blue", linetype = "dashed")+

geom_line(aes(1:lag.max, -acf_ci_bound), color = "blue", linetype = "dashed")+

scale_y_continuous(limits = limits_y)+

labs(x = "Lags", y = latex2exp::TeX("ACF($\\tilde{P}_t^2$)"), color = NULL)+

theme_bw()+

custom_theme+

theme(legend.position = "none")

gridExtra::grid.arrange(plot_acf_x, plot_acf_x2, ncol = 1)

As shown in Figure 11 the residuals present a significant autocorrelation in mean and variance that will make them not identically distributed and correlated.

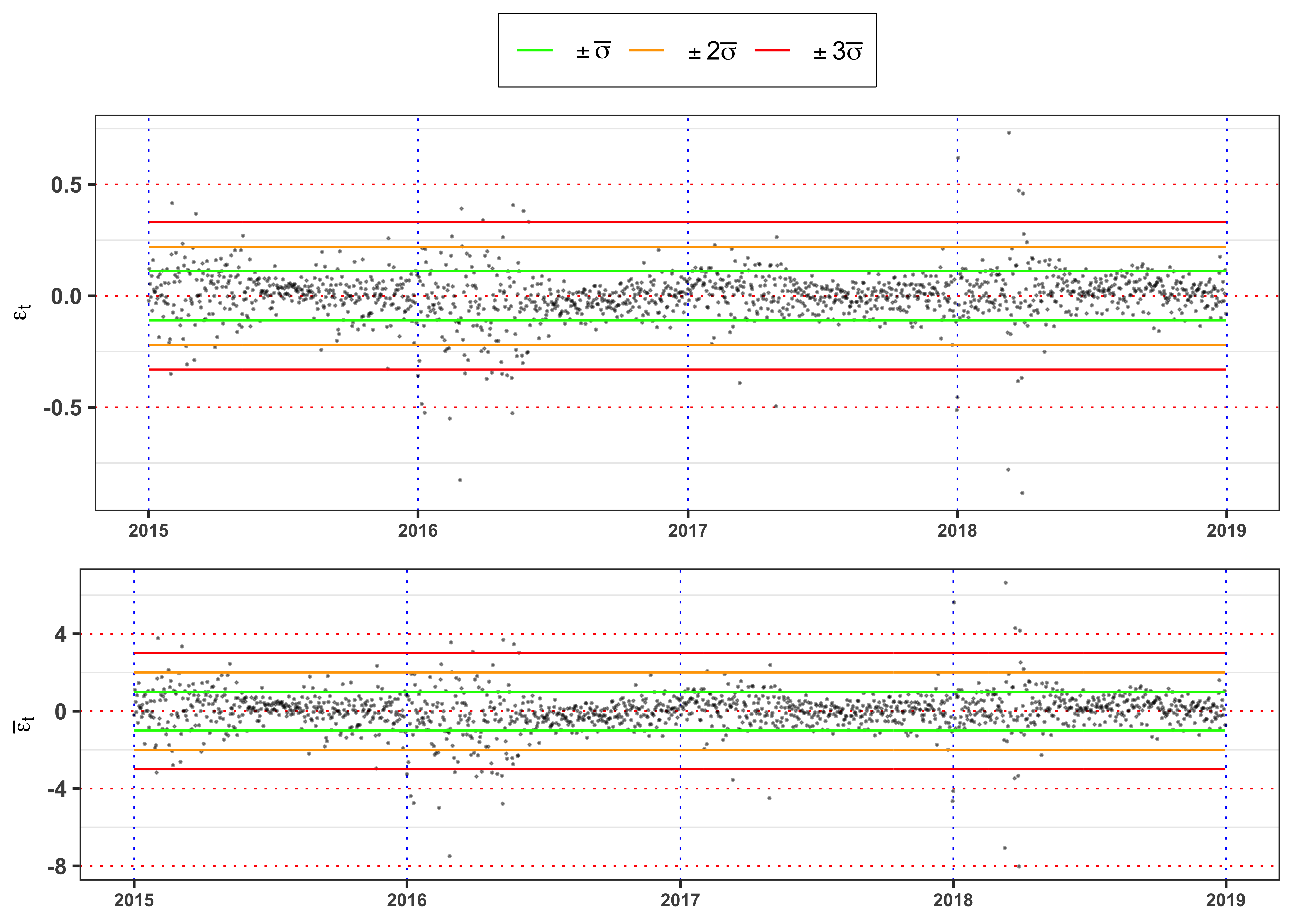

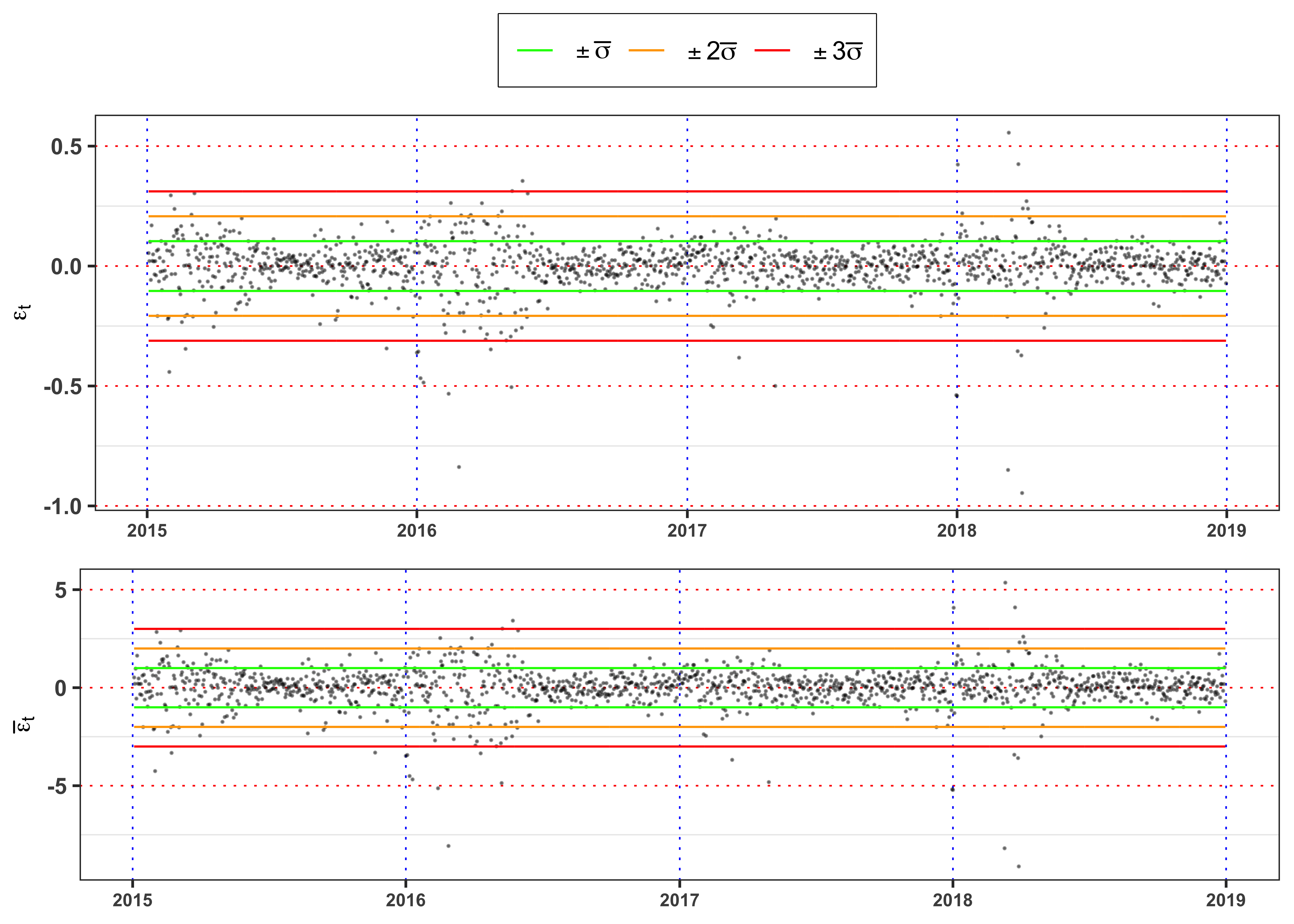

Figure residuals.

plot_eps <- ggplot(data_prices)+

geom_point(aes(date, eps), color = "black", size = 0.1, alpha = 0.4)+

geom_line(aes(date, 3*sigma_bar, color = "sigma3"), size = 0.4)+

geom_line(aes(date, 2*sigma_bar, color = "sigma2"), size = 0.4)+

geom_line(aes(date, 1*sigma_bar, color = "sigma1"), size = 0.4)+

geom_line(aes(date, -1*sigma_bar, color = "sigma1"), size = 0.4)+

geom_line(aes(date, -2*sigma_bar, color = "sigma2"), size = 0.4)+

geom_line(aes(date, -3*sigma_bar, color = "sigma3"), size = 0.4)+

labs(x = NULL, y = TeX("$\\epsilon_t$"), color = NULL)+

theme_bw()+

theme(legend.position = "top")+

theme_bw()+

custom_theme+

scale_color_manual(values = c(sigma1 = "green", sigma2 = "orange", sigma3 = "red", std_eps = "darkorange"),

labels = c(sigma1 = TeX("$\\pm \\bar{\\sigma}$"),

sigma2 = TeX("$\\pm 2\\bar{\\sigma}$"),

sigma3 = TeX("$\\pm 3\\bar{\\sigma}$"),

std_eps = TeX("$\\bar{\\epsilon}_t = \\frac{\\epsilon_t}{\\bar{\\sigma}}$")))

plot_std_eps <- ggplot(data_prices)+

geom_point(aes(date, std_eps), color = "black", size = 0.1, alpha = 0.4)+

geom_line(aes(date, 3, color = "sigma3"), size = 0.4)+

geom_line(aes(date, 2, color = "sigma2"), size = 0.4)+

geom_line(aes(date, 1, color = "sigma1"), size = 0.4)+

geom_line(aes(date, -1, color = "sigma1"), size = 0.4)+

geom_line(aes(date, -2, color = "sigma2"), size = 0.4)+

geom_line(aes(date, -3, color = "sigma3"), size = 0.4)+

labs(x = NULL, y = TeX("$\\bar{\\epsilon}_t$"), color = NULL)+

scale_color_manual(values = c(sigma1 = "green", sigma2 = "orange", sigma3 = "red"))+

theme_bw()+

custom_theme+

theme(legend.position = "none")

gridExtra::grid.arrange(plot_eps, plot_std_eps, ncol = 1, heights = c(0.6, 0.4))

The Figure 12 shows clearly that the standardized residuals presents volatility clusters, hence the time series of \(\bar{\epsilon}_t\) cannot be identically distributed. A formal way to test it, is a two sample Kolmogorov-Smirnov test.

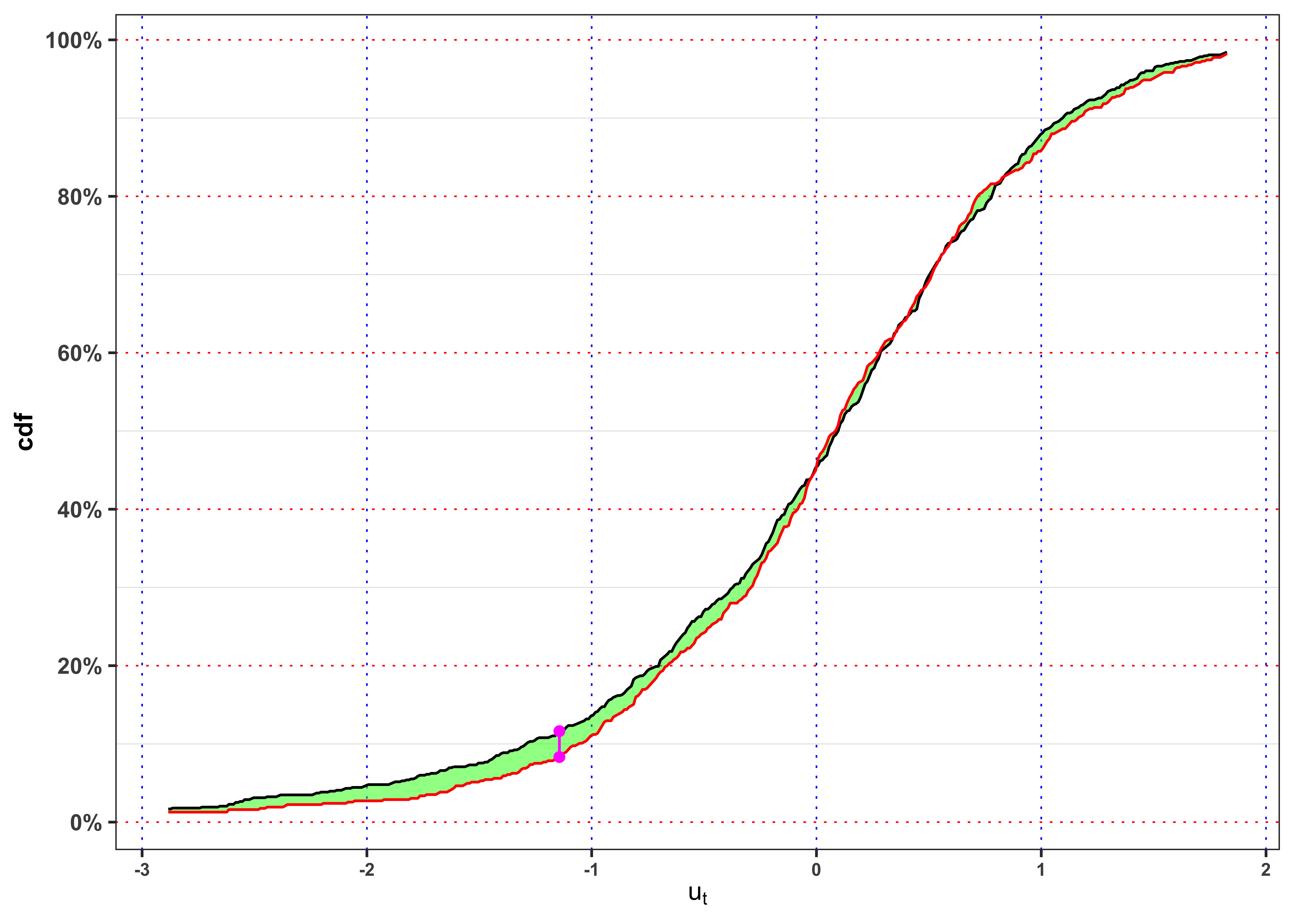

KS-test on \(\tilde{\varepsilon}_t\)

Two samples cdfs and KS-statistics for \(\tilde{\varepsilon}_t\).

kab <- ks_test_ts(na.omit(data_prices$std_eps), ci = 0.01, seed = 2) %>%

dplyr::mutate_if(is.numeric, format, digits = 4, scientific = FALSE)

colnames(kab) <- c("Index split", "$$\\alpha$$", "$$n_1$$", "$$n_2$$",

"$$KS_{n_1, n_2}$$", "p.value", "Critical Level", "$$H_0$$")

knitr::kable(kab, booktabs = TRUE, escape = FALSE, align = 'c') %>%

kableExtra::row_spec(0, color = "white", background = "green") | Index split | $$\alpha$$ | $$n_1$$ | $$n_2$$ | $$KS_{n_1, n_2}$$ | p.value | Critical Level | $$H_0$$ |

|---|---|---|---|---|---|---|---|

| 975 | 1% | 975 | 486 | 0.1179 | 0.02239 | 0.09038 | Rejected |

The null hypothesis of independence and identically distribution is rejected. Hence, we fit an AR(7) model on the standardized residuals.

Autocorrelation Test on \(\tilde{\varepsilon}_t\).

data_test <- data_prices

# Number of lags to test

lag.max <- 7

# Add lagged variables

for(i in 1:lag.max){

data_test[[paste0("L", i, "_std_eps")]] <- dplyr::lag(data_test$std_eps, i)

}

# Select only relevant variables

data_test <- na.omit(dplyr::select(data_test, contains("std_eps")))

# Fit an AR(p) model

AR_model_test <- lm(std_eps ~ ., data = data_test)Table statistics.

| r.squared | adj.r.squared | sigma | statistic | p.value | df | deviance | df.residual | nobs |

|---|---|---|---|---|---|---|---|---|

| 0.0929 | 0.0885 | 0.9552 | 21.1498 | 0 | 7 | 1319.286 | 1446 | 1454 |

Table estimates.

tidy_AR_model_test <- broom::tidy(AR_model_test)

tidy_AR_model_test %>%

dplyr::mutate_if(is.numeric, round, digits = 4) %>%

dplyr::mutate(term = paste0("$$a_", 0:lag.max, "$$")) %>%

knitr::kable(booktabs = TRUE, escape = FALSE, align = 'c') %>%

kableExtra::row_spec(0, color = "white", background = "green") | term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| $$a_0$$ | -0.0020 | 0.0250 | -0.0780 | 0.9378 |

| $$a_1$$ | -0.0640 | 0.0258 | -2.4789 | 0.0133 |

| $$a_2$$ | -0.2211 | 0.0257 | -8.5932 | 0.0000 |

| $$a_3$$ | -0.0117 | 0.0263 | -0.4456 | 0.6560 |

| $$a_4$$ | 0.0579 | 0.0262 | 2.2065 | 0.0275 |

| $$a_5$$ | 0.0748 | 0.0263 | 2.8465 | 0.0045 |

| $$a_6$$ | 0.1074 | 0.0257 | 4.1791 | 0.0000 |

| $$a_7$$ | 0.1864 | 0.0258 | 7.2225 | 0.0000 |

As we can see the coefficients -0.00195 has a p-value of 0.938 and so it is not statistically different from zero. However, the F-test equal to 21.15 has a p-value equal to 0 so we rejects the null hypothesis that all the AR coefficients are jointly equal to zero. Therefore, it is still present autocorrelation in mean that the AR(1) is not able to capture.

4.2.3 Task B.2 (c)

Let’s consider a more general model by fitting an ARMA(2,2). Such process will have the form: \[

\tilde{S}_t = \phi_1 \tilde{S}_{t-1} + \phi_2 \tilde{S}_{t-2} + \theta_1 \varepsilon_{t-1} + \theta_2 \varepsilon_{t-2} + \varepsilon_t

\text{,}

\] and can be fitted with maximum likelihood and by minimizing the sum the squared residuals. We refer to this section for more details. In this case, we prefer to be agnostic about the true distribution of \(\varepsilon_t\) and use the second method. In R you can consider the function arima(). Compute the fitted residuals as \[

\varepsilon_t = \tilde{S}_t - \phi_1 \tilde{S}_{t-1} - \phi_2 \tilde{S}_{t-2} - \theta_1 \varepsilon_{t-1} - \theta_2 \varepsilon_{t-2}

\text{.}

\tag{10}\] Re-compute the std. deviation as in Equation 8 and the standardized residuals as in Equation 9. Then, repeat the tests of Section 4.2.2 on the new standardized residuals. Is the ARMA model able to remove the autocorrelation in mean? Are the new standardized residuals stationary in variance?

Fit ARMA model.

# 3) ARMA model

ARMA_model <- arima(data_prices$log_price_tilde, order = c(2, 0, 2), include.mean = FALSE)

# Fitted residuals

data_prices$eps <- ARMA_model$residuals

# Fitted time series

data_prices$log_price_tilde_hat <- data_prices$log_price_tilde - data_prices$eps

# Estimated constant standard deviation

data_prices$sigma_bar <- sd(data_prices$eps, na.rm = TRUE) * sqrt(nrow(data_prices) / (nrow(data_prices) - 1))

# Standardized residuals

data_prices$std_eps <- data_prices$eps / data_prices$sigma_bar

data_prices <- data_prices[-c(1:2),]ARMA statistics.

| sigma | logLik | AIC | BIC | nobs |

|---|---|---|---|---|

| 0.1037 | 1237.005 | -2464.01 | -2437.576 | 1461 |

ARMA estimates.

tidy_ARMA_model <- broom::tidy(ARMA_model)

tidy_ARMA_model %>%

dplyr::mutate(term = c("$$\\phi_1$$", "$$\\phi_2$$",

"$$\\theta_1$$", "$$\\theta_2$$")) %>%

dplyr::mutate_if(is.numeric, round, digits = 4) %>%

knitr::kable(booktabs = TRUE, escape = TRUE, align = 'c') %>%

kableExtra::row_spec(0, color = "white", background = "green") | term | estimate | std.error |

|---|---|---|

| $$\phi_1$$ | 1.1792 | 0.0801 |

| $$\phi_2$$ | -0.1916 | 0.0765 |

| $$\theta_1$$ | -0.4497 | 0.0770 |

| $$\theta_2$$ | -0.3180 | 0.0378 |

Code

# Maximum number of lags

lag.max <- 365

# Confidence level

ci <- 0.05

# ACF log price tilde

acf_x <- acf(data_prices$std_eps, type = "correlation", plot = FALSE, lag.max = lag.max)$acf[,,1][-1]

# ACF log price tilde squared

acf_x2 <- acf(data_prices$std_eps^2, type = "correlation", plot = FALSE, lag.max = lag.max)$acf[,,1][-1]

# Limits for y-axis

limits_y <- range(c(acf_x, acf_x2))

# Confidence levels

acf_ci_bound <- qnorm(1 - ci / 2) / sqrt(nrow(data_prices))

plot_acf_x <- ggplot()+

geom_bar(aes(1:lag.max, acf_x), stat = "identity", width = 1)+

geom_line(aes(1:lag.max, acf_ci_bound), color = "blue", linetype = "dashed")+

geom_line(aes(1:lag.max, -acf_ci_bound), color = "blue", linetype = "dashed")+

scale_y_continuous(limits = limits_y)+

labs(x = NULL, y = latex2exp::TeX("ACF($\\tilde{\\varepsilon}_t$)"), color = NULL)+

theme_bw()+

custom_theme+

theme(legend.position = "none")

plot_acf_x2 <-ggplot()+

geom_bar(aes(1:lag.max, acf_x2), stat = "identity", width = 1)+

geom_line(aes(1:lag.max, acf_ci_bound), color = "blue", linetype = "dashed")+

geom_line(aes(1:lag.max, -acf_ci_bound), color = "blue", linetype = "dashed")+

scale_y_continuous(limits = limits_y)+

labs(x = "Lags", y = latex2exp::TeX("ACF($\\tilde{\\varepsilon}_t^2$)"), color = NULL)+

theme_bw()+

custom_theme+

theme(legend.position = "none")

gridExtra::grid.arrange(plot_acf_x, plot_acf_x2, ncol = 1)

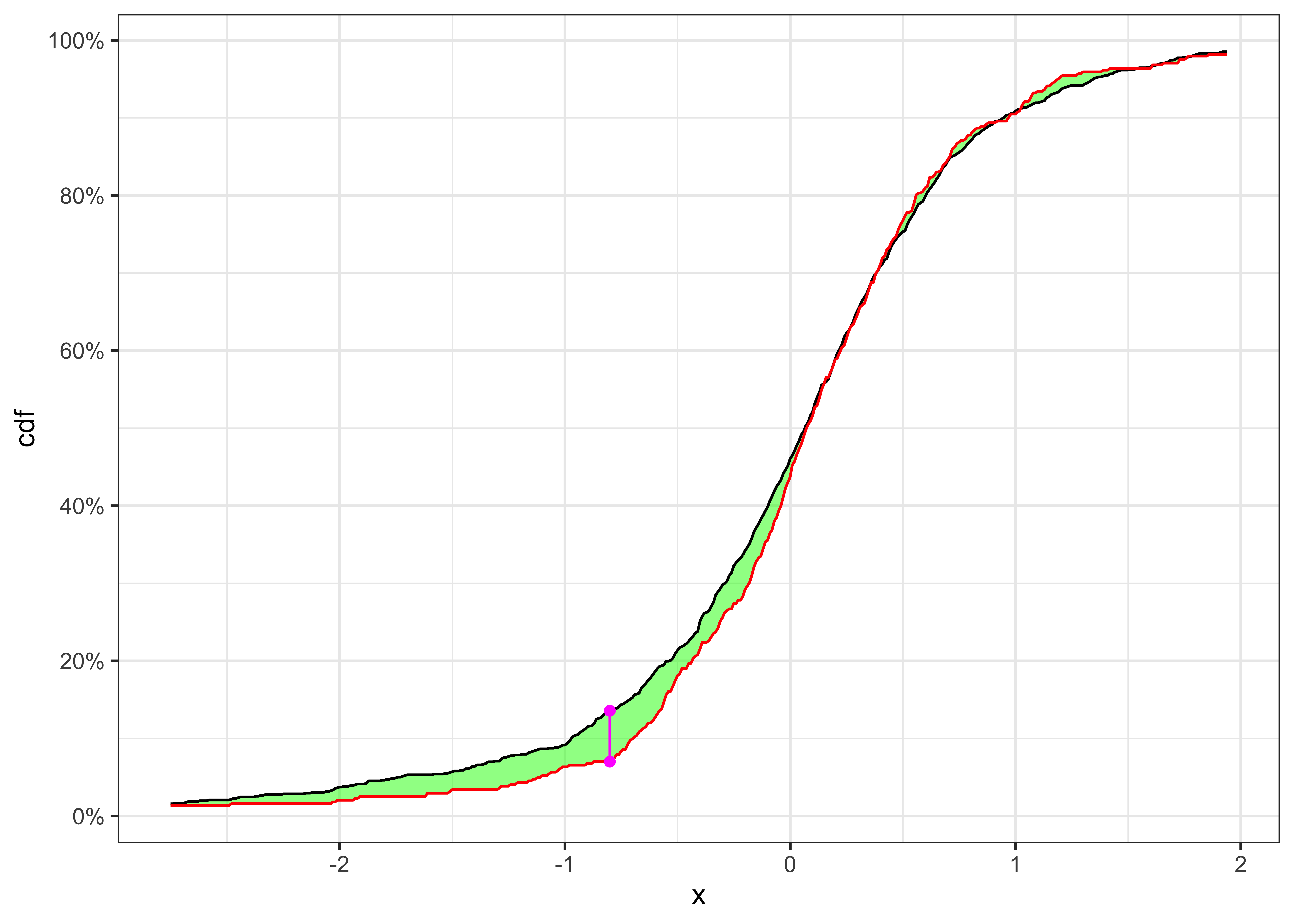

As shown in Figure 14 the squared residuals still present a significant autocorrelation in variance that will make them not identically distributed.

Code

library(latex2exp)

plot_eps <- ggplot(data_prices)+

geom_point(aes(date, eps), color = "black", size = 0.1, alpha = 0.4)+

geom_line(aes(date, 3*sigma_bar, color = "sigma3"), size = 0.4)+

geom_line(aes(date, 2*sigma_bar, color = "sigma2"), size = 0.4)+

geom_line(aes(date, 1*sigma_bar, color = "sigma1"), size = 0.4)+

geom_line(aes(date, -1*sigma_bar, color = "sigma1"), size = 0.4)+

geom_line(aes(date, -2*sigma_bar, color = "sigma2"), size = 0.4)+

geom_line(aes(date, -3*sigma_bar, color = "sigma3"), size = 0.4)+

labs(x = NULL, y = TeX("$\\epsilon_t$"), color = NULL)+

theme_bw()+

custom_theme+

theme(legend.position = "top")+

scale_color_manual(values = c(sigma1 = "green", sigma2 = "orange", sigma3 = "red", std_eps = "darkorange"),

labels = c(sigma1 = TeX("$\\pm \\bar{\\sigma}$"),

sigma2 = TeX("$\\pm 2\\bar{\\sigma}$"),

sigma3 = TeX("$\\pm 3\\bar{\\sigma}$"),

std_eps = TeX("$\\bar{\\epsilon}_t = \\frac{\\epsilon_t}{\\bar{\\sigma}}$")))

plot_std_eps <- ggplot(data_prices)+

geom_point(aes(date, std_eps), color = "black", size = 0.1, alpha = 0.4)+

geom_line(aes(date, 3, color = "sigma3"), size = 0.4)+

geom_line(aes(date, 2, color = "sigma2"), size = 0.4)+

geom_line(aes(date, 1, color = "sigma1"), size = 0.4)+

geom_line(aes(date, -1, color = "sigma1"), size = 0.4)+

geom_line(aes(date, -2, color = "sigma2"), size = 0.4)+

geom_line(aes(date, -3, color = "sigma3"), size = 0.4)+

labs(x = NULL, y = TeX("$\\bar{\\epsilon}_t$"), color = NULL)+

scale_color_manual(values = c(sigma1 = "green", sigma2 = "orange", sigma3 = "red"))+

theme_bw()+

custom_theme+

theme(legend.position = "none")

gridExtra::grid.arrange(plot_eps, plot_std_eps, ncol = 1, heights = c(0.6, 0.4))

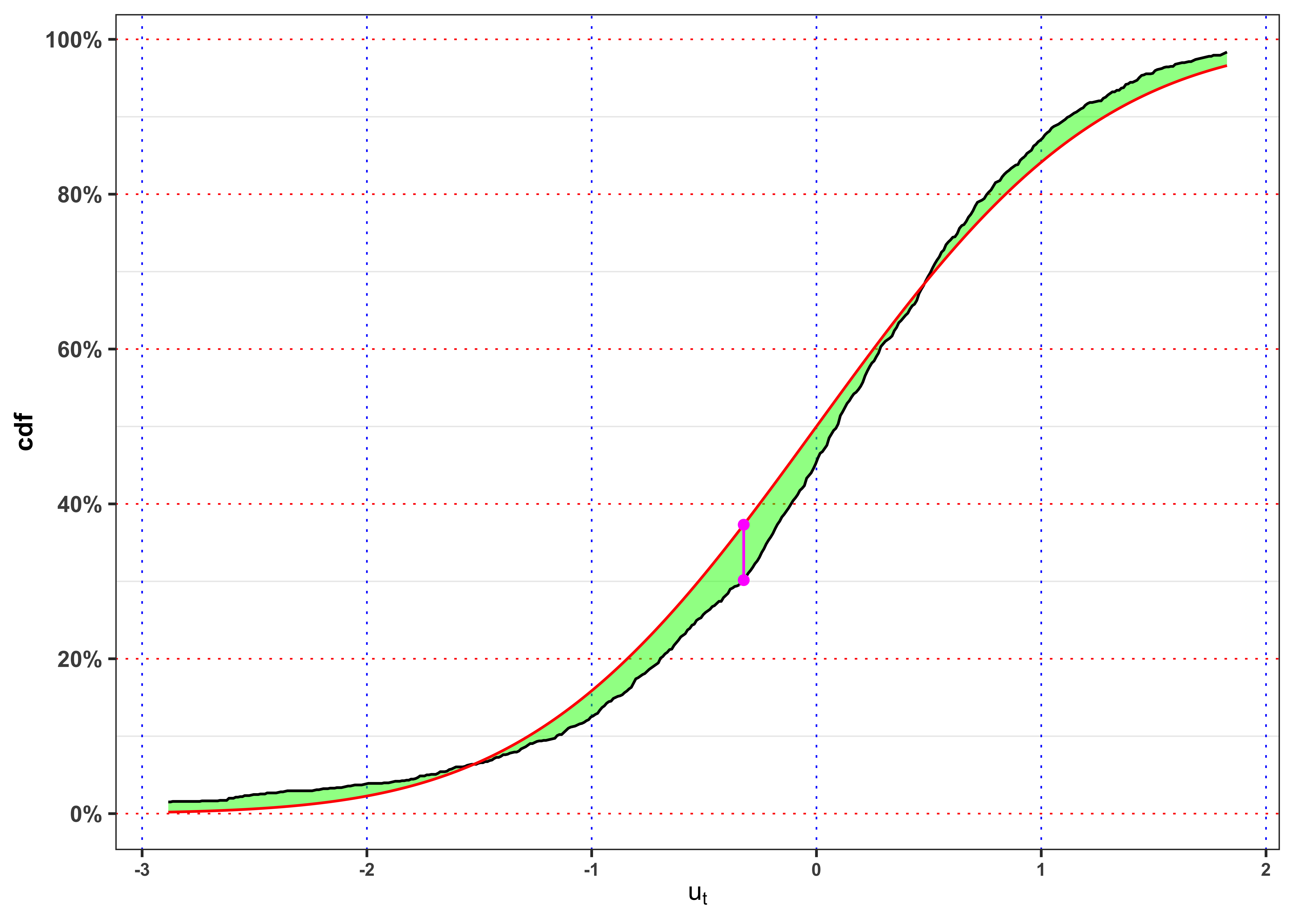

The graph above shows clearly that the standardized residuals presents volatility clusters, hence the time series of \(\bar{\epsilon}_t\) will be not identically distributed. A formal way to test it, is a two sample Kolmogorov-Smirnov.

KS-test on \(\tilde{\varepsilon}_t\)

KS-test \(\tilde{\varepsilon}_t\)

kab <- ks_test_ts(na.omit(data_prices$std_eps), ci = 0.01, seed = 2) %>%

dplyr::mutate_if(is.numeric, format, digits = 4, scientific = FALSE)

colnames(kab) <- c("Index split", "$$\\alpha$$", "$$n_1$$", "$$n_2$$",

"$$KS_{n_1, n_2}$$", "p.value", "Critical Level", "$$H_0$$")

knitr::kable(kab, booktabs = TRUE, escape = FALSE, align = 'c')%>%

kableExtra::row_spec(0, color = "white", background = "green") | Index split | $$\alpha$$ | $$n_1$$ | $$n_2$$ | $$KS_{n_1, n_2}$$ | p.value | Critical Level | $$H_0$$ |

|---|---|---|---|---|---|---|---|

| 975 | 1% | 975 | 484 | 0.06512 | 0.5124 | 0.0905 | Non-Rejected |

The null hypothesis of independence and identically distribution is rejected, hence we have to define a model for the conditional variance of the process.

Test Autocorrelation on the ARMA standardized residuals.

data_test <- data_prices

# Number of lags to test

lag.max <- 7

# Add lagged variables

for(i in 1:lag.max){

data_test[[paste0("L", i, "_std_eps")]] <- dplyr::lag(data_test$std_eps, i)

}

# Select only relevant variables

data_test <- na.omit(dplyr::select(data_test, contains("std_eps")))

# Fit an AR(p) model

ARMA_model_test <- lm(std_eps ~ ., data = data_test)Table statistics.

glance_ARMA_model_test <- broom::glance(ARMA_model_test)

glance_ARMA_model_test %>%

select(-AIC, -BIC, -logLik) %>%

dplyr::mutate_if(is.numeric, format, digits = 4, scientific = FALSE) %>%

knitr::kable(booktabs = TRUE, escape = FALSE, align = 'c') %>%

kableExtra::row_spec(0, color = "white", background = "green") | r.squared | adj.r.squared | sigma | statistic | p.value | df | deviance | df.residual | nobs |

|---|---|---|---|---|---|---|---|---|

| 0.01026 | 0.005463 | 0.998 | 2.139 | 0.03705 | 7 | 1438 | 1444 | 1452 |

Table estimates.

tidy_ARMA_model_test <- broom::tidy(ARMA_model_test)

tidy_ARMA_model_test %>%

dplyr::mutate(term = paste0("$$a_", 0:lag.max, "$$")) %>%

dplyr::mutate_if(is.numeric, format, digits = 4, scientific = FALSE) %>%

knitr::kable(booktabs = TRUE, escape = FALSE, align = 'c') %>%

kableExtra::row_spec(0, color = "white", background = "green") | term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| $$a_0$$ | -0.0021308 | 0.02619 | -0.081354 | 0.9351715 |

| $$a_1$$ | -0.0001462 | 0.02621 | -0.005578 | 0.9955504 |

| $$a_2$$ | -0.0053908 | 0.02622 | -0.205615 | 0.8371207 |

| $$a_3$$ | 0.0007113 | 0.02619 | 0.027153 | 0.9783418 |

| $$a_4$$ | 0.0429757 | 0.02617 | 1.642383 | 0.1007284 |

| $$a_5$$ | -0.0028748 | 0.02619 | -0.109781 | 0.9125983 |

| $$a_6$$ | 0.0142256 | 0.02619 | 0.543246 | 0.5870442 |

| $$a_7$$ | 0.0901152 | 0.02619 | 3.441149 | 0.0005958 |

As we can see the coefficients -0.00213 has a p-value of 0.935 and so it is not statistically different from zero. However, the F-test equal to 2.139 has a p-value equal to 0.037 so we do not reject the null hypothesis that all the AR coefficients are jointly equal to zero with 3.7 % confidence level. Therefore, with the ARMA model we do not have anymore autocorrelation in mean that the AR(1) was not able to completely remove.

4.3 Task B.3

4.3.1 Task B.3 (a)

A popular approach to model the conditional variance of a time series is a GARCH(p,q) model. For simplicity, let’s consider a GARCH(1,1) model, i.e. \[ \begin{aligned} & {}\varepsilon_t = \sigma_{t} u_t \\ & \sigma_{t}^2 = \omega + \alpha \varepsilon_{t-1}^2 + \beta \sigma_{t-1}^2 \\ & u_{t} \sim \; \text{IID}(0, 1) \end{aligned} \] In general, the parameters of such models are estimated with a Quasi-Maximum Likelihood approach where, as long as the residuals are identically distributed, independent and with mean zero and unitary variance, one can estimate the parameters by assuming a normal distribution for \(u_t\). Moreover, to ensure that the long-term GARCH variance is coherent with the variance estimated on the residuals \(\varepsilon_t\), is it possible to constraint \(\omega\) as follows, i.e. \[ \sigma_{t}^2 = \sigma_{\varepsilon}^2 + \alpha (1 - \sigma_{\varepsilon}^2) \varepsilon_{t-1}^2 + \beta (1 - \sigma_{\varepsilon}^2) \sigma_{t-1}^2 \text{.} \] Compute the long-term GARCH(1,1) variance, i.e. \(\mathbb{E}\{\sigma_t^2\}\) \[ \sigma_{\infty}^2 = \mathbb{E}\{\sigma_t^2\} = \frac{\omega}{1-\alpha-\beta} \text{,} \] and compare it with the variance estimated \(\sigma_{\varepsilon}^2\) estimated in Section 4.2.2. Are the two variances equal? Is the estimated model stationary?

Hint: For the parameter estimation you can consider the R package rugarch in which is implemented the QMLE estimator, the possibility to automatically contraint the variance and many others different GARCH models. For the stationarity condition check the estimated parameters \(\alpha\) and \(\beta\).

Fit the GARCH model.

# Variance specification

GARCH_spec <- rugarch::ugarchspec(

variance.model = list(model = "sGARCH", garchOrder = c(1,1), variance.targeting = data_prices$sigma_bar[1]^2),

mean.model = list(armaOrder = c(0,0), include.mean = FALSE), distribution.model = "norm")

# GARCH fitted model

GARCH_model <- rugarch::ugarchfit(data = data_prices$eps, spec = GARCH_spec, out.sample = 0)

# Fitted GARCH standard deviation

data_prices$sigma <- GARCH_model@fit$sigma

# Fitted standardized residuals

data_prices$ut <- data_prices$eps / data_prices$sigmaTable GARCH estimates.

# GARCH parameters

GARCH_params <- GARCH_model@fit$coef

# Std. deviation of the parameters

GARCH_errors <- GARCH_model@fit$se.coef

names(GARCH_errors) <- names(GARCH_params)

# Long-term GARCH standard deviation

sigma2_inf <- GARCH_params["omega"] / (1-GARCH_params["alpha1"]-GARCH_params["beta1"])

kab <- dplyr::tibble(

params = c("$$\\omega$$", "$$\\alpha$$", "$$\\beta$$", "$$\\sigma^2_{\\infty}$$"),

estimates = c(GARCH_params["omega"], GARCH_params["alpha1"], GARCH_params["beta1"], sigma2_inf),

se.coef = c(GARCH_errors["omega"], GARCH_errors["alpha1"], GARCH_errors["beta1"], NA_integer_)) %>%

dplyr::mutate_if(is.numeric, format, digits = 4, scientific = FALSE)

knitr::kable(kab, booktabs = TRUE, escape = FALSE, align = 'c')%>%

kableExtra::row_spec(0, color = "white", background = "green") | params | estimates | se.coef |

|---|---|---|

| $$\omega$$ | 0.0003374 | NA |

| $$\alpha$$ | 0.1793855 | 0.01242 |

| $$\beta$$ | 0.7892810 | 0.01486 |

| $$\sigma^2_{\infty}$$ | 0.0107691 | NA |

Since the sum \(\alpha + \beta =\) 0.79 is less than 1 in absolute value the model is stationary.

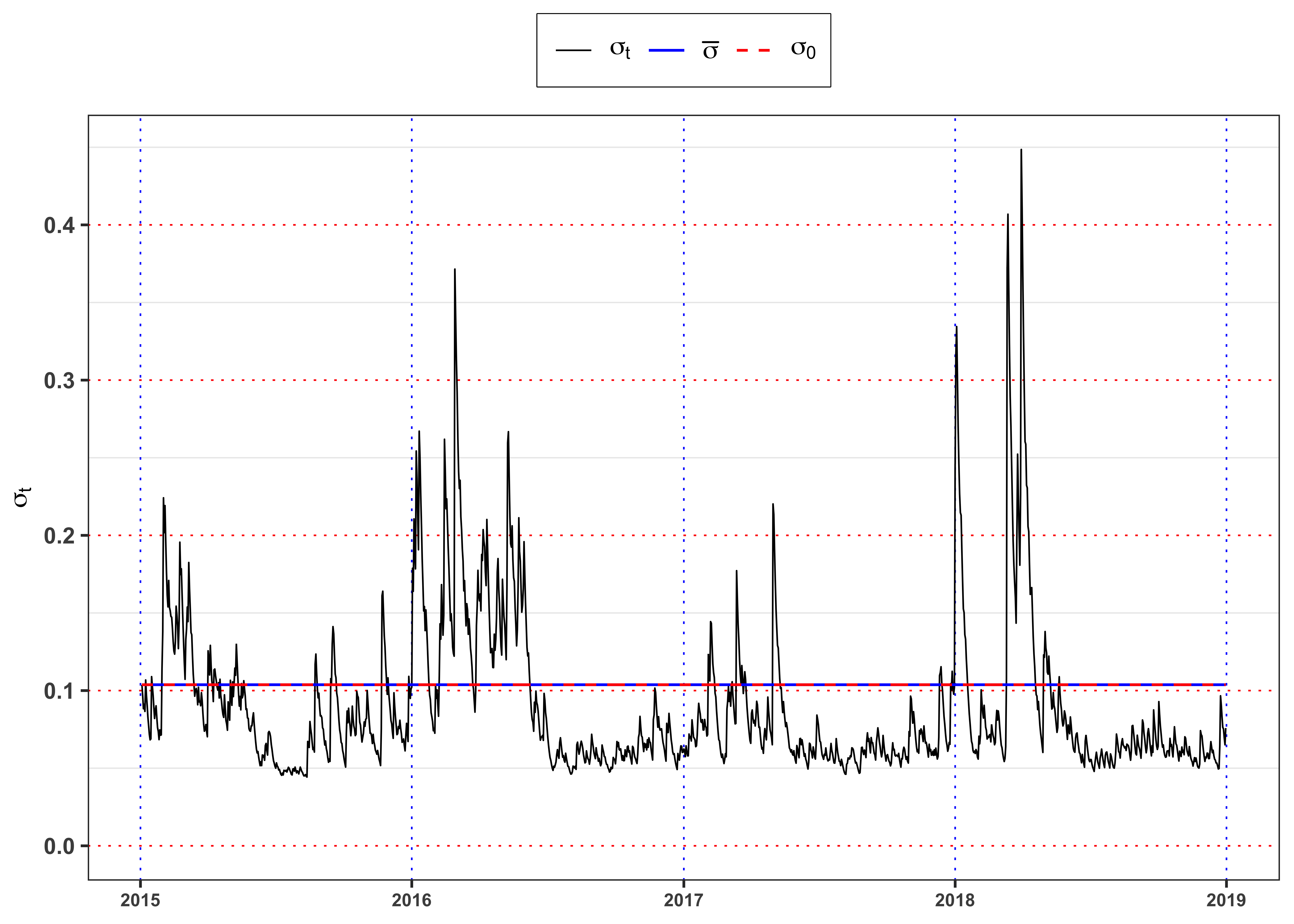

Figure GARCH residuals.

plot_eps <- ggplot(data_prices)+

geom_point(aes(date, eps), color = "black", size = 0.1, alpha = 0.4)+

geom_line(aes(date, 3*sigma, color = "sigma3"), size = 0.4)+

geom_line(aes(date, 2*sigma, color = "sigma2"), size = 0.4)+

geom_line(aes(date, 1*sigma, color = "sigma1"), size = 0.4)+

geom_line(aes(date, -1*sigma, color = "sigma1"), size = 0.4)+

geom_line(aes(date, -2*sigma, color = "sigma2"), size = 0.4)+

geom_line(aes(date, -3*sigma, color = "sigma3"), size = 0.4)+

labs(x = NULL, y = TeX("$\\epsilon_t$"), color = NULL)+

theme_bw()+

custom_theme+

theme(legend.position = "top")+

scale_color_manual(values = c(sigma1 = "green", sigma2 = "orange", sigma3 = "red", std_eps = "darkorange"),

labels = c(sigma1 = TeX("$\\pm \\bar{\\sigma}$"),

sigma2 = TeX("$\\pm 2\\bar{\\sigma}$"),

sigma3 = TeX("$\\pm 3\\bar{\\sigma}$"),

std_eps = TeX("$\\bar{\\epsilon}_t = \\frac{\\epsilon_t}{\\bar{\\sigma}}$")))

plot_std_eps <- ggplot(data_prices)+

geom_point(aes(date, ut), color = "black", size = 0.1, alpha = 0.4)+

geom_line(aes(date, 3, color = "sigma3"), size = 0.4)+

geom_line(aes(date, 2, color = "sigma2"), size = 0.4)+

geom_line(aes(date, 1, color = "sigma1"), size = 0.4)+

geom_line(aes(date, -1, color = "sigma1"), size = 0.4)+

geom_line(aes(date, -2, color = "sigma2"), size = 0.4)+

geom_line(aes(date, -3, color = "sigma3"), size = 0.4)+

labs(x = NULL, y = TeX("$u_t$"), color = NULL)+

scale_color_manual(values = c(sigma1 = "green", sigma2 = "orange", sigma3 = "red"))+

theme_bw()+

custom_theme+

theme(legend.position = "none")

gridExtra::grid.arrange(plot_eps, plot_std_eps, ncol = 1, heights = c(0.6, 0.4))

Figure GARCH standard deviation.

ggplot(data_prices)+

geom_line(aes(date, sigma, color = "sigma"), size = 0.3)+

geom_line(aes(date, sigma_bar, color = "sigma_bar"))+

geom_line(aes(date, sqrt(sigma2_inf), color = "sigma0"), linetype = "dashed")+

geom_line(aes(date, 0, color = "std_eps"), alpha = 0)+

labs(x = NULL, y = TeX("$\\sigma_t$"), color = NULL)+

#scale_y_continuous(limits = c(min(data_prices$sigma), max(data_prices$sigma)))+

scale_color_manual(values = c(sigma = "black", sigma0 = "red", sigma_bar = "blue"),

labels = c(sigma = TeX("$\\sigma_t$"),

sigma0 = TeX("$\\sigma_0$"),

sigma_bar = TeX("$\\bar{\\sigma}$")))+

theme_bw()+

custom_theme+

theme(legend.position = "top")

4.3.2 Task B.3 (b)

Once the parameters \(\omega\), \(\alpha\) and \(\beta\) are estimated, the series of GARCH variance \(\sigma_t^2\) become available and one can compute the standardized GARCH residuals \[ u_t = \frac{\varepsilon_t}{\sigma_t} \text{.} \] Let’s verify if the assumption of the GARCH model holds. The assumption are three:

- Assumption 1.: Identically distributed residuals. We can verify this hypothesis with a two-sample Kolmogorov test.

Hint: You can consider the same implementation used in Section 4.2.2.

Assumption 2.: Uncorrelated residuals. If we do not reject 1. we can use Box-cox test.

Assumption 3.: The assumption of the QMLE estimatior is that the residuals are normally distributed, i.e. \(u_t \sim \mathcal{N}(0,1)\). We can verify this hypothesis with a Kolmogorov test by comparing the empirical distribution of \(u_t\) with the theoric distribution of a standard normal.

Hint: You can consider the following implementation for the Kolmogorov Smirnov Test for a distribution. (See here) for more details)

Kolmogorov Smirnov Test for a Distribution

#' Kolmogorov distribution functions

#'

#' @param x vector of quantiles.

#' @param p vector of probabilities.

#' @param k finite value for approximation of infinite sum.

#' @return A probability, a numeric vector in 0, 1.

#' @examples

#' pks(2, 1000)

#' pks(10, 1000)

pks <- function(x, k = 1000){

# Infinite sum function

# k: approximation for infinity

inf_sum <- function(x, k = 100){

isum <- 0

for(i in 1:k){

isum <- isum + (-1)^(i-1)*exp(-2*(x^2)*(i^2))

}

isum <- 2 * isum

isum

}

# Compute probability

p <- c()

for(i in 1:length(x)){

p[i] <- 1 - ifelse(x[i] <= 0, 1, inf_sum(x[i], k = k))

}

p[p<0] <- 0

return(p)

}

#' Kolmogorov quantile functions

#' @param p vector of probabilities.

qks <- function(p, k = 100, upper = 10){

loss <- function(x, p){

(pks(x, k = k) - p)^2

}

x <- c()

for(i in 1:length(p)){

x[i] <- optim(par = 2, method = "Brent", lower = 0, upper = upper, fn = loss, p = p[i])$par

}

return(x)

}

#' Kolmogorov Smirnov test for a distribution

#'

#' Test against a specific distribution

#'

#' @param x a vector.

#' @param cdf a function. The theoric distribution to use for comparison.

#' @param ci p.value for rejection.

#' @param min_quantile minimum quantile for the grid of values.

#' @param max_quantile maximum quantile for the grid of values.

#' @param k finite value for approximation of infinite sum.

#' @param plot when `TRUE` a plot is returned, otherwise a `tibble`.

#' @return when `plot = TRUE` a plot is returned, otherwise a `tibble`.

ks_test <- function(x, cdf, ci = 0.05, min_quantile = 0.015, max_quantile = 0.985, k = 1000, plot = FALSE){

# number of observations

n <- length(x)

# Set the interval values for upper and lower band

grid <- seq(quantile(x, min_quantile), quantile(x, max_quantile), 0.01)

# Empirical cdf

cdf_x <- ecdf(x)

# Compute the KS-statistic

ks_stat <- sqrt(n)*max(abs(cdf_x(grid) - cdf(grid)))

# Compute the rejection level

rejection_lev <- qks(1-ci, k = k)

# Compute the p-value

p.value <- 1-pks(ks_stat, k = k)

# ========================== Plot ==========================

if (plot) {

y_breaks <- seq(0, 1, 0.2)

y_labels <- paste0(format(y_breaks*100, digits = 2), "%")

grid_max <- grid[which.max(abs(cdf_x(grid) - cdf(grid)))]

plt <- ggplot()+

geom_ribbon(aes(grid, ymax = cdf_x(grid), ymin = cdf(grid)),

alpha = 0.5, fill = "green") +

geom_line(aes(grid, cdf_x(grid)))+

geom_line(aes(grid, cdf(grid)), color = "red")+

geom_segment(aes(x = grid_max, xend = grid_max,

y = cdf_x(grid_max), yend = cdf(grid_max)),

linetype = "solid", color = "magenta")+

geom_point(aes(grid_max, cdf_x(grid_max)), color = "magenta")+

geom_point(aes(grid_max, cdf(grid_max)), color = "magenta")+

scale_y_continuous(breaks = y_breaks, labels = y_labels)+

labs(x = "x", y = "cdf")+

theme_bw()

return(plt)

} else {

kab <- dplyr::tibble(

n = n,

alpha = paste0(format(ci*100, digits = 3), "%"),

KS = ks_stat,

rejection_lev = rejection_lev,

p.value = p.value,

H0 = ifelse(KS > rejection_lev, "Rejected", "Non-Rejected"))

class(kab) <- c("ks_test", class(kab))

return(kab)

}

}KS-test on \(u_t\)

KS-test \(u_t\).

kab <- ks_test_ts(na.omit(data_prices$ut), ci = 0.01, seed = 2) %>%

mutate_if(is.numeric, format, digits = 4, scientific = FALSE)

colnames(kab) <- c("Index split", "$$\\alpha$$", "$$n_1$$", "$$n_2$$",

"$$KS_{n_1, n_2}$$", "p.value", "Critical Level", "$$H_0$$")

knitr::kable(kab, booktabs = TRUE, escape = FALSE, align = 'c') %>%

kableExtra::row_spec(0, color = "white", background = "green") | Index split | $$\alpha$$ | $$n_1$$ | $$n_2$$ | $$KS_{n_1, n_2}$$ | p.value | Critical Level | $$H_0$$ |

|---|---|---|---|---|---|---|---|

| 975 | 1% | 975 | 484 | 0.05389 | 0.7872 | 0.0905 | Non-Rejected |

Since we do not reject the hypothesis of identical distribution we can apply a Box.cox test for autocorrelation

Box-Cox test \(u_t\) and u_t^2$.

| Term | statistic | p.value | parameter | method |

|---|---|---|---|---|

| $u_t$ | 5.603438 | 0.3467367 | 5 | Box-Pierce test |

| $u_t^2$ | 10.382843 | 0.0650865 | 5 | Box-Pierce test |

KS-test on \(u_t\)

Normality KS-test \(u_t\).

kab <- ks_test(na.omit(data_prices$ut), cdf = function(x) pnorm(x), ci = 0.01, plot = FALSE) %>%

mutate_if(is.numeric, round, digits = 4)

colnames(kab) <- c("$n$", "$$\\alpha$$", "$$KS_{n}$$", "Critical Level", "p.value", "$$H_0$$")

knitr::kable(kab, booktabs = TRUE, escape = FALSE, align = 'c') %>%

kableExtra::row_spec(0, color = "white", background = "green") | $n$ | $$\alpha$$ | $$KS_{n}$$ | Critical Level | p.value | $$H_0$$ |

|---|---|---|---|---|---|

| 1459 | 1% | 2.732 | 1.6276 | 0 | Rejected |

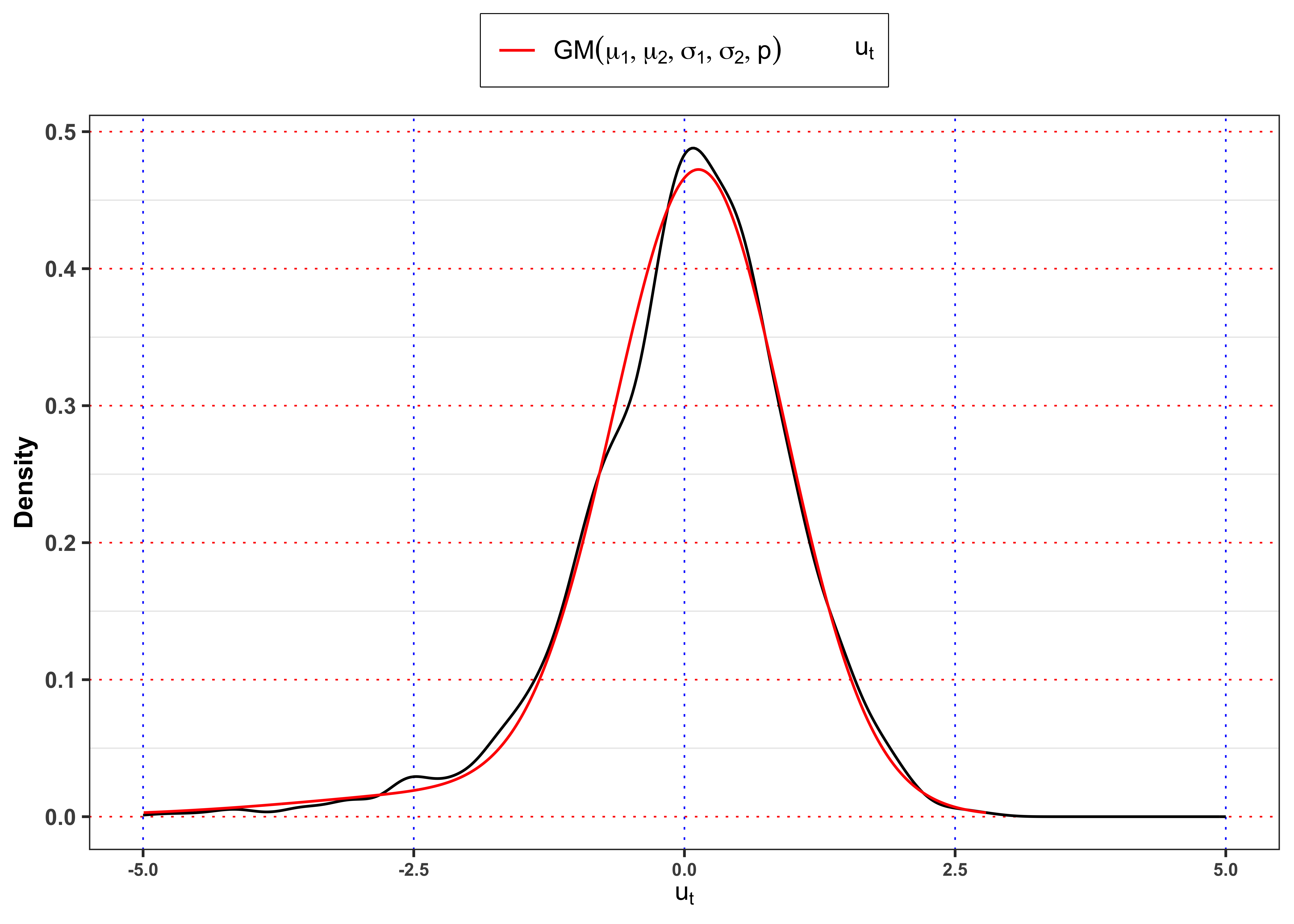

4.4 Task B.4

Let’s consider a Gaussian mixture distribution for the GARCH residuals, i.e. \[ u_t \sim B \cdot (\mu_{1} + \sigma_{1} Z_1) + (1-B) \cdot (\mu_{2} + \sigma_{2} Z_2) \]

where \(B \sim \text{Bernoulli}(p)\), while \(Z_1\) and \(Z_2\) are standard normal. All are assumed to be independent. Estimate the parameters \(\mu_{1}\), \(\mu_{2}\), \(\sigma_{1}\), \(\sigma_{2}\) and \(p\) with maximum likelihood (see here for an example). Consider the estimated parameters and give a possible interpretation of the two states, i.e. B = 1, B = 0.

Yearly Gaussian Mixture parameters.

# Fit a mixture model for all the year

sm <- mclust::Mclust(data_prices$ut, G = 2)

# Means

mu <- sm$parameters$mean

sigma <- sqrt(sm$parameters$variance$scale)

probs <- sm$parameters$pro

# Mixture density

dnorm_mix <- function(x, mu, sigma, probs){

dnorm(x, mu[1], sigma[1])*probs[1] + dnorm(x, mu[2], sigma[2])*probs[2]

}

# Mixture distribution

pnorm_mix <- function(x, mu, sigma, probs){

pnorm(x, mu[1], sigma[1])*probs[1] + pnorm(x, mu[2], sigma[2])*probs[2]

}

# Log-likelihood

loglik <- sum(log(dnorm_mix(data_prices$ut, mu, sigma, probs)))

kab <- dplyr::tibble(mu1 = mu[1], mu2 = mu[2], sd1 = sigma[1], sd2 = sigma[2], p1 = probs[1], p2 = probs[2]) %>%

bind_cols(log_lik = loglik, mu_u = mean(data_prices$ut), sd_u = sd(data_prices$ut)) %>%

mutate_if(is.numeric, format, digits = 4, scientific = FALSE)

sum(mu*probs)

## [1] -0.009603254

sqrt(sum((mu^2 + sigma^2)*probs) - sum(mu*probs)^2)

## [1] 1.038544

knitr::kable(kab,

escape = FALSE,

col.names = c("$$\\mu_1$$", "$$\\mu_2$$",

"$$\\sigma_1$$", "$$\\sigma_2$$", "$$p_1$$", "$$1-p_1$$",

"log-lik", "$$\\mathbb{E}\\{u_t\\}$$", "$$\\mathbb{S}d\\{u_t\\}$$"))| \[\mu_1\] | \[\mu_2\] | \[\sigma_1\] | \[\sigma_2\] | \[p_1\] | \[1-p_1\] | log-lik | \[\mathbb{E}\{u_t\}\] | \[\mathbb{S}d\{u_t\}\] |

|---|---|---|---|---|---|---|---|---|

| -1.475 | 0.1389 | 1.79 | 0.7897 | 0.09202 | 0.908 | -1992 | -0.009603 | 1.039 |

Yearly Gaussian Mixture vs Empirical densities

grid <- seq(min(data_prices$ut), max(data_prices$ut), 0.01)

ggplot()+

geom_density(data = data_prices, aes(ut, ..density..), color = "black")+

geom_line(aes(grid, 0, color = "ut"), alpha = 0)+

geom_line(aes(grid, dnorm_mix(grid, mu, sigma, probs), color = "nm"))+

scale_color_manual(values = c(ut = "black", nm = "red"),

labels = c(ut = TeX("$u_t$"), nm = TeX("$GM(\\mu_1, \\mu_2, \\sigma_1, \\sigma_2, p)$")))+

labs(x = TeX("$u_t$"), y = "Density", color = NULL)+

scale_x_continuous(limits = c(-5, 5))+

theme_bw()+

custom_theme+

theme(legend.position = "top")

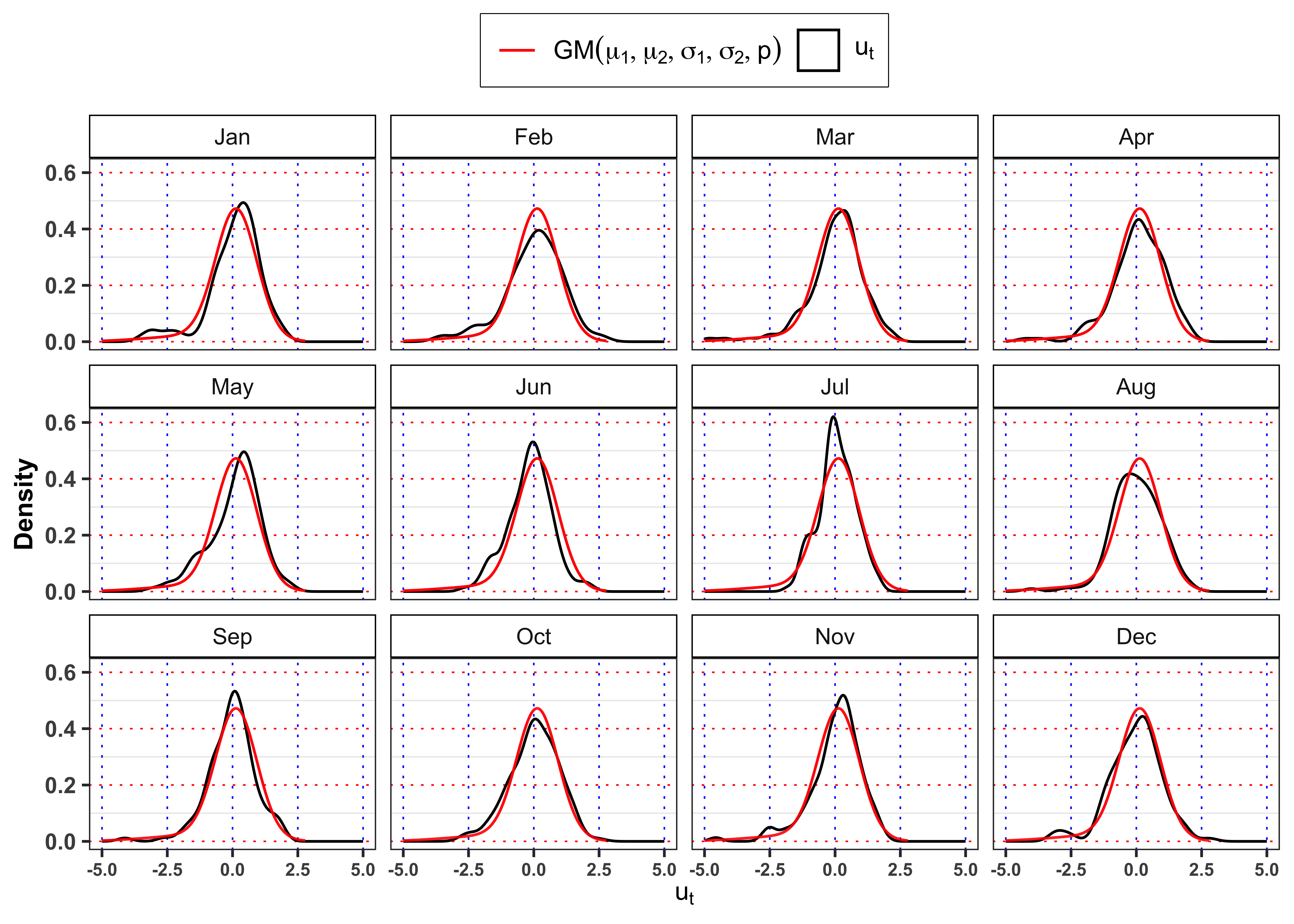

Gaussian Mixture vs monthly empirical densities.

pdf <- dnorm_mix(grid, mu, sigma, probs)

df_grid <- tibble(Month = lubridate::month(1, label = TRUE), grid = grid, pdf = pdf)

for(i in 2:12){

df_grid <- bind_rows(df_grid, mutate(df_grid, Month = lubridate::month(i, label = TRUE)))

}

data_prices %>%

mutate(Month = lubridate::month(date, label = TRUE)) %>%

ggplot()+

geom_density(aes(ut, ..density.., color = "ut"))+

geom_line(data = df_grid, aes(grid, pdf, color = "nm"))+

scale_color_manual(

values = c(ut = "black", nm = "red"),

labels = c(ut = TeX("$u_t$"), nm = TeX("$GM(\\mu_1, \\mu_2, \\sigma_1, \\sigma_2, p)$")))+

facet_wrap(~Month)+

labs(x = TeX("$u_t$"), y = "Density", color = NULL)+

scale_x_continuous(limits = c(-5, 5))+

theme_bw()+

custom_theme+

theme(legend.position = "top")

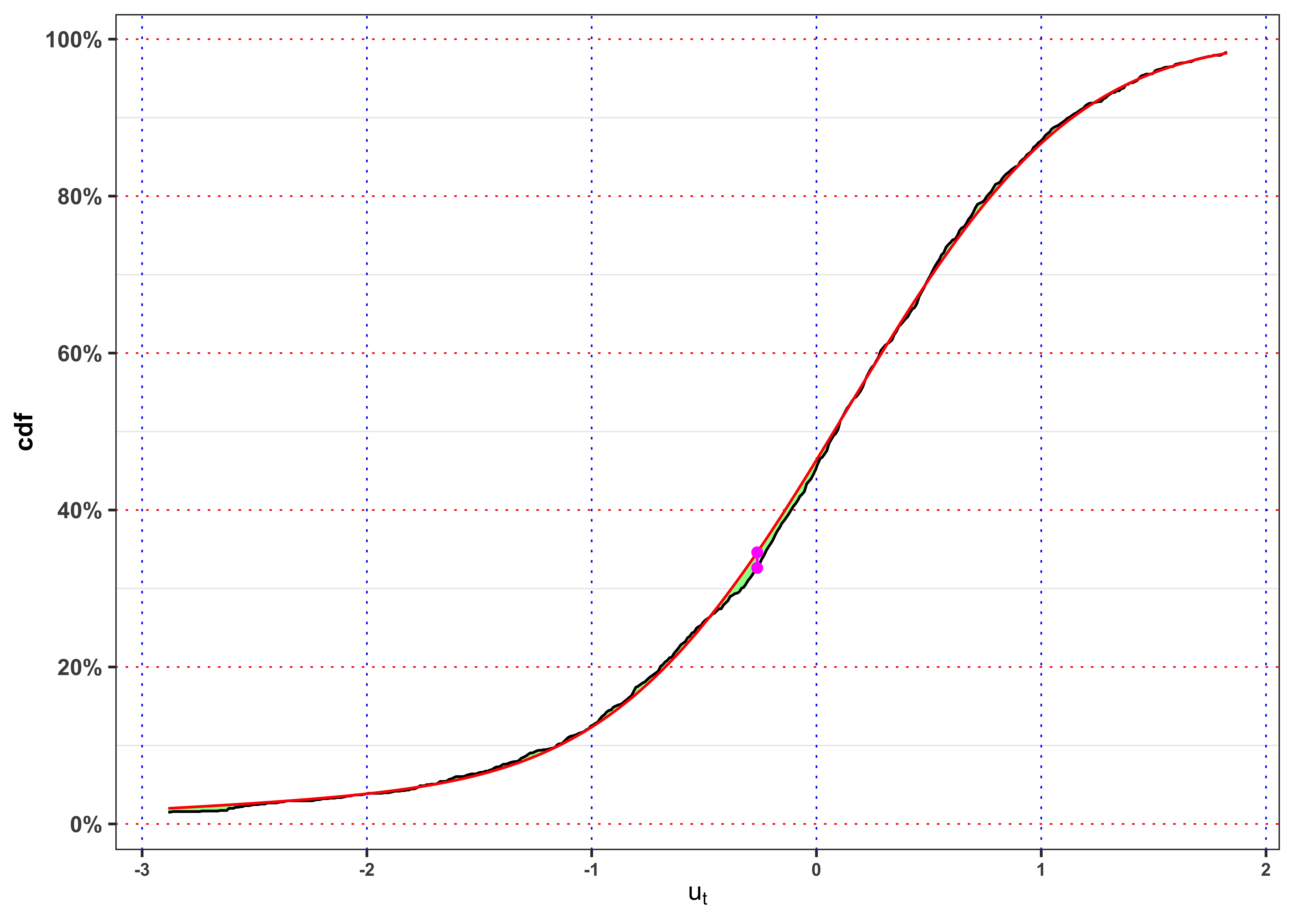

KS-test on \(u_t\)

KS-test \(u_t\).

kab <- ks_test(na.omit(data_prices$ut), cdf = function(x) pnorm_mix(x, mu, sigma, probs), ci = 0.01, plot = FALSE) %>%

mutate_if(is.numeric, round, digits = 4)

colnames(kab) <- c("$n$", "$$\\alpha$$", "$$KS_{n}$$", "Critical Level", "p.value", "$$H_0$$")

knitr::kable(kab, booktabs = TRUE, escape = FALSE, align = 'c') %>%

kableExtra::row_spec(0, color = "white", background = "green") | $n$ | $$\alpha$$ | $$KS_{n}$$ | Critical Level | p.value | $$H_0$$ |

|---|---|---|---|---|---|

| 1459 | 1% | 0.7591 | 1.6276 | 0.6119 | Non-Rejected |

5 Task C

Let’s say that we want to understand the impact on price when demand increases and is satisfied by a specific energy source (e.g., fossil, hydro, wind, etc.). In practice we ask ourselves the following question:

“What happens to the price if demand increases by 1%, and that increase is matched by a 1% increase in, say, fossil output?”

This implies a price sensitivity to marginal supply source. Electricity prices are set by the marginal unit that supplies the last unit of demand. So:

- If the marginal increase in demand is met by cheap supply (e.g., wind), prices rise little.

- If it’s met by expensive generation (e.g., fossil), prices increase significantly.

To capture this in a model, we need a model that is able to distinguish which source is meeting the marginal demand.

5.1 Task C.1

Let’s decompose the demand across sources by defining a model of the form \[ S_t = \beta_0 + \beta_1 d_t + \gamma_1 d_t T_t + \sum_{\ast} \gamma_{\ast} \cdot \left[d_t \cdot s_{\ast,t} \right] + \text{controls} + \varepsilon_t \text{,} \] where

- \(d_t = \log(D_t + 1)\): log electricity demand.

- \(\beta_1\): baseline elasticity of price to demand.

- \(T_t\): is the temperature.

- \(\gamma_{\ast}\): differential impact when demand is met by source \(\ast\).

- \(S_t = \log(P_t)\): log electricity price at time t from Equation 5.